- SHIB stabilizes at $0.00000989, defending the necessary Fibonacci base round $0.0000095.

- The Fed’s 25bps price lower and the Trump-Xi commerce deal have did not spark sustained crypto momentum.

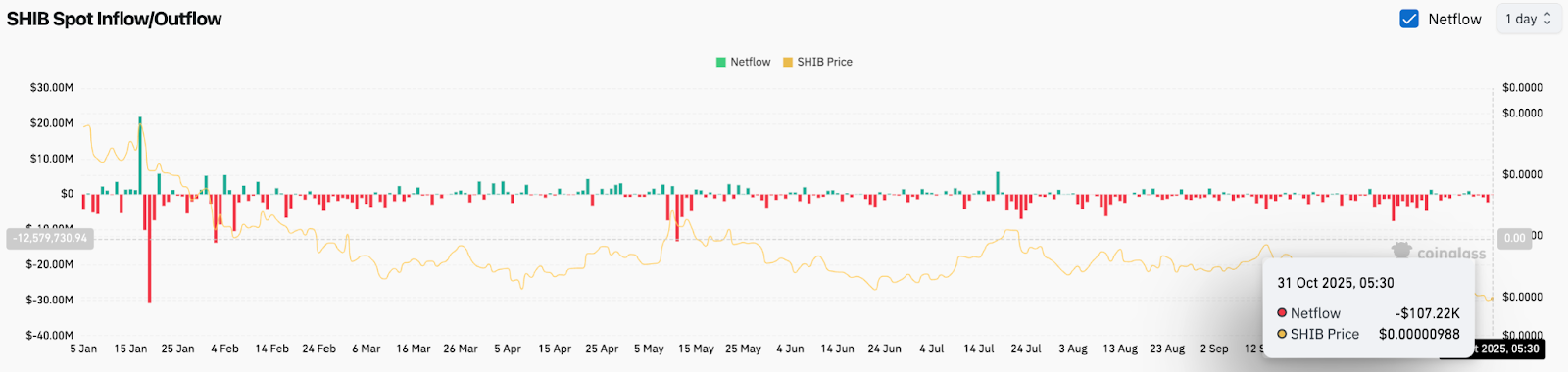

- On-chain information reveals a moderation in outflows, suggesting vendor fatigue and a doable rebound.

Shiba Inu worth right this moment is buying and selling at $0.00000989, stabilizing after a risky week marked by macro uncertainty and failed breakout makes an attempt. The meme token continues to check the decrease Fibonacci zone above the $0.00000950 space the place consumers have just lately absorbed robust promoting stress.

Fed price cuts fail to ignite crypto momentum

The Federal Open Market Committee lower U.S. rates of interest by 25 foundation factors, a transfer broadly anticipated by the market. The choice initially sparked optimism throughout digital belongings, however the response rapidly dissipated as buyers have been already pricing within the coverage change. Fed Chairman Jerome Powell’s feedback signaled warning about future price cuts, leaving merchants unsure in regards to the liquidity outlook for November.

Shiba Inu’s worth motion mirrored the broader crypto market, the place enthusiasm has cooled regardless of improved funding circumstances. Cryptocurrencies are inclined to carry out higher when borrowing prices fall, however the bullish temper was dampened by Chairman Powell’s reluctance to offer additional easing.

SHIB worth fluctuations recommend base formation

On the 4-hour chart, Shiba Inu’s worth continues to respect the decrease certain of the symmetrical triangular construction. The token’s drop beneath $0.0000100 earlier this week triggered a pointy flush in the direction of $0.0000095, matching the 0.236 Fibonacci retracement degree. This zone coincides with the earlier accumulation space and is held as a dependable assist.

The 20-EMA and 50-EMA are nonetheless buying and selling intently round $0.0000101 to $0.0000102, suggesting a compressed setup that would result in extra volatility. A definitive shut above this vary might pave the way in which for the $0.00001076 (Fib 0.5) and $0.00001129 (Fib 0.618) retracement zones, each of which function the subsequent technical checkpoint.

On the draw back, continued failure to defend $0.00000950 might expose the swing low of $0.00000849. The Supertrend indicator continues to flash resistance close to $0.00001025, confirming that consumers nonetheless want a breakout to verify a pattern reversal.

Circulate signifies sell-out

In accordance with Coinglass’ on-chain information, web outflows on October thirty first have been roughly $107,000, making it one of many lowest withdrawal days up to now two weeks. This follows a interval of destructive flows all through October, indicating the continuation of exchange-based distributions.

A decline in outflows alerts vendor exhaustion and sometimes precedes the buildup part. Traditionally, such levels have coincided with stabilization of SHIB costs close to decrease retracement zones. If this sample holds, we might see a short-term rebound in the direction of $0.0000107 as liquidity rotation returns to altcoins.

Commerce agreements present restricted reduction

The current US-China commerce deal supplied some reduction for threat belongings, nevertheless it was not a decisive breakthrough. The deal’s 10% tariff lower and guarantees on agricultural imports boosted market morale within the quick time period. However buyers have been betting {that a} sharp lower in tariffs might ease inflationary pressures and strengthen the case for additional Fed easing.

This partial settlement has left Shiba Inu costs beneath stress as macro merchants stay cautious in regards to the broader liquidity outlook. If inflation issues persist, this might restrict the upside potential for speculative tokens like SHIB within the quick time period.

Outlook: Will the Shiba Inu enhance?

For now, Shiba Inu worth predictions stay cautiously optimistic. The token is holding agency above the $0.00000950 threshold, with technical indicators pointing to a doable rescue rebound. A clear break above $0.0000102 might change sentiment and pave the way in which for a transfer in the direction of $0.0000108 to $0.0000113, the place the Fibonacci and EMA confluence intersect.

Failure to maintain assist might undermine the restoration regime and result in additional losses in the direction of $0.0000085. Merchants watch the amount response close to the triangle’s apex to verify path.

As macro circumstances stabilize post-Fed, consideration will return to threat flows and on-chain actions. If promoting stress continues to ease and Bitcoin stabilizes, Shiba Inu costs might see a major rebound into early November.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.