To establish traits in DeFi, it’s worthwhile to analyze exercise on decentralized exchanges (DEXs). These DEXs are the cornerstone of his DeFi market, the middle of DeFi exercise, and the principle driving pressure of this sector. To grasp what drives DeFi, we have to have a look at DEX buying and selling volumes, dealer exercise, and completely different buying and selling pairs.

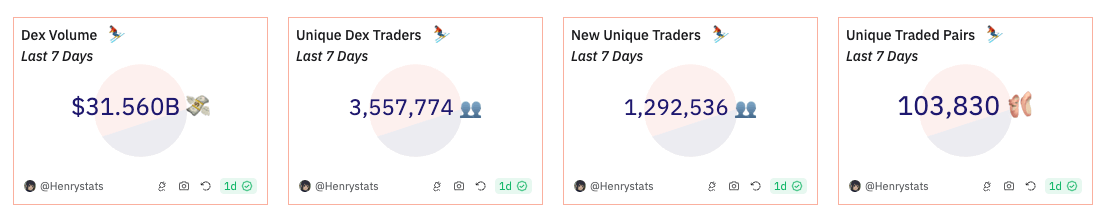

Over the previous seven days, the DEX market has seen vital exercise, with complete buying and selling quantity reaching $31.56 billion. In line with knowledge from Dune Analytics, there have been 103,830 distinctive buying and selling pairs throughout this era, and the market welcomed roughly 1.292 million new merchants.

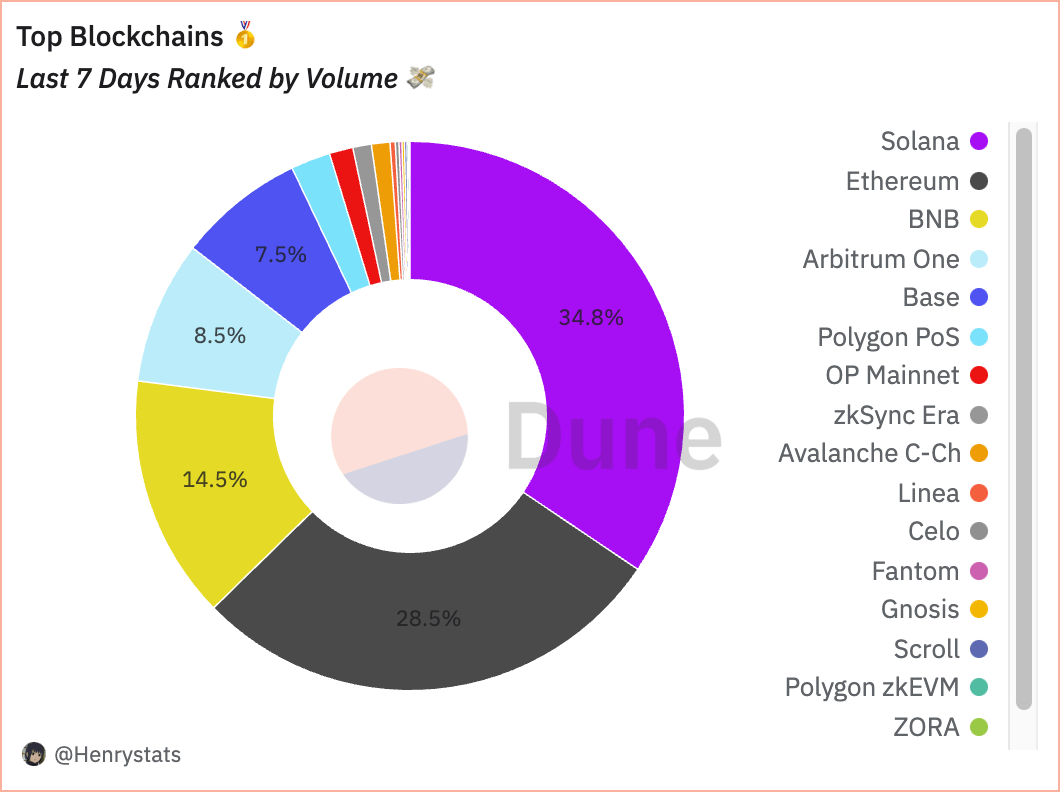

Probably the most attention-grabbing developments within the DeFi market is Solana, which has dethroned Ethereum and established itself because the de facto king of DeFi. Final week's complete buying and selling quantity was $10.98 billion, with Solana accounting for 34.8% of the full DEX market buying and selling quantity. This huge market share is a testomony to Solana's fast-growing ecosystem that helps a variety of his DEXs, from area of interest swap markets to well-known gamers like his Raydium.

Though buying and selling quantity decreased barely by 4.49% in the course of the interval, Solana continues to steer by way of variety of energetic merchants, internet hosting 2.542 million customers. That is considerably larger than another blockchain and considerably larger than the 470,704 customers that Ethereum has seen prior to now week. Such a big discrepancy between Solana and Ethereum person numbers highlights Solana's enchantment as a most well-liked buying and selling platform. The blockchain additionally helps 50,707 energetic pairs, the best in the marketplace, demonstrating all kinds of buying and selling choices for customers.

| blockchain | Quantity (USD) | % of complete quantity | Change interval | energetic dealer | energetic pair |

|---|---|---|---|---|---|

| Solana | $10.98 billion | 34.8% | -4.49% | 2542M | 50,707 |

| Ethereum | $9.01 billion | 28.5% | -27.05% | 470,704 | 15,568 |

| BNB | $4.56 billion | 14.5% | +0.71% | 1M | 45,249 |

| Arbitrum One | $2.67 billion | 8.5% | -28.04% | 336,072 | 2,952 |

| base | $2.36 billion | 7.5% | -29.39% | 672,196 | 16,495 |

Ethereum had a buying and selling quantity of $9.01 billion, carefully following Solana, accounting for 28.5% of the market. Buying and selling quantity decreased by 27.05% over the previous week. This will not be a noticeable change for a small blockchain, however it’s particularly vital contemplating Ethereum’s elementary function in DeFi. Nonetheless, with 470,704 energetic merchants and 15,568 energetic pairs, the blockchain stays a major hub of DEX exercise regardless of the decline.

Binance’s BNB ranks third with $4.56 billion, accounting for 14.5% of the full market. This corresponds to a slight enhance of 0.71% and reveals resilience even within the midst of a market downturn. With 1 million energetic merchants and 45,249 energetic pairs, his BNB chain continues to be the popular selection for a lot of merchants. Nonetheless, the comparatively low buying and selling quantity in comparison with the variety of customers signifies that these merchants could also be buying and selling lower than on Ethereum.

Arbitrum's buying and selling quantity was $2.67 billion, accounting for 8.5% of the market. The 28.04% quantity decline might mirror adjustments in person preferences and broader market traits. Nonetheless, the variety of energetic merchants confirmed final week of 336,072 signifies that vital worth remains to be being created. Base is a notable DeFi startup with buying and selling quantity of $2.36 billion and market share of seven.5%. Regardless of the 29.39% lower in buying and selling quantity, Base helps a comparatively giant variety of energetic merchants at 672,196, indicating robust person engagement.

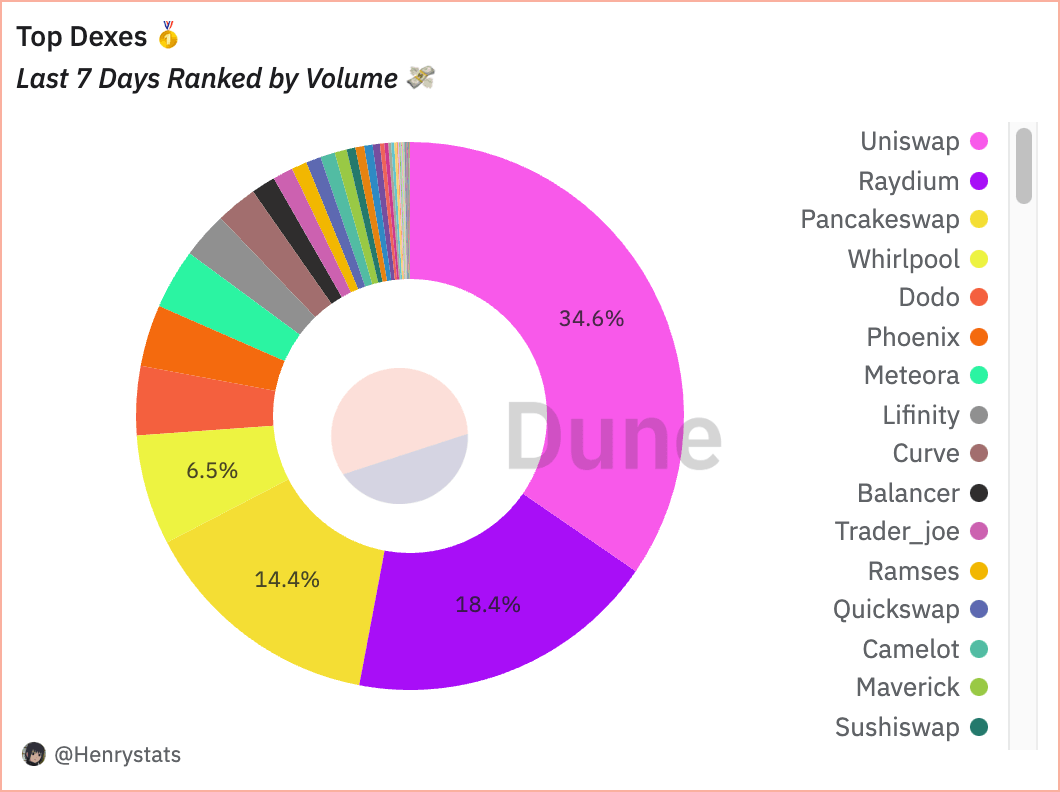

When it comes to DEXs, Uniswap leads the market with a 7-day buying and selling quantity of $10.91 billion, accounting for 34.6% of the full market buying and selling quantity. Regardless of a 28.93% drop in quantity over the previous week, it nonetheless maintains a excessive variety of energetic merchants at 1.456 million and helps 30,683 energetic pairs. Whereas the decline in buying and selling volumes will be attributed to broader market situations, its deep dealer base suggests enduring loyalty and belief within the platform.

| dex | Quantity (USD) | % of complete quantity | Change interval | energetic dealer | energetic pair |

|---|---|---|---|---|---|

| uniswap | $10.91 billion | 34.6% | -28.93% | 14.56 million | 30,683 |

| Radium | $5.8 billion | 18.4% | +11.76% | 23.09 million | 46,905 |

| pancake swap | $4.54 billion | 14.4% | -0.63% | 11.72 million | 43,239 |

| swirl | $2.05 billion | 6.5% | -4.68% | 514,709 | 1,963 |

Raydium, which runs on the Solana blockchain, confirmed spectacular development with transaction quantity of $5.8 billion, a rise of 11.76%. With 2.309 million energetic merchants and 46,905 energetic pairs, Raydium is a key participant in Solana's dominance, providing customers a variety of buying and selling choices and contributing considerably to buying and selling volumes on the blockchain.

BNB’s major DEX, Pancake Swap, had a buying and selling quantity of $4.54 billion, a slight lower of 0.63% over the previous 7 days. With 1.172 million energetic merchants and 43,239 energetic pairs, Pancakeswap stays a major pressure within the DeFi house. Its quantity stability suggests a resilient platform that continues to draw a gradual movement of customers.

Numerous merchants and energetic pairs signifies that the DeFi market is very liquid and merchants have a variety of choices. Solana's market dominance reveals that customers favor a platform that provides pace and low buying and selling prices, regardless of occasional outages and points.

The numerous decline in quantity seen throughout blockchains and even particular person DEXs contrasts with the resilience of platforms similar to Pancakeswap and BNB, which have created pockets of stability out there even throughout instances of volatility. It reveals that

The submit DeFi panorama adjustments as Solana dethrones Ethereum in buying and selling quantity appeared first on nft-cryptocurrency.