- Solana Value trades right now for $202 and has assist over $200-194 after rejecting it with a resistance of $218-220.

- Constancy updates the Solana ETF submitting, including a powerful institutional narrative regardless of fragile on-chain move.

- The $2297 million excessive sentiment is highlighted in a quantity of internet spills and degraded derivatives.

Solana Value At the moment is buying and selling almost $202 and is struggling after dropping its $218-$220 resistance zone. Patrons defend $200 in assist, however after a pointy September pullback, momentum stays fragile. At the moment, the market is specializing in ETF’s optimism about mixed-on-chain flows.

Solana Value retains rising channel assist

Day by day charts present Solana clinging to the decrease boundary of the upward channel with speedy assist of $200 and demand close to $194. The 20-day EMA is $218, serving as the primary main ceiling, whereas the 50-day EMA provides layered resistance at $209.

Parabolic’s SAR turned its bearish round earlier this week and confirmed downward momentum. Nonetheless, so long as SOL is above $194 and 100-day EMA is above $196, the broader uptrend stays. The important thing combat is $218, and a rejection may very well be invited much more negatively in direction of $181.

Constancy ETF submitting provides fundamental catalysts

Investor sentiment has improved as Constancy updates its Solana ETF submitting to make use of well-liked itemizing requirements. The transfer will strengthen the case for remaining approval and place Solana together with institutional product pipelines Bitcoin and Ethereum.

Market analysts counsel that even pending ETF functions present a story tailwind, attracting speculative flows and strengthening Solana’s place as a number one blockchain. If approvals progress within the US, demand for SOL may develop considerably.

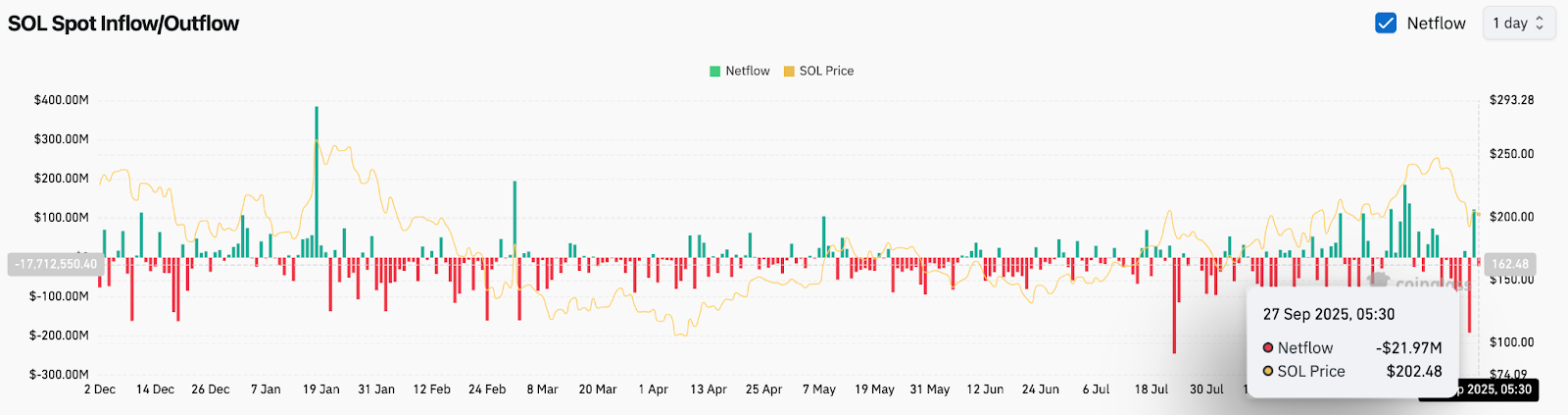

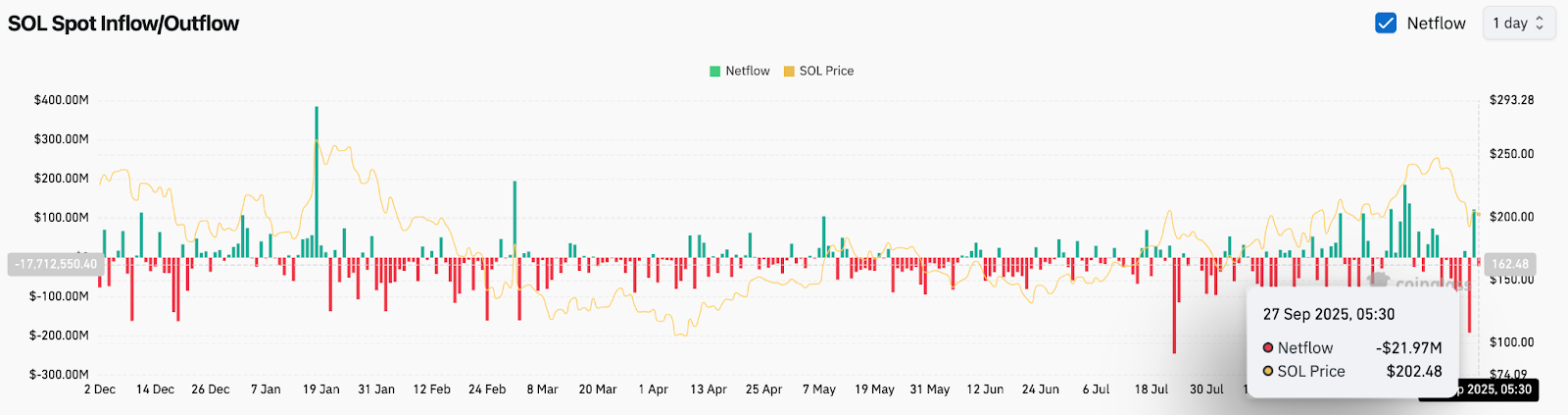

On-chain move signifies up to date outflow

Trade information confirmed a internet outflow of $21.97 million on September twenty seventh, reflecting gross sales strain at current ranges. The damaging pattern follows a collection of combined prints in September, highlighting the appetites of weak traders.

Though sustained spills are being taken care, merchants argue that heavy gross sales may already be absorbed given the dimensions of Solana’s summer season gathering. A sustained constructive move is required to assist restore confidence and regenerate a better zone of resistance.

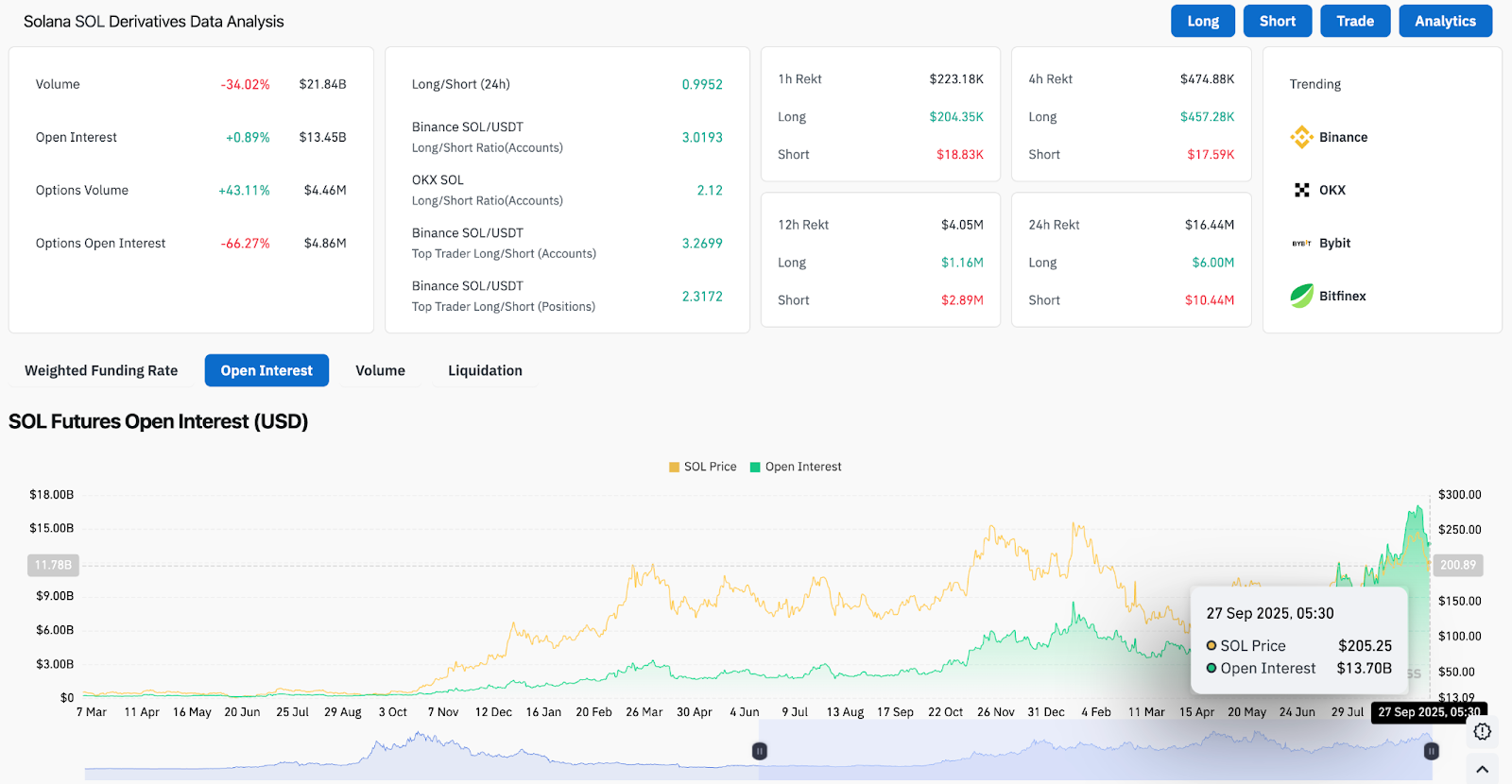

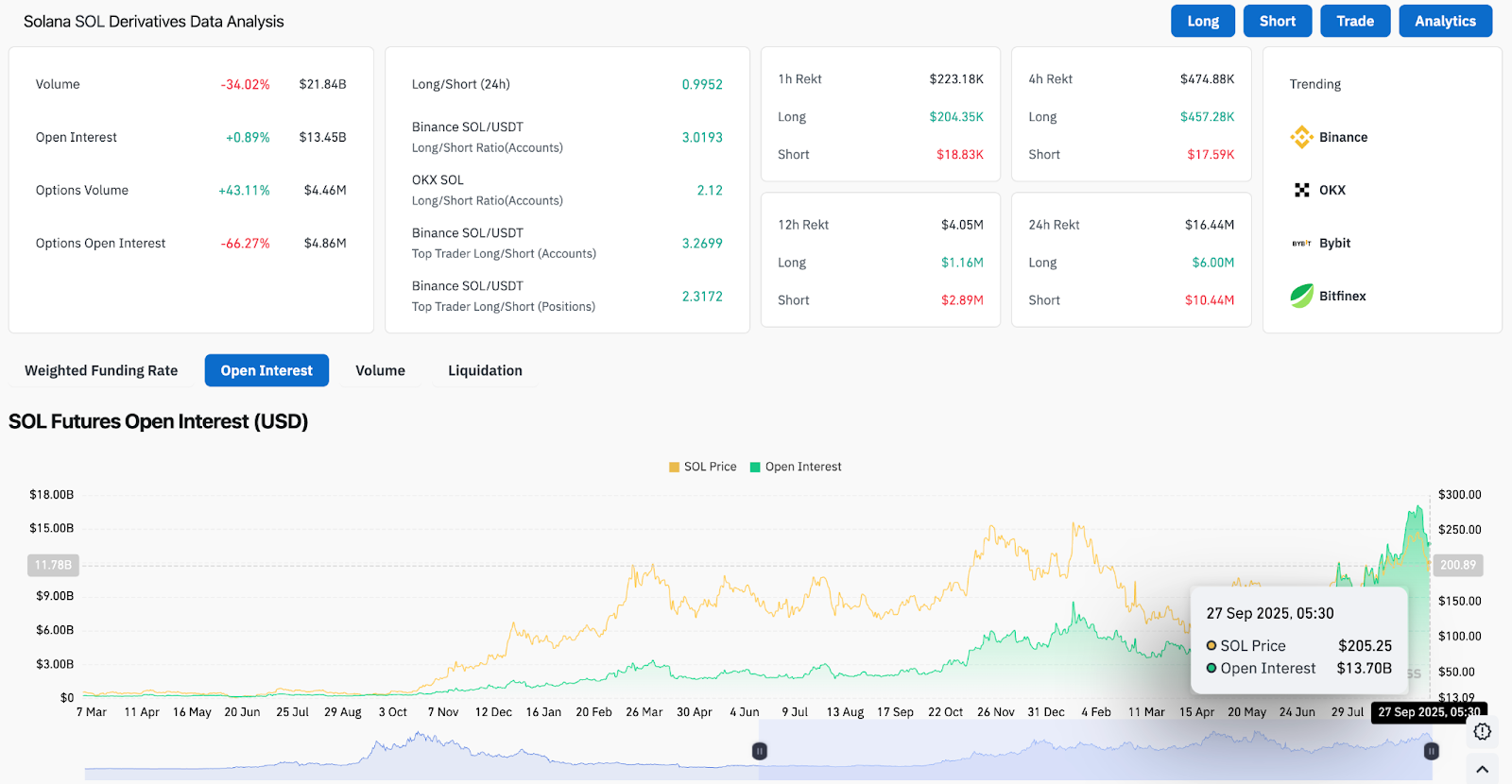

Futures information highlights cautious positioning

Spinoff information reveals cut up photographs. Solana’s open curiosity rose barely to $13.7 billion, reflecting sustained participation, whereas every day buying and selling volumes fell 34% to $21.8 billion. Whereas elective actions spiked, open curiosity collapsed by over 60%, suggesting selective hedges slightly than broad hypothesis.

The lengthy/quick ratio is bullish, with Binance’s prime merchants holding extra lengths than the shorts. This implies that bigger accounts are leaning optimistically, at the same time as the broader volumes lower. Shiftbacks above $218 may probably invite extra aggressive leverage.

Solana Value Technical Outlook

Solana’s value forecast focuses on assist bands starting from $200 to $194. Maintaining this stage will allow the channel construction, however breakdowns threat opening the door to $181. The benefit is that if you happen to clear $218, you may see that bullish continuation is $234 and $252.

- Upside Degree: $218, $234, $252 as details of resistance.

- Drawback ranges: $200, $194, $181 as necessary defensive zones.

Outlook: Will Solana go up?

Solana’s direct path is determined by whether or not ETF optimism can offset weaker flows and technical rejection by $218. So long as the customer protects $200, the broader bull cycle stays the identical. The decisive breakout, over $218, shifts momentum to $234, probably at $252.

Nonetheless, if Sol loses $194, the vendor can regain management and lift the worth to $181, slowing down the following bullish leg. For now, Solana will stay within the integration part, with the system headlines and spot demand figuring out the route of the following breakout.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version shouldn’t be answerable for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.