- Shiv stays above Keemas, confirming bullish momentum and potential upward traits.

- A significant Fibonacci resistance, near $0.00001271, might outline the subsequent necessary motion of Siv.

- A light-weight gross sales tip is a web move of $1.37 million, which cautions short-term merchants.

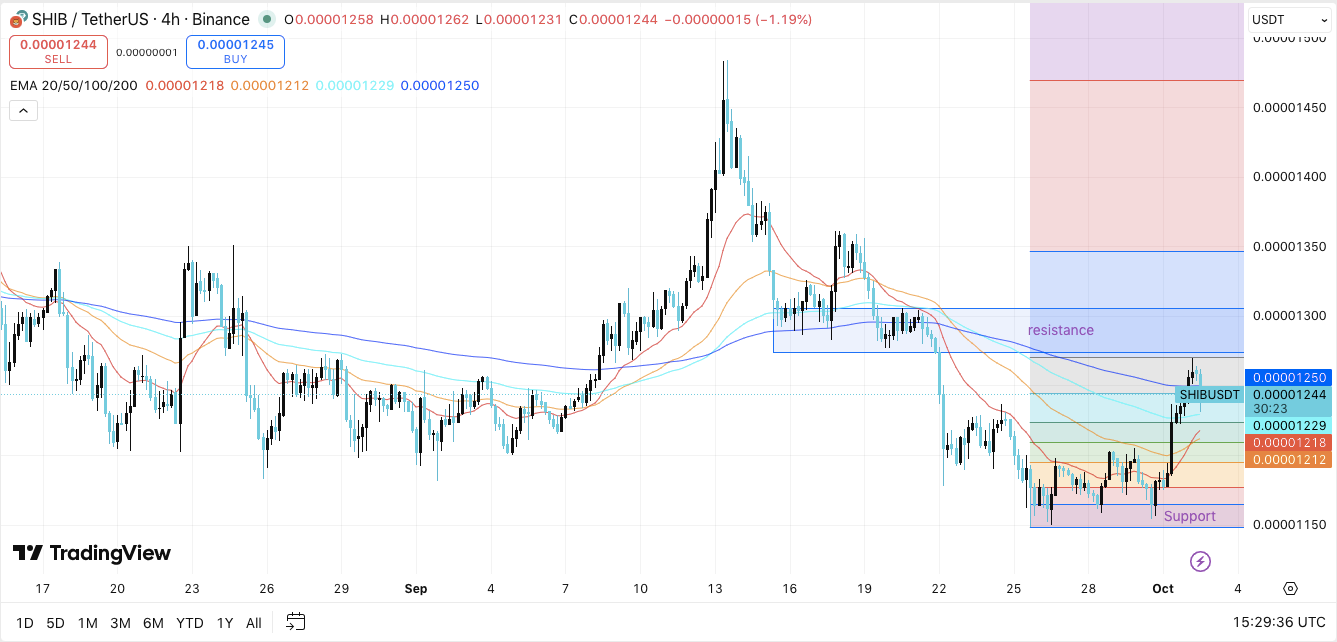

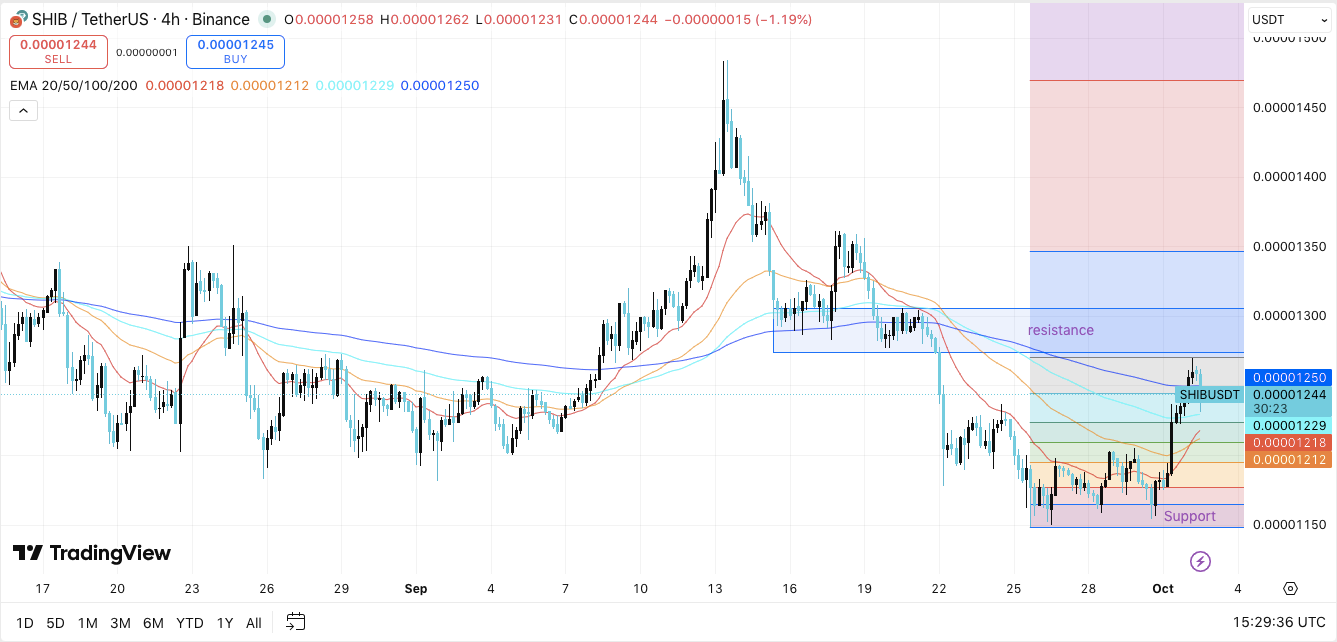

Shiba Inu (SHIB) is buying and selling in a bullish construction over a four-hour time-frame, with consumers regaining management after defending key ranges of help. The market is exhibiting new power, pushing tokens above the principle shifting averages, approaching the important thing Fibonacci resistance zone. Merchants are carefully watching how Shiv behaves as they method key worth ranges the place they will outline their subsequent transfer.

Key worth ranges and development outlook

The help zone stays mounted at round $0.00001148, with costs not too long ago bounced again after the combination interval. This degree, according to 0.236 Fibonacci retracement, is attracting curiosity in recent purchases.

Above this zone, the intermediate resistance is between 0.00001195 and 0.00001224, and corresponds to retracement ranges of 0.382 and 0.618. These areas can quickly decelerate Shiv’s climbing.

Essentially the most notable resistance is close to $0.00001245, reaching $0.00001271. This matches the 1.0 Fibonacci degree. If the breakout right here is profitable, Shiv may head in direction of $0.00001347, a 1.618 extension, $0.00001347. Nevertheless, when you fail to clear this zone, you might be invited to a pullback as it might retest a help area with a worth of $0.00001148.

The EMA indicator reinforces bullish circumstances. SHIB is buying and selling comfortably above 20, 50, 100 and 200 exponential shifting averages for the 20, 50, 100 and 200 durations, suggesting that momentum stays within the purchaser’s favor.

Associated: Shiba inu Value Prediction: Analysts monitor reversal of resistance over volatility in October

Futures market and open curiosity sign

Open revenue traits reveal a direct correlation between dealer positioning and worth actions. Through the latest surge, open curiosity has escalated quickly, reflecting a rise in participation. As costs stabilized, curiosity cooled.

On October 2nd, Shib Futures Open Curiosity was cautious however steady involvement at $195.5 million. This implies that buyers stay lively, however they’re cautious of sudden pullbacks.

Spot move and market sentiment

On-chain exercise provides one other layer of perception. Spot influx and outflow knowledge spotlight a robust connection between capital flows and worth fluctuations. Lively inflow has traditionally preceded the rally, however robust outflows typically sign gross sales. On October 2nd, netflow recorded a minus $1.37 million, suggesting gentle gross sales strain.

As seen in December 2023 and Might 2024, giant fluctuations in move have traditionally resulted in sharp volatility. Due to this fact, merchants typically predict directional actions, so they need to take note of sudden modifications in change move traits.

Shiba Inu worth technical outlook

Key ranges stay nicely outlined as October unfolds.

- Upside Stage: $0.00001224, $0.00001245, and $0.00001271 as quick hurdles. Breakouts may be prolonged to $0.00001347 and $0.00001480.

- Drawback degree: $0.00001148 Development Line Assist, then $0.00001110 and $0.00001050 as a deep cushion.

- Ceiling of resistance: $0.00001271 (FIB Growth and Key Resistance Zone) is the principle degree to flip over for medium-term bullish continuation.

The technical drawing reveals shib integration inside narrowing ranges, reflecting compression that always precedes important motion. Costs are at present buying and selling above 20, 50, 100 and 200 EMAs, enhancing bullish integrity within the quick and medium time period. Nevertheless, a resistance cluster between $0.00001245 and $0.00001271 stays a problem for consumers.

Associated: SHIB costs fall 13% over three days as management debate intensifies

Outlook: Does the Bible preserve restoration?

Shiba Inu’s October outlook depends upon whether or not consumers are in a position to defend the $0.00001148–$0.00001110 zone whereas pushing excessive in direction of $0.001245-0.00001271. Compression, mixed with seasonal volatility traits, means that potential breakouts could also be approaching. If Momentum is constructed, Shib may additionally rethink $0.00001347 and push additional to $0.00001480.

Nevertheless, when you do not maintain $0.00001148, the danger of breaking the buildup base and exposing your token to deeper help is round $0.00001110 and $0.00001050. For now, Shiv is at a vital stage. There, a conviction flows and affirmation of resistance flips determines the subsequent necessary transfer.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version shouldn’t be answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.