Solana Worth Right this moment is buying and selling at $209 and is held close to the higher restrict of the upward channel after a robust summer season gathering. Patrons are testing zones between $210 and $220. This coincides with Fibonacci’s retracement ranges and EMA clusters, the place merchants weigh the influence of bullish foundations on seasonal headwinds.

Solana Worth retains channel assist

Each day charts present that SOL has progressed inside rising parallel channels since April. Assist is near $197-200, with 20-day EMA in keeping with medium-channel demand. Resistance stays within the enrichment vary round $220, the place costs have stalled a number of instances.

Associated: XRP (XRP) Worth Forecast: Analyst Eye $3.60 Breakout ETF Expectations Sizzling

Momentum indicators are impartial but constructive. The RSI is close to 58, indicating the area to make extra income with out over-purchase. In the meantime, Emma’s alignment for 50 and 100 days beneath the spot continues to offer structural assist. A clear breakout over $220 may open the highway to $236 and Kee Fibonacci ranges for $252.

Alpenglow upgrades guarantee overwhelming approval

Fundamental sentiment has skyrocketed this week after Solana Stakers overwhelmingly voted to approve the much-anticipated Alpenro improve. Over 98% of members supported the proposal. The proposal introduces two elements, voting and rotors, designed to interchange the proof of historical past and tower bufft.

Overhaul is ready to scale back the ultimate transaction time from 12 seconds to about 150 milliseconds, a person expertise milestone. Later Rotor deployments optimize Validator Communications and goal efficiency enhancements for prime demand Defi and gaming functions. In 52% of stakessols concerned within the vote, the outcomes present sturdy group integrity and strengthen confidence in Solana’s scalability roadmap.

Associated: World Liberty Monetary (WLFI) Worth Forecast 2025–2030

Seasonal developments and Elliott’s wave outlook

Analysts warn that September has traditionally been a weak month for Solana. Seasonal charts for Seasonal Axe present repeated dip or lateral trades throughout this era, with a robust restoration usually persevering with in October.

Elliott Wave Evaluation displays this view. The chart means that SOL is consolidating on the corrective stage, with the broader construction pointing to a resumption of the upward development. Based on extra Crypto On-line, persistence could also be required till September, however bias prefers the next degree of This fall if present assist is retained.

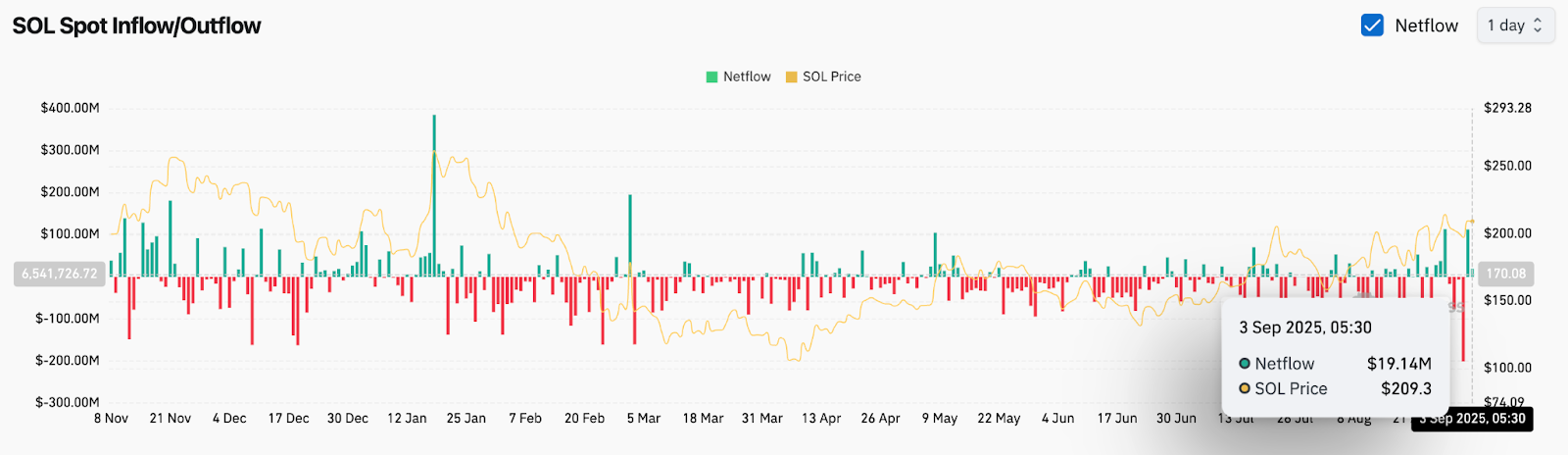

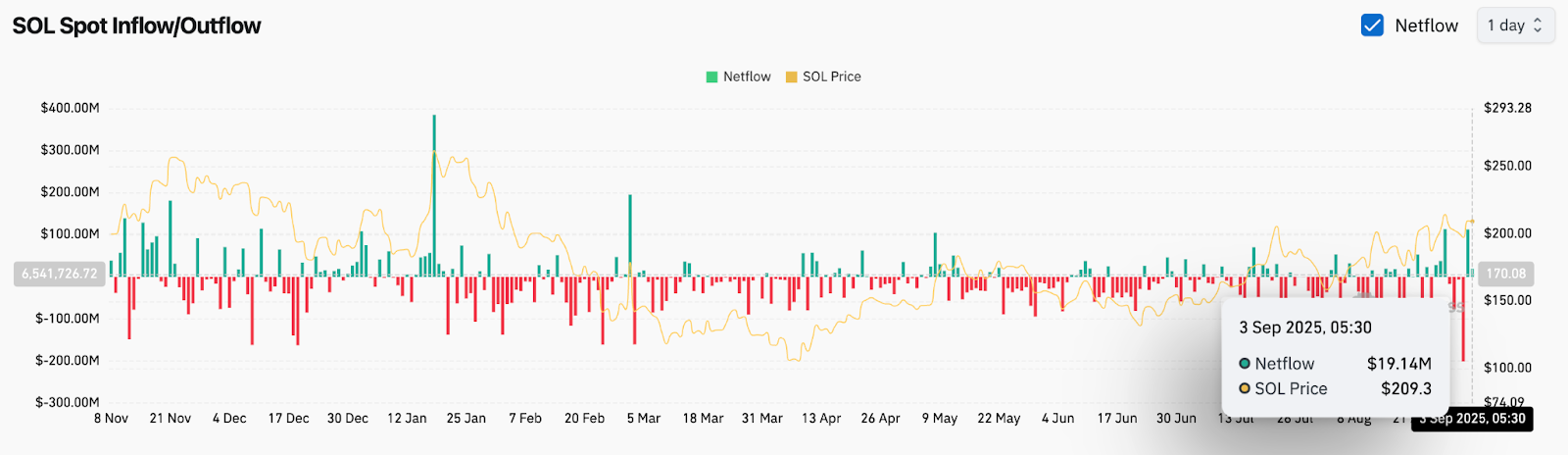

On-chain move alerts cautious accumulation

On-chain knowledge supplies combined but improved photographs. Coinglass’ Spot Netflow knowledge confirmed an aggressive influx of $19.14 million on September 3, reflecting a cautious accumulation on the $209 degree.

Though the influx has not been constant over the previous few months, the most recent pickups recommend that merchants are positioning for potential breakouts. The conviction would require a sustained influx of over $50 million, which is in keeping with broader optimism about Alpenroe’s upgrades.

Solana Worth Technical Outlook

Speedy assist is between $197 and $200, and there’s a deeper danger in direction of $186 and $171 if gross sales strain happens. The benefit is that recalling $220 in quantity will bolster the rally’s lawsuit heading in direction of $236 and $252, the latter marking the earlier downtrend of 0.786 Fibonacci retracement.

Failure to clear $220 in September may probably lengthen integration in keeping with historic seasonality earlier than new makes an attempt rise later within the 12 months.

Associated: Dogecoin (Doge) Worth Forecast for September third

Outlook: Will Solana go up?

Solana’s short-term trajectory relies on whether or not the bull can take in seasonal weak point and harness the momentum from the Alpenglow improve. So long as Sol is above $197, the broader construction will stay bullish, with $236-252 as a key upward goal of $252.

Analysts are cautiously optimistic. The mixture of sturdy group backing for upgrades, constructive Netflows, and a constructive Elliott Wave setup means that even when September brings a short-term pause, it may prime one other leg that surpasses Solana’s This fall.

Solana Worth Prediction Desk

| degree | assist | resistance | Indicator bias |

| Latest interval | 197-200 {dollars} | $220 | From impartial to sturdy |

| brief time period | $186 | $236 | RSI Assist |

| Mid-term | $171 | $252 | Channel + Fibonacci bullish |

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version isn’t chargeable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.