- Solana Value trades almost $196 at this time and has help from over $192-$199 after rejecting it from a $246 channel resistance.

- The chain circulate remained combined, and the web influx of $21.8 million couldn’t affirm a robust accumulation pattern.

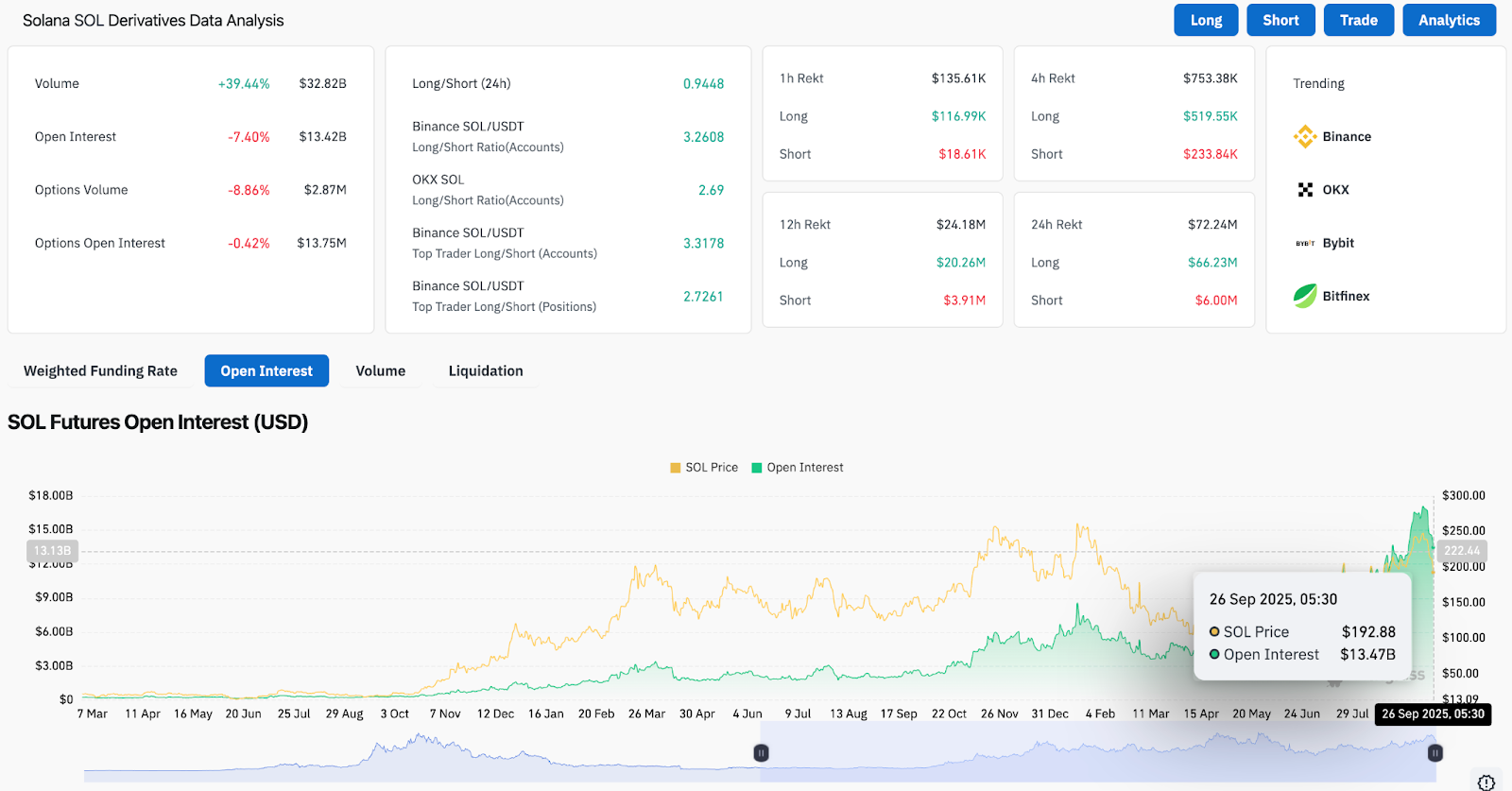

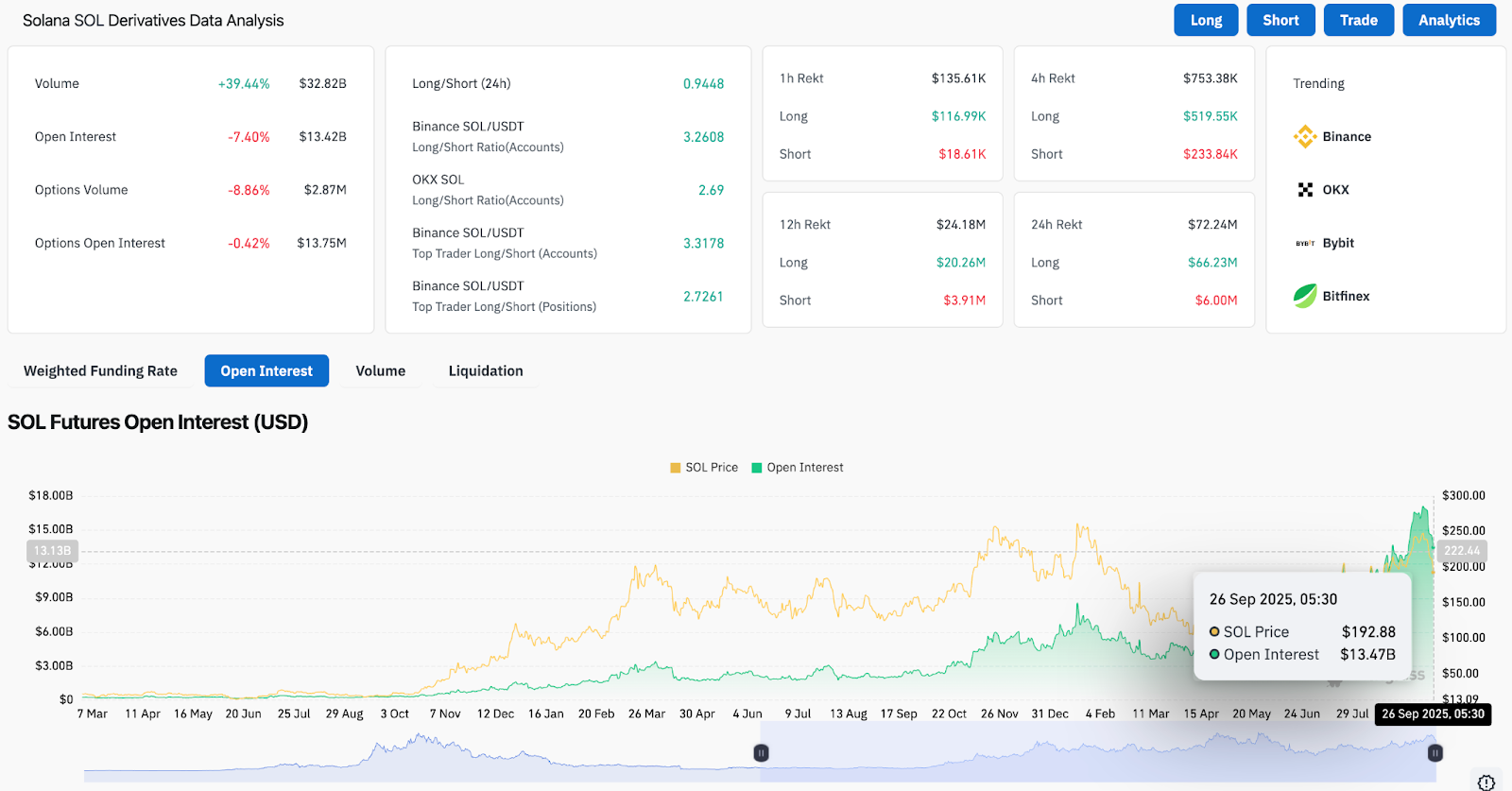

- Curiosity on the Open Futures Sliding 7.4% to $13.4 billion, indicating a decline in leverage urge for food as merchants cut back their danger publicity.

Right now’s Solana Value is buying and selling almost $196 and is recovering modestly after sliding from its $246 peak final week. Sharp Reversal has Sol situated simply above the primary trendline help, however consumers try to defend the $192-$196 zone. The principle query is whether or not Solana can stabilize past this stage or is there a deeper flaw in direction of $172.

Solana Value loses momentum with channel resistance

Every day charts present Solana refused to withstand $246. After that, costs went again to the $192-$196 zone. This can be a area supported by each Fibonacci stage and midrange trendlines.

Speedy resistance is at the moment near $218, with obstacles being $246 and $252. On the draw back, dropping $192 reveals a help stage of $171, permitting deeper flashes to check out the $142 area. Indicators of momentum counsel cooling circumstances at early bearish crossover pressures of MACD signaling, regressing from the surplus ranges of RSI.

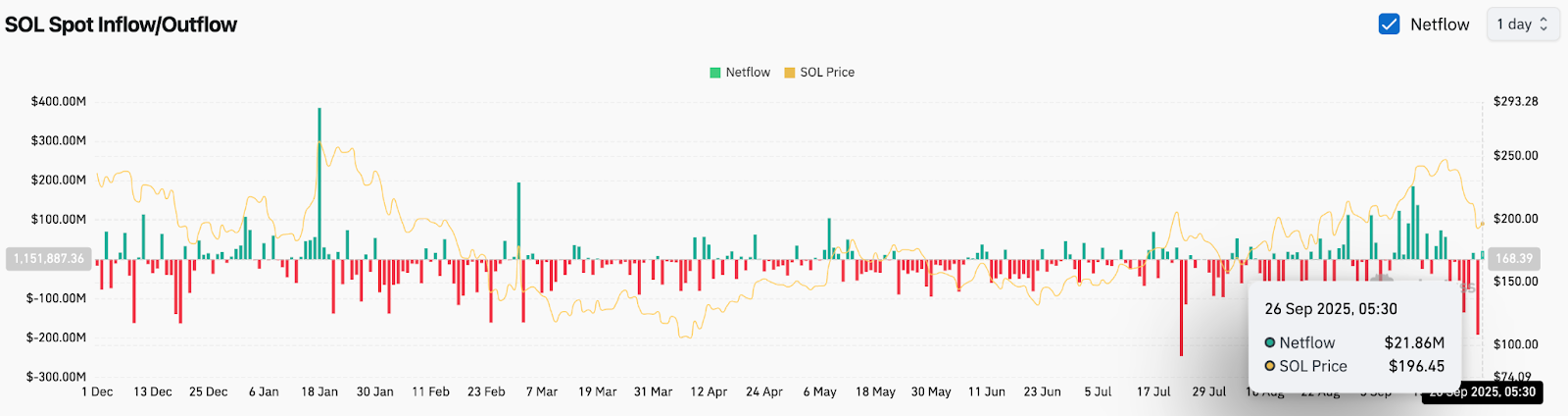

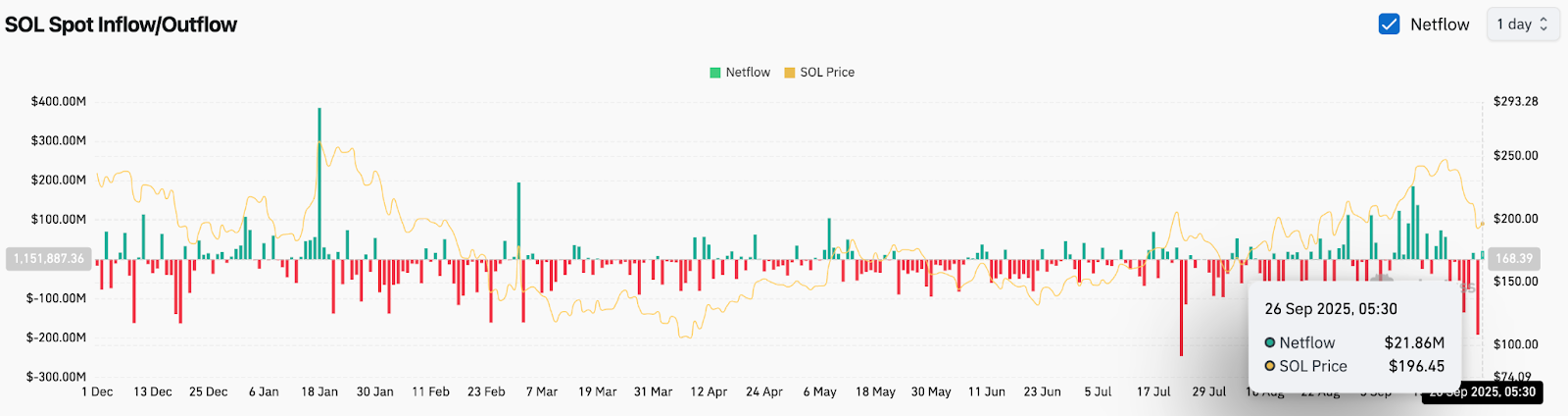

On-chain circulate indicators weak positioning

Alternate Spot Knowledge reveals Solana recorded a internet influx of roughly $21.8 million on September twenty sixth. Inflows typically mirror up to date accumulation, however broader tendencies spotlight inconsistent demand, with alternating bursts of influx and outflow that dominate the previous few months.

This uneven participation raises questions surrounding convictions amongst consumers. Supporting sturdy rebound requires a sustained constructive circulate. In any other case, sellers could proceed to stress pricing measures round pivots between $190-200.

Derivatives Markets Mirror Bearish Consideration

Open curiosity in Solana’s futures has fallen to $13.4 billion, slipping 7.4% previously day. This contraction underscores the cooling need for leveraged publicity after the latest $246 rejection.

Regardless of sturdy buying and selling volumes of over $32 billion, the decline in choices exercise and a shrinking OI present that merchants are decreasing danger somewhat than constructing bullish positions. The lengthy/quick ratio stays barely leaning in direction of the lengthy of the primary trade, however with out sustained capital inflows, the imbalance is caught within the vendor’s benefit.

Solana Value Technical Outlook

- Upwards goal: Reclaiming $218 will ease the stress, bringing again $246 and $252 to the following breakout stage of $252.

- Draw back danger: Shedding $192 will reveal $171, with the following liquidity pocket of $142.

- Development Help: The 200-day EMA, near $177, stays a long-term line of protection.

Outlook: Will Solana go up?

Solana’s path is dependent upon whether or not consumers can stabilize costs above $192, however the circulate improves. Whereas on-chain knowledge stays combined and reveals fragmented demand, futures merchants proceed to scale back their publicity.

If Solana Value owns $192 at this time and will get again $218, the door will begin for one more try at $246. Nevertheless, in case you do not maintain this zone, you danger Sol being pulled again to $171. For now, the market is leaning fastidiously with momentum and circulate that marks an integration section somewhat than an instantaneous restoration.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.