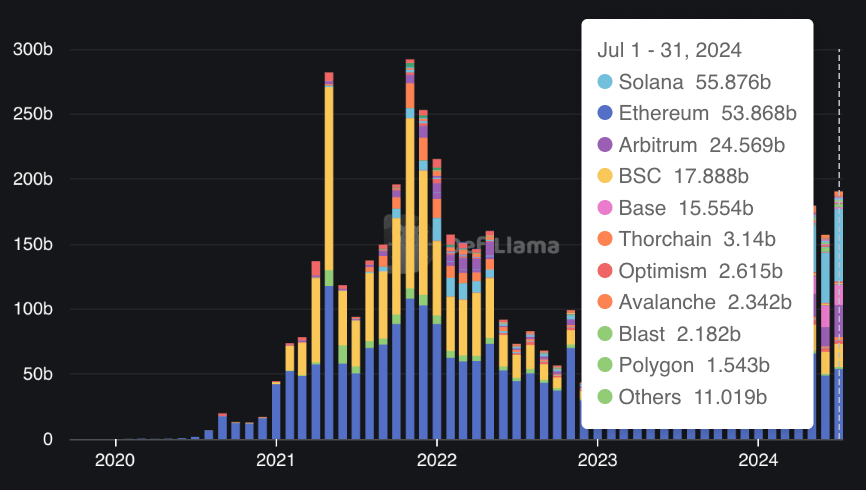

The Solana community surpassed Ethereum in month-to-month decentralized change (DEX) buying and selling quantity in July, in accordance with information from DefiLlama.

Solana's DEX buying and selling quantity reached $55.8 billion, surpassing Ethereum's $53.8 billion for a similar interval. That is Solana's second highest month-to-month buying and selling quantity after its peak of $60.7 billion in March 2024.

Solana's buying and selling quantity surge is principally on account of exercise on platforms similar to Raydium, Orca, and Phoenix. In distinction, Ethereum's buying and selling quantity is primarily pushed by the Uniswap change.

Regardless of these figures, Ethereum stays the main DeFi platform, accounting for round 61% of the market and locking in $67 billion in belongings. As compared, Solana accounts for simply 4.64% of the market with $5.16 billion in whole worth locked (TVL).

What’s driving Solana's progress?

Analysts level to elevated meme coin exercise as the principle issue behind Solana’s DEX quantity progress.

Over the previous 12 months, the blockchain has seen an enormous rise in meme cash, starting from cat-themed to politically impressed tokens, which has led to elevated liquidity as merchants search to leverage these belongings.

Institutional backing has additionally spurred curiosity in Solana, and hypothesis a couple of potential Solana exchange-traded fund (ETF) could have additionally contributed to the expansion. In June, massive asset managers VanEck and 21Shares filed with the U.S. Securities and Trade Fee (SEC) to create a spot-based Solana ETF.

Moreover, market analysts have famous the rising use of stablecoins on Solana: In response to information from Allium on Visa’s stablecoin dashboard, buying and selling quantity for Solana’s USDC stablecoin has exceeded $8 trillion because the begin of final 12 months, adopted by USDT on the Tron blockchain at $6.5 trillion.

Wash buying and selling considerations

In the meantime, the latest surge in Solana DEX buying and selling has raised considerations over potential wash buying and selling, with a latest report by nameless crypto analysts Flip Analysis claiming that 93% of transactions on the blockchain are inorganic.

In response to the report, Solana's each day buying and selling is closely impacted by wash buying and selling, MEV bots and fraud, which offer little worth to retail merchants.

“Wanting on the wallets concerned, the bulk look like bots in the identical community with tens of hundreds of transactions. They generate their very own pretend quantity with random quantities of SOL and random transaction numbers till the challenge is accomplished, then transfer on to the subsequent challenge.”