- Solana is buying and selling close to $141.79 after breaking the yearly uptrend line and failing to retest close to $160.

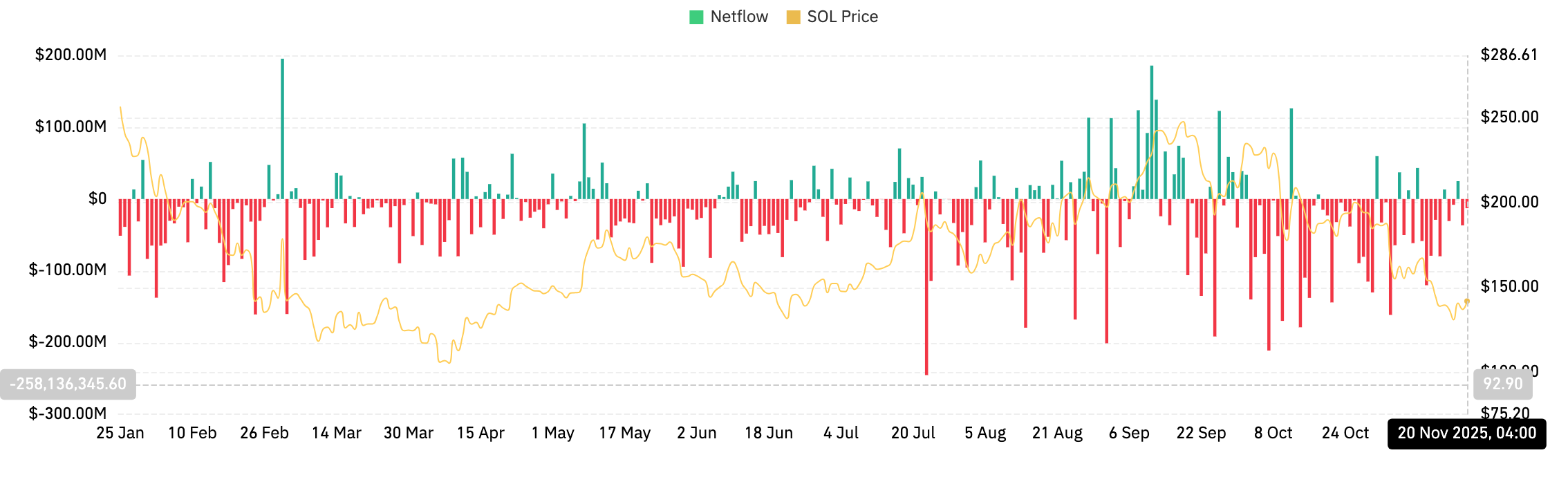

- Spot flows remained unfavorable with outflows of $11.66 million, reinforcing the distribution pattern that has been dominant since early September.

- Derivatives exercise picks up as open curiosity rises to $7.51 billion, with consumers trying to stabilize above the intraday VWAP close to $141.60.

Solana worth is buying and selling round $141.79 in the present day, stabilizing after falling effectively under the annual uptrend line that has supported each main rally since early 2025. This transfer shifts momentum to sellers as spot outflows stay excessive and derivatives positioning signifies leveraged merchants are exiting.

A break within the pattern line confirms a change in momentum.

The day by day chart reveals clear structural adjustments. Solana has decisively damaged under the uptrend line on which its worth moved from April to October. As soon as the breakdown occurred, the retest round $160 failed and the value rolled over to the present help space.

Solana is presently buying and selling effectively under its 20-day EMA of $153.56, 50-day EMA of $173.45, and 100-day EMA of $182.43. All three are sloping downward and above worth, forming a heavy resistance band overhead. The 200-day EMA at $181.12 marks the higher sure of this cluster and strengthens the bearish pattern.

Associated: Bitcoin Value Prediction: BTC faces growing strain as downtrend deepens

Parabolic SAR is outperforming worth throughout day by day and intraday time frames. Sellers proceed to dictate short-term route, and the shortage of upper lows confirms that the market is in a correction part following the break of a long-term uptrend.

The present help band between $133 and $138 has survived two current makes an attempt to interrupt out of the lows. A detailed under this zone would point out a brand new technical deterioration.

Spot outflows point out the vendor continues to be energetic

Coinglass’ spot circulate information continues to ship indicators. Solana recorded web outflows of $11.66 million on Nov. 20, persevering with a string of unfavorable days since early September.

This sample is constant. Purple bars dominate the circulate profile, with sellers repeatedly sending SOL again to the alternate reasonably than holding or accumulating it. The heaviest outflow surge in current months occurred amidst a retrieval of the EMA cluster, indicating merchants are profiting from the rally to scale back publicity.

Construct a place as derivatives open curiosity will increase

Solana’s derivatives information paints a special image. Futures open curiosity elevated by 3.28% to $7.51 billion. The rise in OI suggests merchants are prepared so as to add to positions in the course of the decline, however it’s unclear whether or not this can be a defensive hedge or a directional wager.

Quantity surged 27.25% to $21.48 billion, displaying robust engagement as the value approached the help band. Choices open curiosity additionally elevated by 1.81%, though complete choices quantity decreased barely.

Associated: Ethereum worth prediction: ETF outflows surge as downtrend line thwarts any upside makes an attempt

The long-to-short ratio reveals a noticeable lengthy bias. Binance accounts have a ratio of two.85, whereas prime merchants have a ratio of three.59, indicating that giant accounts nonetheless have room to recuperate. The OKX account reveals an identical ratio of two.04.

Liquidation information reveals comparatively subdued exercise, with $30.88 million liquidated prior to now day. Brief-term liquidations accounted for $9.78 million and long-term liquidations totaled $21.1 million. This imbalance displays the strain confronted by longs in the course of the trendline breakdown.

Intraday momentum makes an attempt to stabilize

Charts on shorter time frames present early indicators of stabilization. Solana is buying and selling above the session VWAP close to $141.60, with the higher VWAP band close to $143.69 performing as intraday resistance. Costs have struggled to clear this band, suggesting that consumers are holding again regardless of the restoration try.

The RSI is presently close to 55.90, recovering from the earlier oversold stage. A transfer above 62 would strengthen the bullish intraday construction, however the broader pattern continues to be constrained by the breakdown on the day by day chart.

Intraday volatility has diminished and merchants look like ready for a cue earlier than taking new directional positions.

outlook. Will Solana go up?

The following transfer will depend upon how Solana performs on the $133 to $138 help band. This space has repeatedly served as a turning level, however the break within the pattern line and the huge outflows improve the chance of a extra extended correction.

- Bullish case: A rebound above $153.56 would retake the 20-day EMA and sign a short-term momentum change. A clearing of $173.45 will verify the energy and open the way in which to $200.

- Bearish case: If the day by day shut falls under $133, the following liquidity zone might be round $122, adopted by deeper help round $108.

Associated: XRP Value Prediction: XRP weakens as outflows improve, OI declines greater than ETFs per bit

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.