- Analyst Lark Davis says Solana is outperforming Ethereum when it comes to pace, exercise, and development.

- Ethereum’s upgrades proceed, however scalability and usefulness points proceed to sluggish progress.

- The Solana ETF has attracted almost $200 million, displaying robust shopping for demand from institutional traders.

The battle between Solana (SOL) and Ethereum (ETH) is shaping as much as outline the subsequent part of the cryptocurrency market. In response to cryptocurrency analyst Lark Davis, the info is presently leaning in Solana’s favor at the same time as Ethereum continues to improve and develop its ecosystem.

Ethereum has not made sufficient progress but

Whereas Ethereum has made regular progress with decrease charges and scaling updates, it nonetheless faces structural challenges, Davis stated. Regardless of upcoming upgrades aimed toward growing on-chain scalability by an element of 10, Ethereum continues to battle with efficiency and person expertise.

Davis has had a combined view of ETH for many of this yr, however has just lately taken a barely extra optimistic view, citing curiosity from institutional gamers like Tom Lee. Even so, he views the Ethereum place as a short-term commerce moderately than a conviction maintain.

Solana’s development can’t be ignored

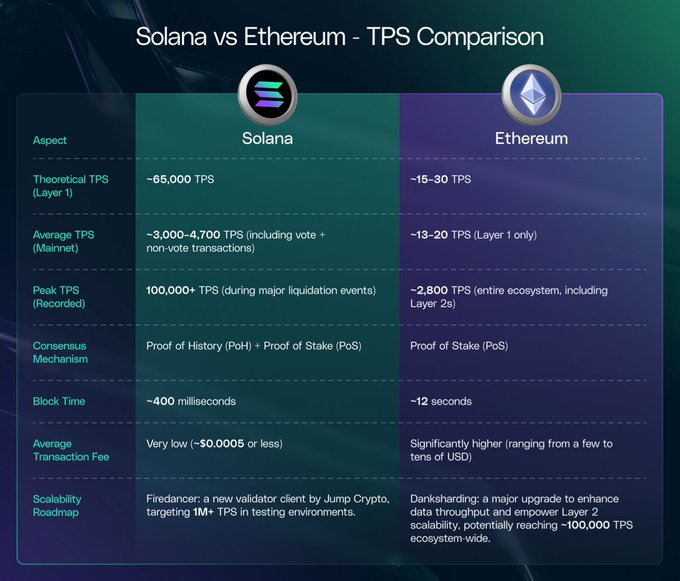

When evaluating each blockchains straight, Solana seems to have the sting in pace, exercise, and community development. Whereas Ethereum’s energy lies in its layer 2 ecosystem, Solana’s single-chain effectivity makes it common amongst builders and new tasks. Lark Davis stated:

“Evaluating Ethereum principal chain to Solana, Solana wins. Solely whenever you calculate all Layer 2 collectively can the ETH ecosystem take the lead.”

Davis believes it’s undervalued in comparison with Ethereum given its market capitalization and developer traction. Now, if he have been pressured to decide on only one community, he would select Solana. We described it as a stronger short-term wager based mostly on present fundamentals.

Nonetheless, he cautions that this isn’t a winner-take-all market. “In all probability 4 to 5 main chains will seize 90% of the customers, builders, and transactions,” he stated. Ethereum and Solana are each a part of that group, which additionally contains Binance Sensible Chain and rising rivals corresponding to Avalanche and Sui.

Associated: Altcoin Market (TOTAL3) Breaks 4-12 months $1.13 Trillion Resistance: Analyst Declares “Altcoin 3.0” Setup

solana worth prediction

The Spot Solana exchange-traded fund debuted on U.S. exchanges with a powerful begin, posting almost $200 million in web inflows in its first week. The Solana ETF is presently valued at over $500 million.

Regardless of robust inflows, Solana costs stay flat. SOL is holding close to the help between $178 and $184, however no breakout has been confirmed but. A break above $196 might open the door for a short-term rally in the direction of $195-$200, but when present ranges fail to maintain, the token might stay range-bound for now.

Associated: Is Solana altering technique? New debate on decentralization intensifies

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.