- Solana value is buying and selling round $221 and consolidating inside the triangle as consumers defend the assist at $219.

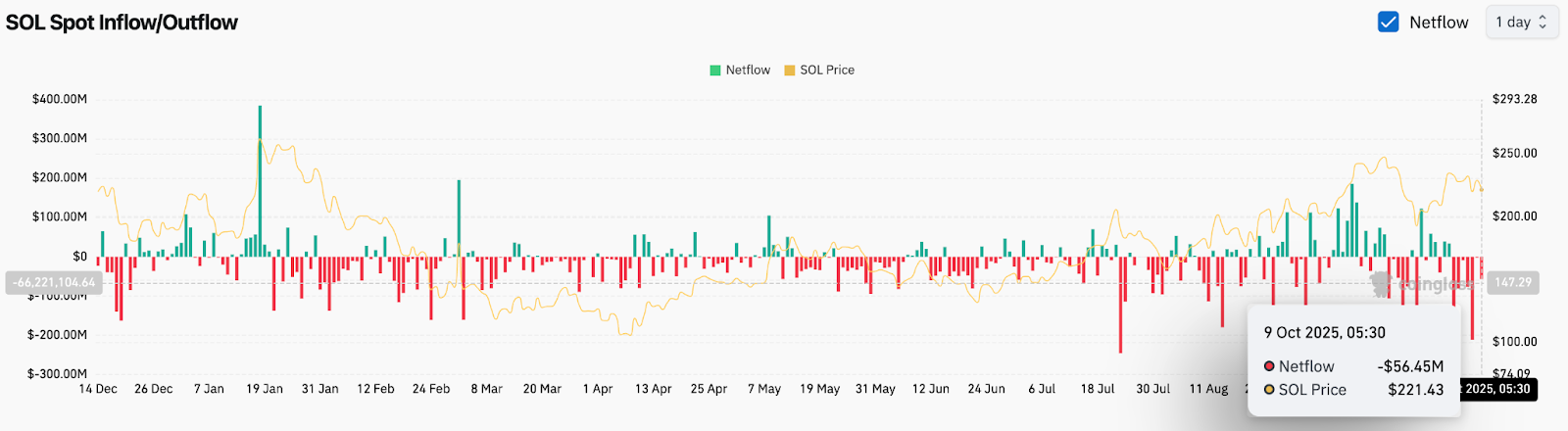

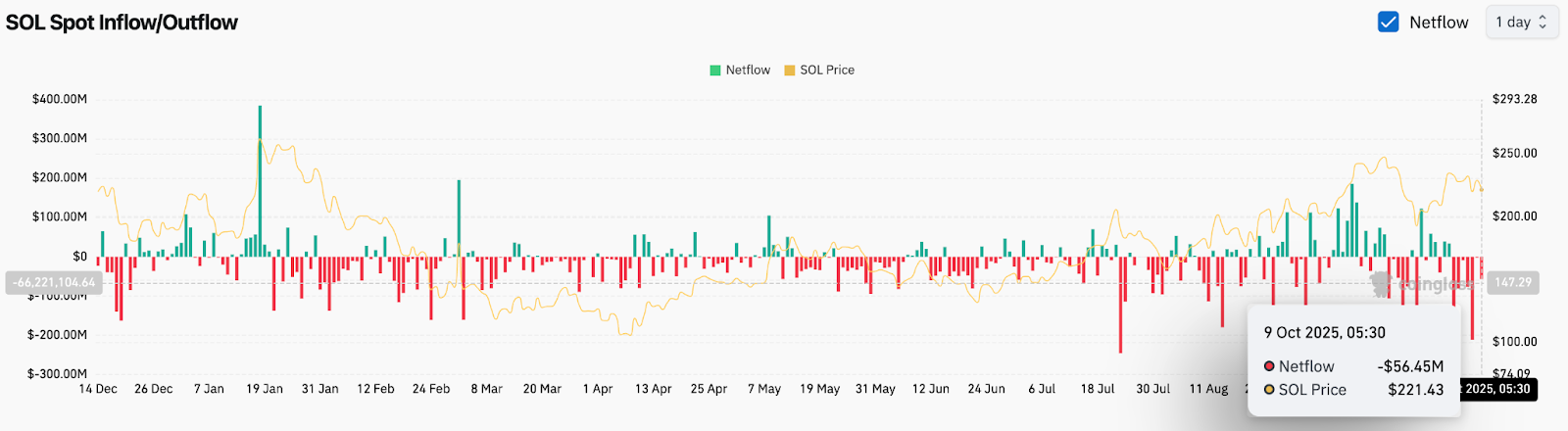

- Coinglass information reveals outflows of $56 million, suggesting accumulation regardless of short-term consolidation.

- Bitwise ETF updates and Solana’s dominance in tokenized inventory buying and selling add to the bullish momentum.

Solana value is buying and selling round $221 at the moment, stabilizing after sliding off the $225-$226 resistance. In a broader setting, we see the asset consolidating inside a symmetrical triangle with consumers defending the rising assist line round $219.

Solana Value defends rising assist

The 4-hour chart reveals that SOL is buying and selling inside a contracting triangle sample, sandwiched between an ascending assist development line close to $219 and a descending resistance line at $226. This construction suggests a possible breakout within the upcoming trades as volatility is compressed between the 20EMA and 50EMA.

Speedy assist lies at $219-$220, adopted by deeper cushions at $215 and $212 marked by the 100 and 200 EMAs. A detailed above $226 may set off an upside push to $233-$238, but when the worth can’t maintain $219, there’s a threat of a collapse towards $210.

Associated: Ethereum value prediction: ETH holds key Fibonacci ranges forward of Fusaka improve

The RSI is hovering round 44, indicating impartial momentum after settling from latest overbought ranges. The technical bias stays cautiously bullish so long as the bottom continues to rise.

On-chain information reveals $56 million leaked

Coinglass change information recorded a web outflow of $56.4 million on October ninth, indicating regular accumulation regardless of slower value actions. Outflows sometimes point out a decline in promoting stress, and this development confirms that merchants are shifting SOL off exchanges with the intention of holding it for the long run.

Runoff over the previous week has proven alternating spikes, however the predominance of runoff means that the underlying buildup stays intact. This sample is in keeping with value consolidation round main helps and displays investor endurance within the face of potential elevated volatility.

Bit-by-bit ETF updates reignite institutional investor curiosity

Sentiment improved after Bitwise submitted an replace to its Solana ETF proposal that features staking with a 0.20% payment construction. This addition strengthens Solana’s institutional narrative by introducing passive yield alternatives inside a regulated product framework.

Associated: Bitcoin value prediction: Polymarket and former PayPal chief predict 1.3 million BTC

Market analysts say integrating staking into ETFs may make them extra engaging to conventional buyers on the lookout for yield publicity within the digital asset house. The information follows months of hypothesis surrounding the launch of the Solana ETF, positioning the community as a number one contender after Bitcoin and Ethereum.

Solana leads tokenized inventory market exercise

SolanaFloor information reveals that Solana accounts for over 95% of the whole tokenized inventory quantity over the previous 30 days, additional boosting sentiment. This benefit over Gnosis and Ethereum highlights Solana’s rising affect in decentralized buying and selling infrastructure.

This milestone indicators the community’s rising use of tokenized equities, a market that’s anticipated to develop considerably as regulatory readability will increase. Analysts see this as a key structural benefit that would assist Solana’s value motion via the following market cycle.

outlook. Will Solana go up?

Solana’s subsequent transfer will rely upon whether or not consumers can preserve management above $220 as consolidation will increase. On-chain information and ETF-related information proceed to drive accumulation, whereas technical compression suggests a breakout is close to.

Associated: PancakeSwap (CAKE) Value Prediction 2025-2030

Analysts count on Solana value to development towards $233-$238 within the close to time period so long as the $219 assist development line holds. If the worth closes under $219 for the day, this outlook might be invalidated and draw back threat will improve once more in direction of $210.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.