- SHIB remains to be trapped in a descending channel with sellers defending the development resistance.

- Assist close to $0.00000700 holds, however the bounce lacks momentum and follow-through.

- The outflow of consideration and modest positioning proceed to cap upside regardless of the headlines.

Shiba Inu worth is buying and selling round $0.00000716 right this moment as sellers proceed to dictate construction heading into December twenty eighth. Costs stay trapped in a descending channel, with repeated failures close to development resistance capping makes an attempt to maneuver greater.

December prolonged the broader bearish image. SHIB is down 14.15% to begin the month at $0.000008385, bringing its year-to-date loss to just about 65%. Coupled with the seasonal hunch, December is popping detrimental for the fourth time previously 5 years.

Descending channels outline the market

The every day chart stays the clearest sign. SHIB has been respecting a downward channel since early October, producing decrease highs and shallow aid bounces. Each time it rises to the higher restrict, there’s a new selloff, reinforcing the development moderately than difficult it.

Presently, the value is positioned close to the decrease half of the channel, the place a rebound shaped earlier however failed to carry. The supertrend stays purple round $0.00000818, confirming that the development management has not modified. The parabolic SAR dot stays above worth, indicating that sellers are able of continuation moderately than depletion.

This isn’t a collapse part, however it is usually not an accumulation part. This construction displays a managed downturn moderately than a give up.

Assist stays, however momentum stays fragile

SHIB continues to defend the $0.00000700 to $0.00000710 zone that has repeatedly absorbed promoting stress all through the second half of December. This degree coincides with the decrease sure of the channel and the latest drop in liquidity, making it an important short-term assist.

Up to now, consumers have been profitable in stopping clear failures. However any pushback from assist is shallow and short-lived. The shortage of upper lows signifies that consumers are passive moderately than energetic.

As quickly because the every day closing worth falls under $0.00000700, $0.00000650 can be uncovered. Under that, the following pocket of demand is round $0.00000600, the place a earlier consolidation shaped earlier this yr.

Intraday worth actions point out stalemate

The quick time-frame displays hesitation moderately than restoration. On the 1-hour chart, SHIB has compressed right into a slender vary between $0.00000710 and $0.00000725. Volatility has pale and momentum indicators stay flat.

The RSI stays near 50, indicating stability moderately than energy. The MACD continues to hover across the zero line, with no enlargement in both path. These situations typically precede motion, however they don’t present path in and of themselves.

With no decisive break above intraday resistance, consolidation will stay suspended in a bearish development.

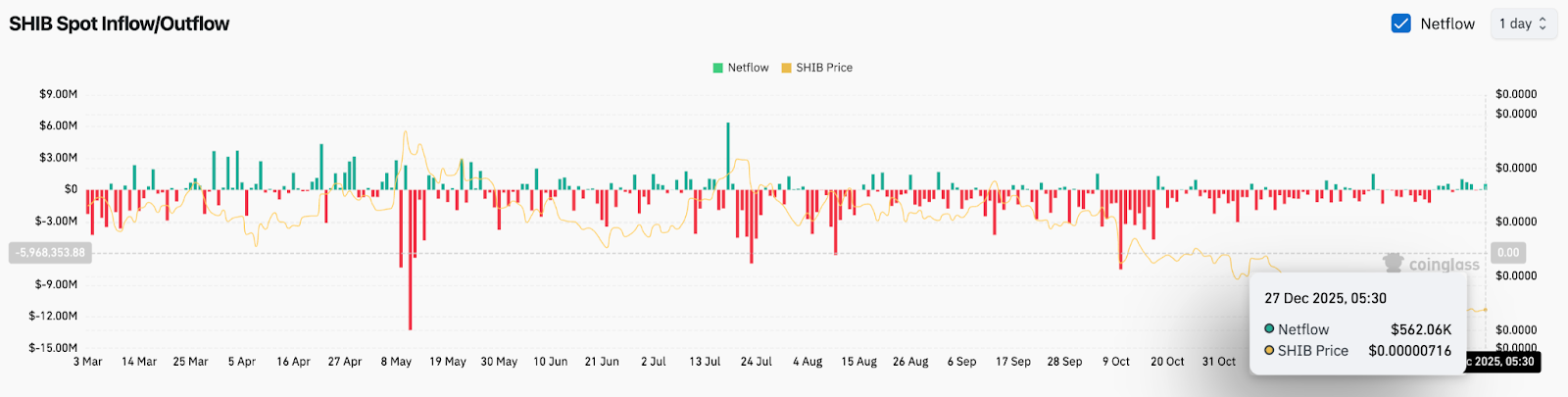

Spot circulate nonetheless favors consumers

Spot circulate knowledge will proceed to work for any ascent makes an attempt. Whereas the newest buying and selling confirmed modest internet inflows of $562,000, the broader sample of latest weeks stays dominated by outflows.

Capital persistently flows out of the alternate moderately than flowing into it throughout the rally, indicating that contributors are utilizing pressure to scale back their publicity. Till that habits adjustments, rebound has no structural assist.

Dealer positioning reveals warning, not conviction

Derivatives knowledge displays an aggressively unleveraged market. The accounts of prime merchants on Binance have lengthy publicity of 52.01% vs. quick publicity of 47.99%, giving a long-to-short ratio of 1.08.

This place suggests gentle optimism, however not sufficient to pressure a development reversal. There isn’t a clear leverage imbalance, so sharp liquidation-driven actions are much less possible. As a substitute, costs nonetheless have a tendency to maneuver slowly, decided by spot exercise.

Burn headlines do not transfer costs

December noticed a excessive proportion of burn exercise, however the precise influence was minimal. Regardless of the person spikes, the decline in complete provide remains to be negligible in comparison with the circulating provide of over 580 trillion tokens.

Worth motion displays that actuality. Markets largely ignore burn headlines and as a substitute give attention to development construction, assist integrity, and capital flows.

outlook. Will Shiba Inu rise?

SHIB stays technically weak, however not damaged.

- Bullish case: A every day shut above $0.00000760 and a subsequent retrieval of $0.00000820 will break the draw back resistance and open room for $0.00000900.

- Bearish case: A agency closing worth under $0.00000700 indicators a continuation, with $0.00000650 being uncovered initially and $0.00000600 being uncovered if the promote accelerates.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.