The cryptocurrency market is in turmoil after Soar Buying and selling not too long ago transferred hundreds of thousands of Ethereum to a centralized trade.

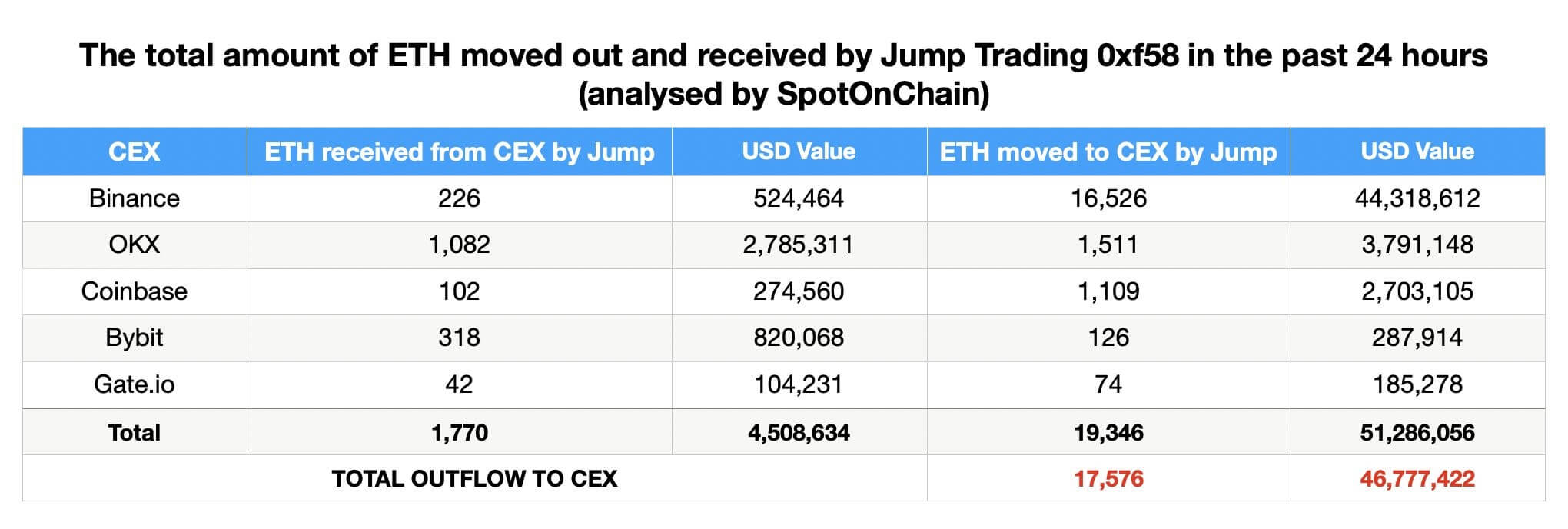

In response to blockchain analytics platform Spot On Chain, the corporate moved 17,576 ETH (price $46.78 million) over the weekend to exchanges together with Binance, OKX, Coinbase, ByBit, and Gate.io.

The transfer follows a sample famous by crypto analyst EmberCN: Since July 25, Soar Buying and selling has transformed 83,091 wstETH price $341 million into 97,600 stETH and unstaked 86,059 stETH price $274 million from Lido Finance. The corporate has subsequently deposited a internet 72,213 ETH price $231 million into varied exchanges.

Sometimes, such strikes point out bearish sentiment and counsel that holders might wish to promote their cryptocurrencies. Regardless of these strikes, the corporate nonetheless holds important belongings price round $110 million, together with round 37,604 wstETH and three,214 RETH, in response to information from Arcam Intelligence.

In the meantime, one other pockets related to the corporate holds roughly $585 million in cryptocurrencies, together with USDC and USDT, however on-chain information exhibits the pockets's steadiness fell by greater than 50% final month earlier than recovering to its present steadiness..

Market affect

The bounce buying and selling actions led to a broader market sell-off, with main digital belongings like Bitcoin and Ethereum experiencing double-digit drops. Blockchain analyst LookonChain famous that the market has fallen greater than 33% because the agency launched its providing on July 24.

Vidget CEO Gracie Chen mentioned: currencyjournals The market decline was influenced by outstanding gamers like Soar Buying and selling promoting off their ETH, in addition to bearish predictions following the ETF's approval.

Adam Cochran, managing accomplice at Cinneamhain Ventures, criticised Soar Buying and selling's operations, saying:

“Liquidating their crypto books on a summer time Sunday afternoon in a skinny market is an ideal illustration of why their crypto enterprise is in such disarray.”

In the meantime, different members of the crypto group have speculated that the fund's strikes could possibly be a precursor to an impending authorized confrontation with the U.S. Commodity Futures Buying and selling Fee (CFTC). The monetary regulator is investigating the corporate's buying and selling and funding actions within the cryptocurrency house. Amid these challenges, the corporate's president, Kanav Kariya, has resigned.

Over time, Soar Buying and selling has confronted quite a few challenges, together with a $325 million hack to Wormhole, losses from the FTX collapse in 2022, and accusations of manipulating Terra's algorithmic UST stablecoin peg.