Bitcoin worth has been quiet since breaking the $30,000 stage, setting a good buying and selling vary between $30,000 and $31,000 for a lot of July. Throughout this era of low volatility, many merchants and analysts are anxious about future worth motion. Nevertheless, on-chain information, particularly fee of return on expenditure (SOPR), could give a clearer indication of the place the market is headed.

SOPR is a crucial metric in Bitcoin evaluation. It’s calculated by dividing the sale worth by the Bitcoin cost worth, successfully measuring the revenue or loss that Bitcoin holders make when promoting their cash. A rising SOPR signifies that holders are promoting at a revenue, whereas a falling SOPR signifies that they’re promoting at a loss. Entity-adjusted SOPR, which considers solely entities which were energetic for at the very least one month, gives a extra correct indication of the market.

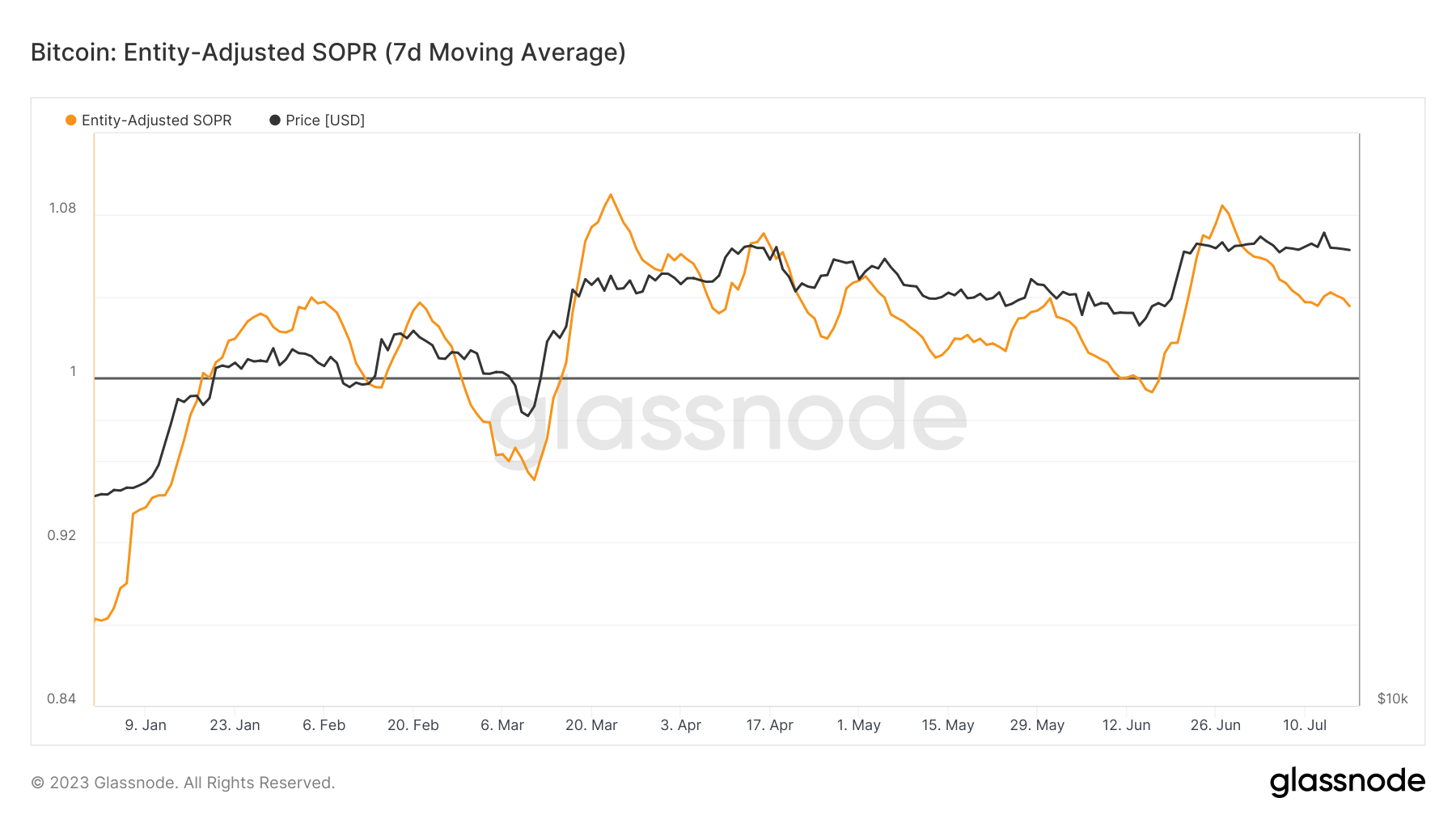

The body-adjusted SOPR 7-day transferring common has been on an upward pattern for the reason that starting of the 12 months and is above worth 1. Regardless of a number of sharp upward developments in January, February and June, it has been declining since then. June twenty seventh, right down to 1.03 on July seventeenth.

Nevertheless, regardless of the notable decline, the ratio remains to be in a profit-oriented regime. Which means that, on common, corporations promoting Bitcoin are nonetheless worthwhile.

In response to market evaluation, the present SOPR sideways pattern could point out that the market is in a consolidation section, which may pave the way in which for Bitcoin’s subsequent huge worth transfer.

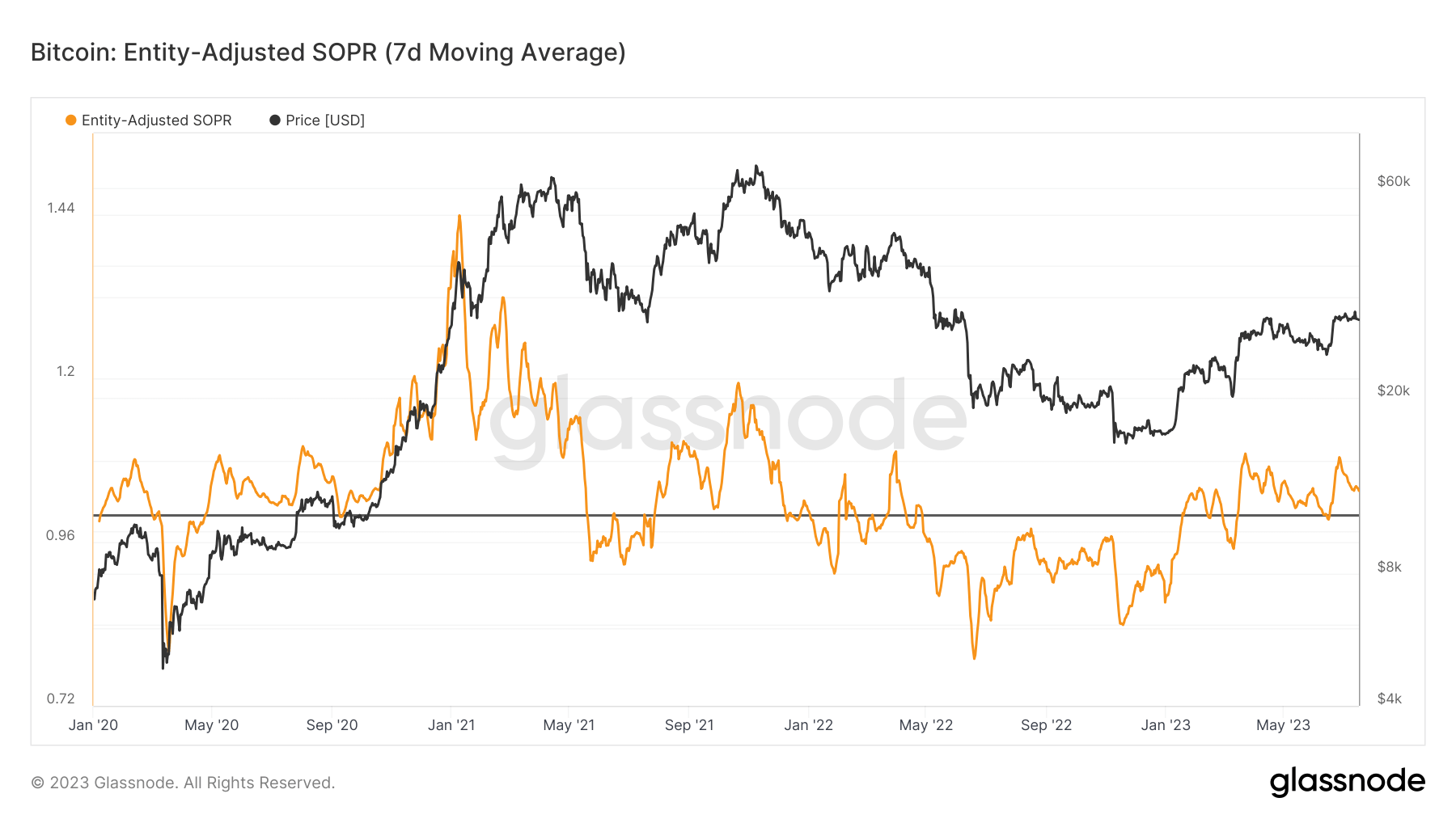

On this planet of buying and selling and investing, consolidation is a interval of indecision that ends when an asset’s worth crosses a restrictive barrier. As in 2016 and 2019, a big worth improve is feasible after this era.

Moreover, a steady SOPR suggests a balanced market the place the variety of worthwhile Bitcoin sellers is roughly equal to the variety of shedding Bitcoin sellers. There could also be. This equilibrium can result in a extra steady market, decreasing the probability of utmost worth volatility within the quick time period. .

The publish Sideways SOPR: A prelude to Bitcoin’s subsequent huge transfer? First appeared on currencyjournals.

(Tag translation) Bitcoin

Comments are closed.