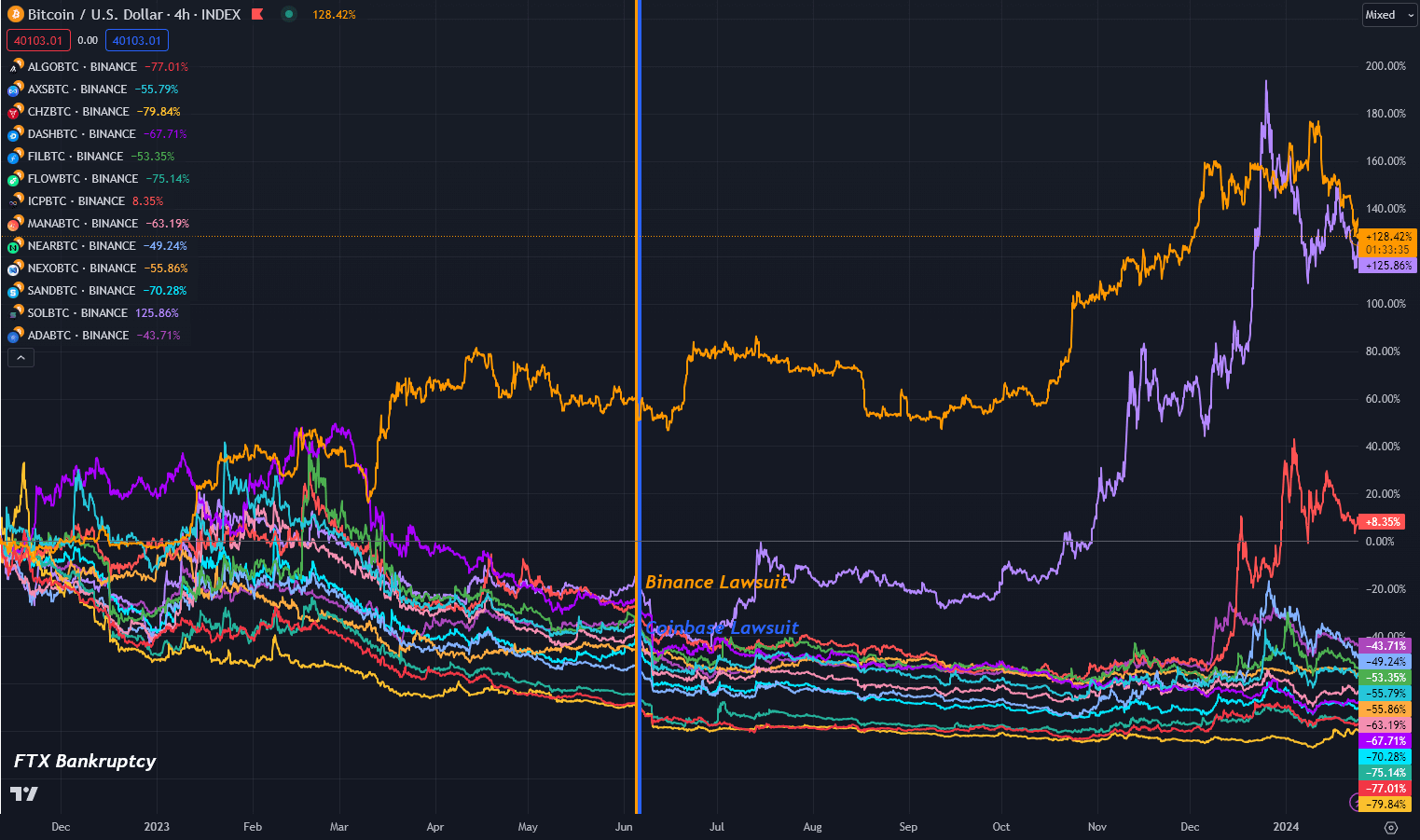

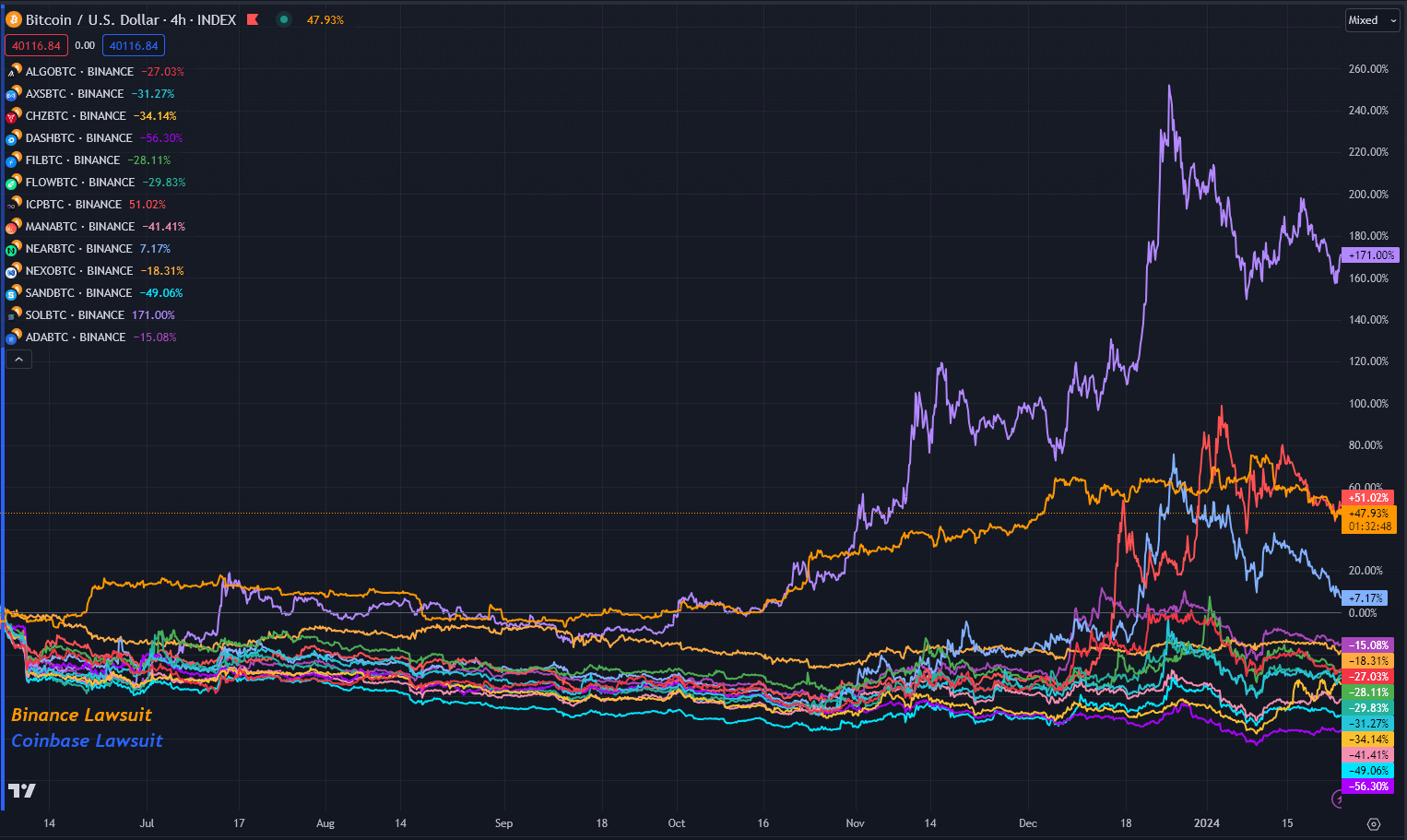

With Bitcoin down about 20% from its year-to-date highs, it's typically useful to zoom out and take a look at the larger image. I’ve saved a graph of all of the tokens listed within the Coinbase and Binance lawsuits (C&B lawsuits) filed on June 6 and June 5, 2023, respectively, and their costs in Bitcoin .

For context, Binance and Coinbase are at present defending themselves in US courts. The central challenge in each circumstances is whether or not the crypto property provided by these exchanges needs to be categorised as securities and due to this fact topic to SEC regulation.

Tokens listed as potential securities within the above lawsuit embrace Alogrand, Solana, Cardano, Close to, Filecoin, and so on., as proven within the desk under. Let's check out how these property have carried out in comparison with Bitcoin over the previous eight months, then check out the efficiency of some standout tokens in greenback phrases.

For context, let's first take a look at the efficiency of digital property for the reason that black swan occasion that preceded the C&B lawsuit: the chapter submitting and subsequent collapse of FTX. The change filed for Chapter 11 chapter on November 11, 2023, when the value of Bitcoin was round $16,900. Since then, it has soared about 140% towards the greenback, making him one in all solely two property to outperform it.

Solana and ICP elevated in worth in BTC phrases, growing by 116% and 9%, respectively. All different tokens listed as potential securities fell between -41% and -80% versus Bitcoin.

The most effective performer was Cardano, which misplaced 41% of its worth to Bitcoin. The worst was Chilliz, down -80%. In greenback phrases, Cardano is up 50% whereas Chiliz is down -53%, displaying Bitcoin's energy over the previous 15 months.

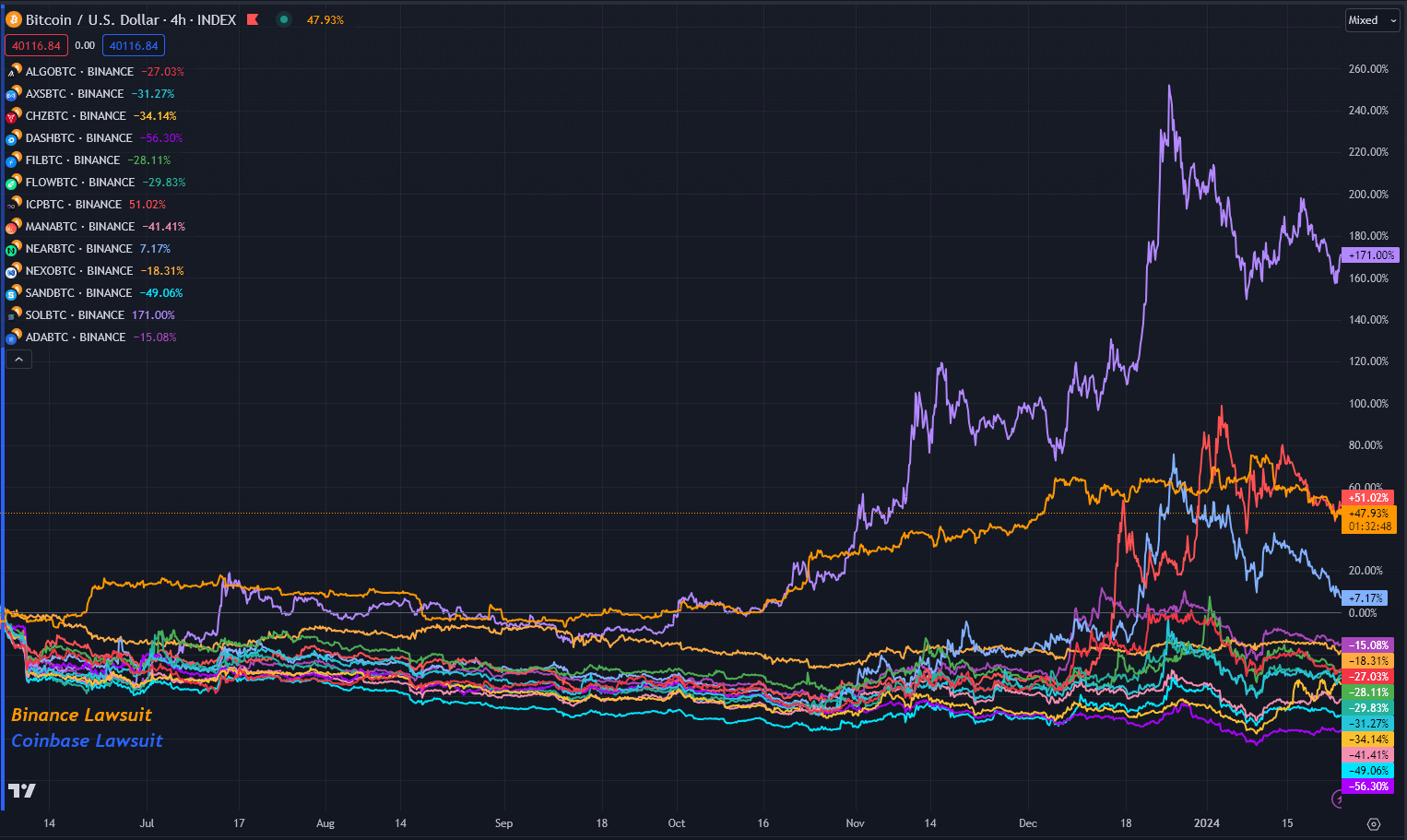

Coinbase and Binance efficiency since SEC litigation.

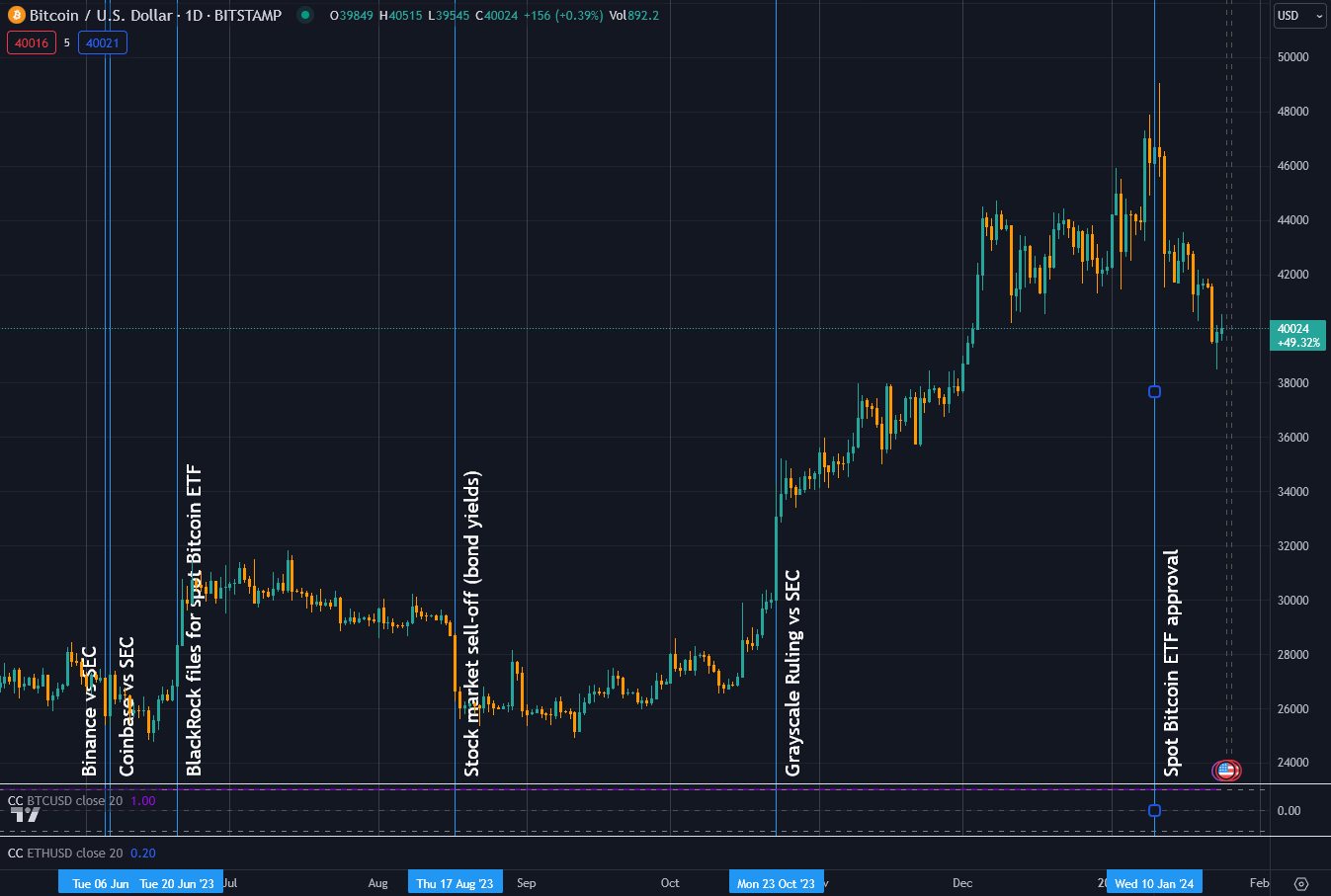

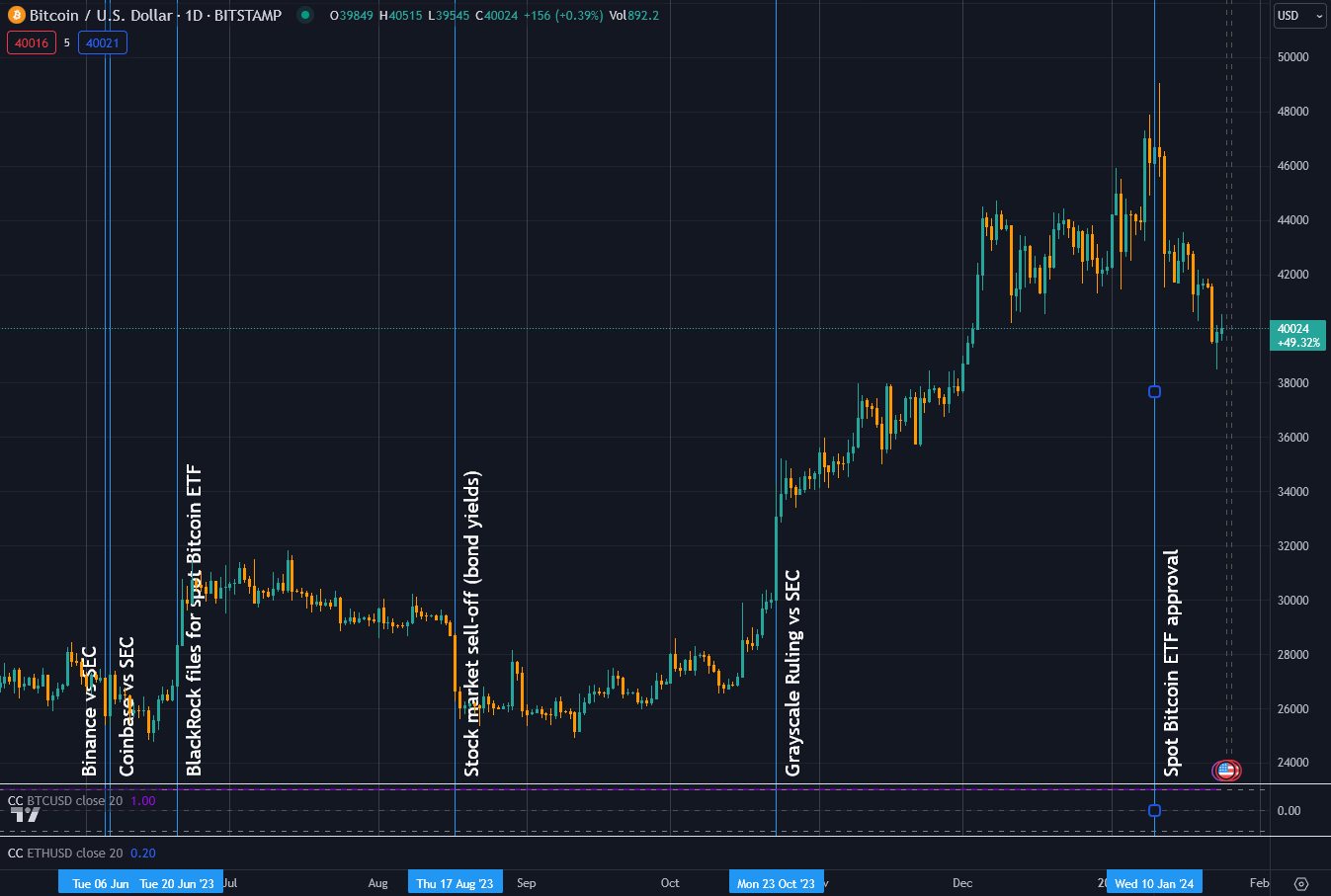

When Binance and Coinbase had been hit with SEC lawsuits inside a day of one another final June, markets had been shocked by the direct concentrating on of two of essentially the most outstanding crypto exchanges. On June 5, the day Binance was provided, Bitcoin fell from about $26,800 to $25,300. Nonetheless, on the day Coinbase went into service, its worth recovered and slowly bled to about $25,00 alongside the way in which.

On June 20, 2023, BlackRock utilized for a spot within the Bitcoin ETF, and the value of Bitcoin rose to over $30,000 till the August inventory market decline reversed the positive factors. From there, it traded sideways till Grayscale received a authorized battle towards the SEC, and the value finally rose in direction of a two-year excessive of $49,000 on the day the Spot Bitcoin ETF was launched. At this peak, Bitcoin has risen 90% for the reason that C&B lawsuit.

As of this writing, Bitcoin has rallied a bit, however is up 47% for the reason that C&B lawsuit, with three property outperforming. Solana and ICP outperformed Bitcoin this time round by 169% and 49%, respectively. Nonetheless, Close to Protocol can be up 8% on Bitcoin.

As securities fell towards Bitcoin throughout the interval, all different tokens are underneath menace of classification, with the worst at present being Sprint, down -56%, and the least affected being Cardano, down -15% Did.

Particularly, towards the greenback, Solana, ICP, and Nia are up 286%, 265%, and 145%, respectively, over the identical interval. Furthermore, even Sprint, the largest loser towards Bitcoin, is up 4%, whereas Cardano is up 87% versus the greenback.

In case you worth all the things in crypto {dollars}, you may miss out on the decline in your property in Bitcoin phrases.

Binance and Coinbase will defend themselves in court docket.

Whereas a lot of the business has centered on ETFs this yr, the Binance case might be heard in a Washington courtroom on January twenty second, presided over by Decide Amy Berman Jackson of the District of Columbia, and Coinbase He appeared in court docket in New York on March seventeenth. , Decide Katherine Polk Feira will oversee the case.

The SEC's allegations towards Binance deal with Binance's BUSD stablecoin and BNB tokens, suggesting that not less than the BNB tokens could have been initially bought as funding contracts. Binance's protection disputed the applicability of the Howie take a look at to cryptocurrencies and objected to comparisons with different court docket circumstances akin to SEC and Zakinov v. Ripple Labs.

Coinbase additionally disputed the relevance of the Howey take a look at to cryptocurrencies. The SEC's broad method has raised considerations about increasing the definition of securities to incorporate classes usually outdoors the SEC's purview, akin to collectibles. Decide Failla acknowledged the complexity of the difficulty and deferred judgment.

Elliott Stein, senior litigation analyst at Bloomberg, charges the SEC’s June 2023 lawsuit towards Coinbase at a 70% likelihood of being dismissed. Nonetheless, in both case, an SEC victory may have a big impression on the crypto business. It could require crypto exchanges to deal with digital tokens as securities, probably basically altering how these property are dealt with and controlled in the US.

The end result of those lawsuits will possible set a precedent for future regulation of digital property within the nation and have a tangible impression on the tokens named within the C&B lawsuits.

(Tag Translation) Algorand