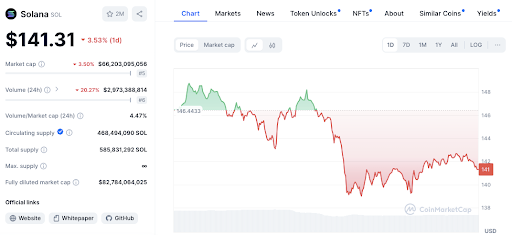

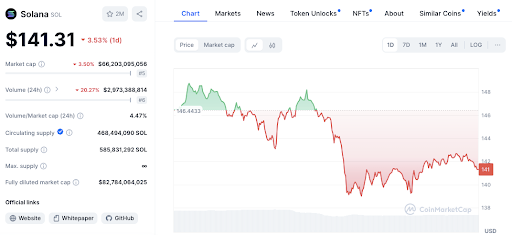

- SOL is going through sturdy resistance at $146.44, with weak help at $142 and $140.

- The decline in buying and selling volumes is a warning signal, elevating the chance of additional downward stress.

- The RSI and MACD pattern of 46.55 continues to point bearish sentiment in the direction of Solana.

Solana (SOL) value has fallen to $141.74 after falling 3.2% prior to now 24 hours, leaving traders questioning if the cryptocurrency has reached its backside. Technical indicators are additionally giving combined indicators as to the long run value motion of SOL.

Merchants are carefully monitoring Solana's value actions for indicators of a potential reversal or additional decline.

SOL value tendencies and market exercise

Solana's value pattern exhibits weakening momentum. After reaching a excessive of $146.44, the worth started to say no, indicating that the bullish energy was waning. Regardless of some positive aspects, SOL struggled to take care of its positive aspects and fell in the direction of the $142 mark.

Associated article: Analyst says SOL will attain 20% of ETH market cap in subsequent bull market

Notably, buying and selling volumes have declined by greater than 20%, suggesting a slowdown in market exercise. This decline means that merchants have gotten extra cautious, and if this pattern continues, it may trigger additional value declines.

Key help and resistance ranges to look at

The short-term help stage for SOL is $142, and the worth is at the moment buying and selling at this stage. If SOL breaks beneath this level, the subsequent help stage could be $140, which could possibly be an necessary space for merchants trying to assess additional draw back danger.

Higher resistance lies on the latest peak at $146.44. If Solana can break above this stage, it may sign a return to bullish territory. The intermediate resistance at $144, which SOL briefly examined, additionally performs a task in figuring out the short-term value motion of the cryptocurrency.

Up to now 12 hours, Solana has had extra short-term liquidations than long-term liquidations. When costs rose early within the interval, long-term liquidations outperformed short-term liquidations.

Additionally learn: Will Solana (SOL) put up a great spike following Market Recto?

Nevertheless, as soon as costs began to fluctuate, there was a noticeable improve in short-term liquidations when costs fell. Lengthy-term liquidations then surged as costs recovered, displaying elevated volatility as merchants took positions on either side of the market. This volatility signifies uncertainty as members react to sudden value adjustments.

SOL's each day RSI is at the moment at 46.55, suggesting some promoting stress however not but in oversold territory. Additionally, the 1-day MACD is buying and selling beneath the sign line, suggesting a short-term bearish pattern.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.