- SEC approves Grayscale Solana Belief ETF, paving the way in which for NYSE Arca itemizing.

- SOL is buying and selling inside a triangle sample at $194 and is eyeing the breakout zone at $225.

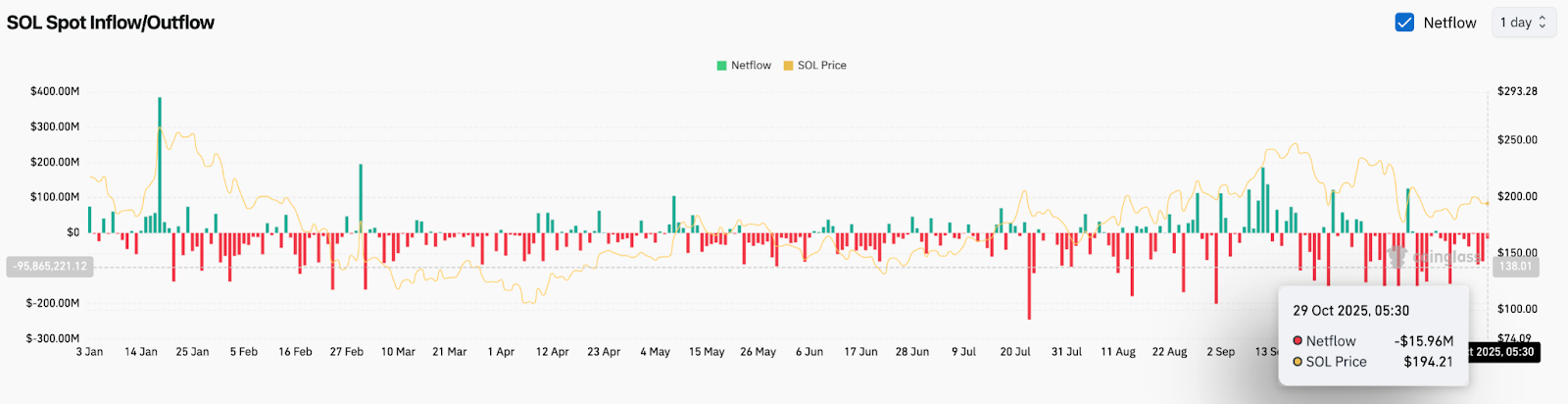

- On-chain flows confirmed outflows of $15.9 million, indicating cautious sentiment regardless of the ETF catalyst.

Solana (SOL) value is buying and selling round $194.19 right now, remaining regular after a risky session that noticed restricted motion forward of main resistance. Market focus shifted sharply following affirmation that the Grayscale Solana Belief ETF has acquired formal itemizing and registration approval from the U.S. Securities and Trade Fee (SEC).

ETF approval reignites curiosity in Solana

In a submit on X, Solana’s official account confirmed that the Grayscale Solana Belief ETF has been permitted by the SEC, paving the way in which for itemizing on NYSE Arca. This growth positions Solana as one of many few non-Bitcoin and non-Ethereum belongings to have achieved a trust-level ranking within the U.S. market.

This information triggered a pointy intraday rally throughout Solana-related merchandise, however total crypto sentiment stays muted because of macroeconomic uncertainty and the Federal Reserve’s upcoming coverage announcement. For merchants, the ETF itemizing signifies Solana’s rising adoption and confirmed attain to institutional traders, which might assist drive deeper liquidity inflows within the coming months.

Associated: Bitcoin Value Prediction: BTC Value Regular as Open Curiosity Reaches $73 Billion

Value modifications fall inside a symmetrical triangle

On the day by day chart, Solana continues to commerce inside a tightening symmetrical triangle sample, with upside resistance capped close to $225.50 and an uptrend line offering assist close to $187.00. This consolidation section has been ongoing since mid-year, compressing volatility and setting the stage for a possible breakout because the sample nears completion.

The important thing exponential shifting common (EMA) gives essential short-term steerage. The 20-day EMA is at $196.59, which is sort of the identical as the present value, however the 50-day and 100-day EMA are at $202.11 and $197.57, that are the instant resistance zones. A definitive shut above this band strengthens the potential for a bullish breakout in the direction of $214.29, adopted by the $225.52 supertrend degree.

On the draw back, failure to maintain the $187 development line might expose a decline to $175, the place earlier structural assist emerged in early October.

RELATED: Official Trump Value Prediction: Trump goals for $10 goal on speculative rotation

Regardless of ETF information, on-chain flows recommend gradual outflows

Solana recorded web outflows of $15.96 million on October 29, in accordance with Coinglass information. The numbers proceed a multi-week sample of average capital turnover, with sellers outpacing consumers on a number of main exchanges.

Whereas these numbers point out profit-taking relatively than large-scale liquidations, the constant crimson flag all through October signifies that regardless of the ETF catalyst, institutional investor positioning has not but modified definitively to the bullish course. Numerous days of sustained inexperienced influx might be required to verify the buildup and validate the brand new upward development.

Outlook: Will Solana costs rise?

For now, Solana’s value predictions are trending from impartial to bullish. The asset trades at a key inflection level inside a multi-month triangle, supported by sturdy fundamentals of ETF approval, however constrained by lackluster foreign money inflows.

If consumers handle to push SOL above $202 and keep momentum in the direction of $214, a breakout in the direction of $225-$240 might develop rapidly. Nonetheless, if the assist at $187 shouldn’t be defended, the worth dangers shifting again in the direction of $175 earlier than trying to maneuver larger once more.

Associated: Pi value prediction: Rise cools as unlocking of 121 million tokens approaches

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be chargeable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.