- Solana’s $180 assist stays essential as sellers tighten administration of short-term traits

- Improve in open curiosity of over $10 billion suggests elevated volatility and potential liquidation threat

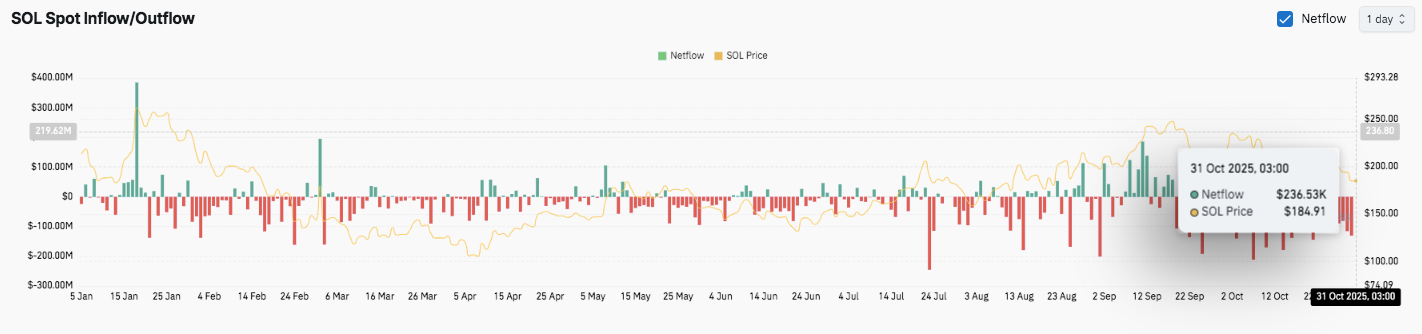

- Latest capital inflows sign a return to cautious optimism after months of profit-taking strain

Solana (SOL) has did not regain the $190 resistance and is below renewed promoting strain. The cryptocurrency is buying and selling round $185, hovering under the mid-Bollinger Band, indicating weakening short-term momentum. Analysts notice that current assist breakdowns recommend that sellers have regained management and momentum indicators are aligning to the draw back.

Key ranges outline short-term course

SOL’s instant assist lies between $180 and $182, which coincides with the decrease certain of the Bollinger Bands. If we shut under this vary, the value might attain $170, which coincides with the earlier swing low and the 0% Fibonacci retracement stage. Subsequently, it is very important shield the $180 mark to stop additional decline.

On the upside, the zone between $192 and $195 serves as a key pivot space. This coincides with the 20-day easy transferring common and the 38.2% Fibonacci retracement. A return to this stage might restore bullish sentiment within the quick time period.

Associated: Chainlink value prediction: $3.6 million influx and Ondo buying and selling increase confidence

Above that, additional resistance seems at $203 and $211, the place the 50% and 61.8% Fibonacci ranges are positioned. If restoration makes an attempt proceed, these ranges are prone to result in robust promoting strain.

Momentum and derivatives present divergence

The RSI stays weak at 39, reflecting delicate oversold situations, however lacks affirmation of a reversal. A pullback above 45 might point out renewed shopping for energy in direction of the $192 resistance zone. Till then, the bearish momentum stays intact.

In the meantime, Solana’s futures open curiosity soared to $10.63 billion on October 31, suggesting elevated speculative exercise. The rise adopted a quiet consolidation part earlier within the quarter.

Sustained open curiosity above $10 billion typically signifies elevated volatility expectations. Nonetheless, if the value falls whereas leverage is excessive, it could point out overcrowded buying and selling and potential liquidation threat.

Inflows recommend gradual stabilization

Spot inflows and outflows to Solana point out altering investor sentiment all through 2025. Inflows peaked in January and February at greater than $300 million, suggesting robust accumulation.

Outflows dominated from March to August, suggesting profit-taking and declining demand. Inflows have just lately accelerated once more, with web inflows of $236,000 recorded on October thirty first.

Technical Outlook for Solana Costs

Key ranges stay clearly outlined for November.

- High stage: $192-195 is the primary hurdle and coincides with the 20-SMA and 38.2% Fibonacci zone. Above $195, the rally might lengthen in direction of the 50% and 61.8% Fibonacci retracement ranges of $203 and $211, respectively.

- Cheaper price stage: $182-$180 types essential short-term assist, adopted by $170, the earlier swing low and key space of demand. Under $180, the value might rise to $165 and even $155 if promoting strain accelerates.

- Higher restrict of resistance: $195 stays an essential stage for medium-term bullish affirmation. If buying and selling continues above this threshold, upward momentum might be reestablished and sign new power available in the market.

Technical construction reveals Solana consolidating under the median Bollinger Band, indicating the market is swirling inside a slender vary. A decisive get away of this compression might ignite extra volatility in both course.

Will Solana rebound?

Solana’s near-term outlook is determined by whether or not consumers can defend the $180 assist zone as bearish momentum continues. If the RSI recovers above 45 and inflows proceed to enhance, a retest of $192-$203 is probably going. Nonetheless, if the value can’t maintain $180, the bearish pattern in direction of under $170 can be confirmed.

Associated: Shiba Inu value prediction: Fed rate of interest cuts and commerce truce paving the best way for a rebound

For now, Solana stays within the crucial zone. Futures open curiosity of greater than $10 billion suggests heightened speculative exercise, however the confidence from spot inflows will decide whether or not the subsequent massive transfer is a restoration or an additional decline.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.