The Solana validator stated as we speak that it’s going to restart the blockchain community's mainnet beta cluster utilizing model 1.17.20 after an outage on February sixth.

Earlier as we speak, Solana's standing web page confirmed a mainnet outage. “Engineers throughout the ecosystem are investigating the mainnet beta outage,” a consultant on the blockchain firm’s official social media stated. I’ve written.

Laine, a software program and blockchain firm validating the Solana blockchain, additional defined:

“Solana mainnet beta is experiencing efficiency degradation and block development is presently halted and core engineers and validators are actively investigating.”

The corporate added:

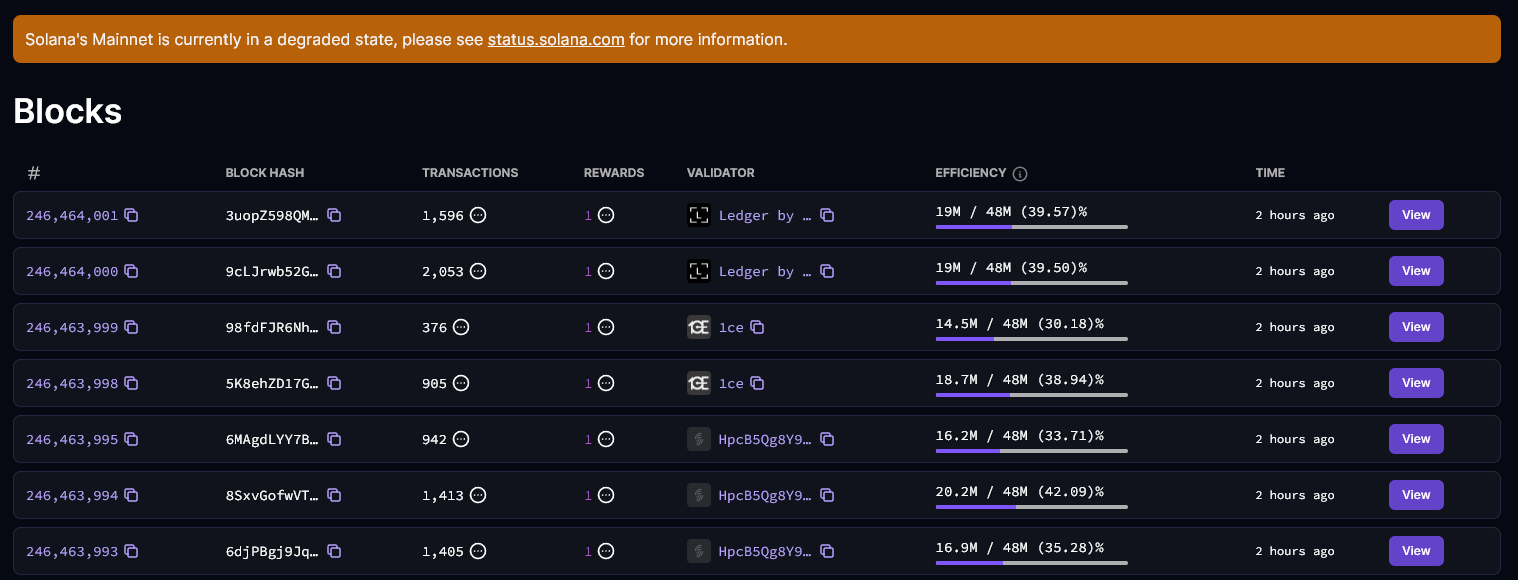

“Whereas engineers are investigating and figuring out potential remediation strategies, it isn’t but clear whether or not restoration is feasible with out orchestrating a cluster restart. The final optimistic slot has been agreed upon at 246464040. , validators are standing by for subsequent steps if wanted.”

For those who have a look at Solana's blockchain explorer, you possibly can see that the blockchain community processed its final transaction two hours in the past at round 09:52 UTC.

Solana has an extended historical past of outages, with the final outage occurring someday early final yr, in line with its standing web page.

SOL dip

Following this information, SOL's worth fell by about 5% to about $94, persevering with a major adverse improvement that has seen it decline by greater than 10% over the previous week. crypto slate knowledge. Solana stays the sixth-largest digital asset by market capitalization, regardless of the drop in worth.

The community confirmed nice resilience after revelations final yr of its intensive ties to Sam Bankman Fried, the founding father of the bankrupt FTX alternate.

This has spurred adoption and development amongst cryptocurrency fanatics who flock to the community for cheaper and sooner transactions in comparison with well-known rivals like Ethereum. Over the previous three months, the Solana-based decentralized alternate briefly surpassed Ethereum's decentralized alternate twice when it facilitated extra routine buying and selling actions.