- SHIB stays in a decent vary as consumers defend demand, however resistance remains to be holding again momentum.

- Derivatives have proven sharp leverage exits, indicating lowered hypothesis and warning.

- Governance tensions and communication points enhance ecosystem-driven bearish strain.

The Shiba Inu continues to commerce inside a slender vary as value developments, derivatives knowledge, and ecosystem developments level to elevated uncertainty. On the 4-hour chart, SHIB is displaying consolidation following a correctional decline that started in early November.

Sellers had beforehand managed the momentum, however draw back strain has slowed. Because of this, the token began transferring sideways as merchants waited for clearer indicators. Whereas this pause displays warning in each spot and derivatives markets, inside ecosystem issues are additional weighing on sentiment.

SHIB value construction stays weak under key resistance ranges

SHIB is at present buying and selling under the 100 and 200 exponential transferring averages, reinforcing broad bearish strain. Nevertheless, value has repeatedly defended the $0.00000830 to $0.00000821 demand zone. The realm continues to draw consumers and avoids severe chapter. Due to this fact, the vary construction stays intact.

Quick resistance lies between $0.00000862 and $0.00000865, the place the earlier rally failed. Moreover, the $0.00000879 to $0.00000894 zone represents an necessary intermediate resistance.

Associated: Fundamental Featured Token Value Prediction: BAT Stays Bullish Construction…

Bulls have to reclaim this area to alter short-term momentum. A sustained transfer above $0.00000927 would point out an enchancment within the construction. Till then, any climb makes an attempt will stay correctional.

Volatility indicators reinforce the consolidation narrative. Compression of the Donchian and Keltner bands suggests restraint in value will increase. Nevertheless, such compression is commonly preceded by a motion in a extra forceful course. Due to this fact, the market stays delicate to any catalyst.

Derivatives and spot flows mirror defensive positioning

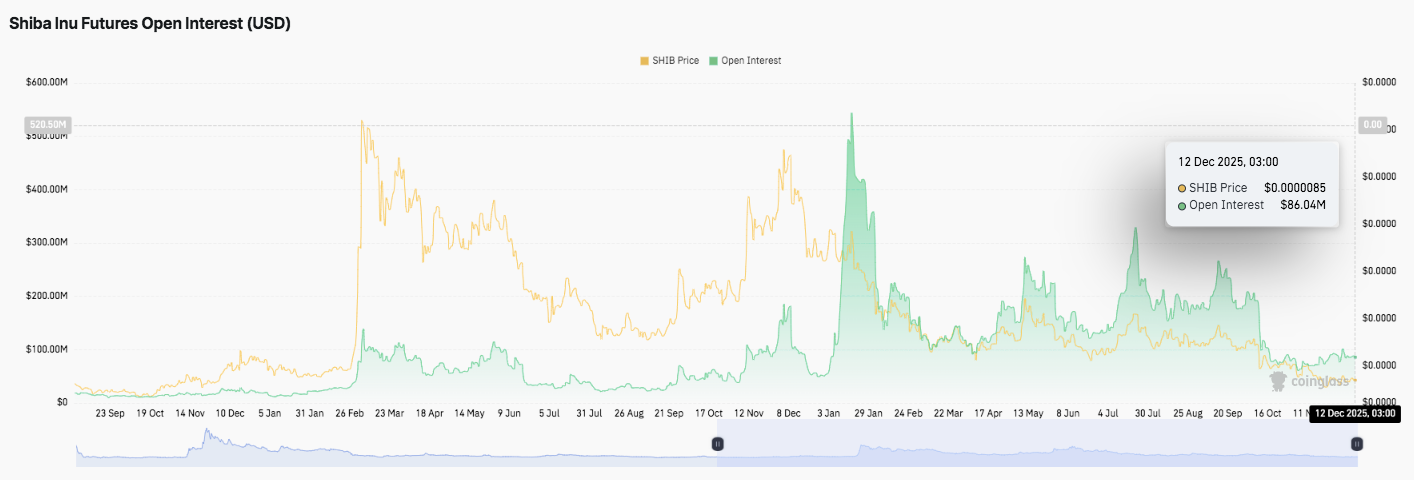

Futures knowledge reveals a transparent decline in speculative publicity. Open curiosity has fallen considerably from its earlier peak of over $500 million. Present ranges of almost $86 million counsel that leverage has largely exited the market. Moreover, the surge in open curiosity beforehand resulted in a speedy unwinding, stopping aggressive positioning.

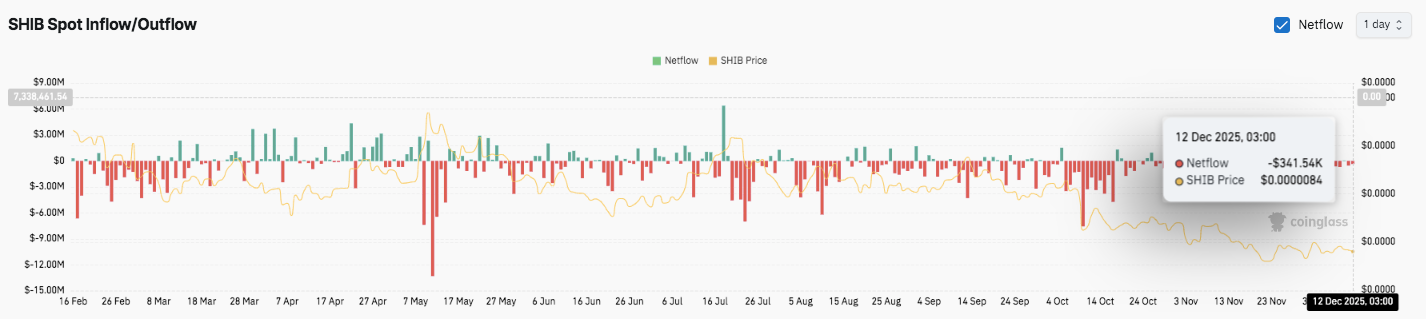

Spot market knowledge is according to this defensive posture. SHIB has recorded steady internet outflows all year long. Bigger outflow bars have appeared throughout a number of value declines, together with in latest classes.

Associated: Bitcoin Value Prediction: $77M ETF Outflow Stresses Symmetrical Triangle…

Web outflows on Dec. 12 had been roughly $341,000. Importantly, the influx spikes stay small and rare. This imbalance signifies that liquidity continues to circulation out of the market sooner than it may circulation into it.

Ecosystem issues gas bearish temper

Past technical points, ecosystem developments now affect sentiment. K9 Finance DAO lately revealed a long-term communication breakdown with its Shiba Inu handler. This disclosure comes after months of reconciliation makes an attempt following the Shibarium Bridge exploit.

In accordance with K9 Finance, regardless of complying with all requests, the management’s involvement regularly ceased. Because of this, issues about accountability and venture governance are growing.

Technical outlook for Shiba Inu costs

SHIB trades inside a tightening construction, so key ranges stay properly outlined. Along with the latest volatility, value actions are displaying compression slightly than course.

Upside resistance begins at $0.00000862, adopted by $0.00000894 as an necessary reclamation zone. If this space is confirmed, a transfer in the direction of $0.00000927 and $0.00000974 may start. Moreover, the excessive of the $0.00001034 vary stays the first higher sure for a broader development change.

On the draw back, $0.00000821 stays the foremost assist. Patrons have repeatedly defended this stage, sustaining short-term stability. Nevertheless, a lack of $0.00000821 weakens the construction. Because of this, the worth is prone to slide in the direction of $0.00000755, which marks an necessary invalidation stage within the present vary.

Technically, SHIB is buying and selling under the 100 and 200 EMAs, with broader strain conserving it bearish. Moreover, the volatility bands proceed to compress, indicating a possible growth part. This construction is much like a consolidation zone after a correctional decline, the place a decisive breakout can set off a sharper transfer.

Will Shiba Inu rise?

Shiba Inu’s short-term course depends upon whether or not consumers can maintain on to $0.00000821 and get again $0.00000894. Stronger inflows and follow-through above resistance may push SHIB in the direction of larger Fibonacci ranges.

Nevertheless, if the assist isn’t protected, there’s a danger {that a} draw back value goal will likely be set once more. For now, SHIB stays at a pivotal inflection level and requires affirmation earlier than making the subsequent huge transfer.

Associated: Zcash Value Prediction: Breaking above $485 may begin a rally in the direction of $620

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.