- Solana will combine practically $228.90 with sturdy EMA help and a bullish setup.

- Curiosity on the Open Futures reached $1.464 billion, indicating an increase in hypothesis and volatility.

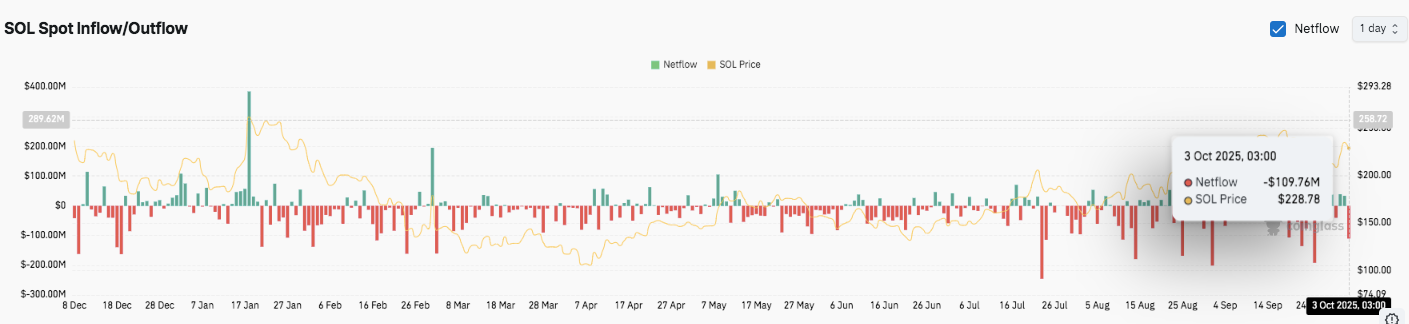

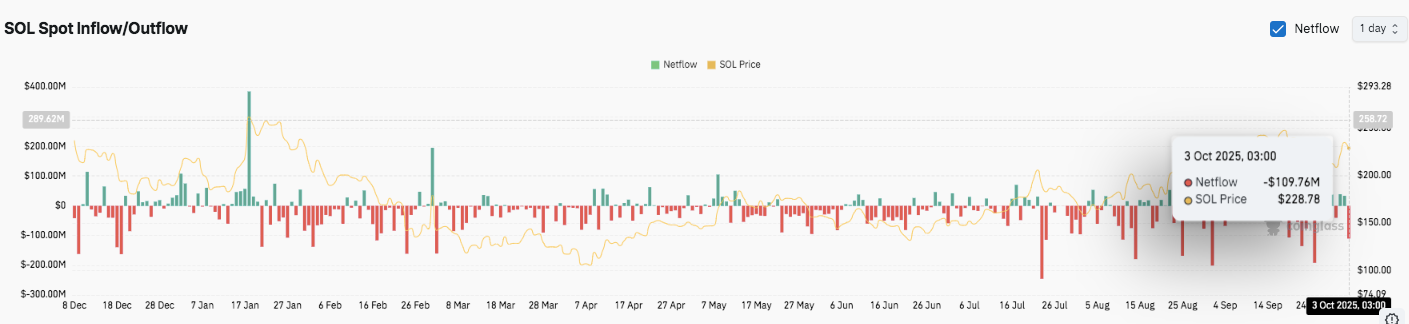

- The $110 million spot spill exhibits it would profit from a current restoration from lows.

Solana has made a powerful comeback following that sharp repair, with costs regular at practically $228.90. Trainers look intently because the tokens merge after rebounding from a sudden drop early within the week. With Momentum Constructing and Futures Lively reaching report highs, Solana is at the moment sitting at a important time that would form a short-term trajectory.

The technical setup exhibits resilience

Solana rebound is supported by a most popular know-how setup. Restoration above the $230 zone, matching the 0.618 Fibonacci retracement, offered a big continuation sign. Moreover, the exponential shifting common is bullishly stacked, with 20-EMA providing instant help of $223 and 50-EMA providing $218.

This alignment means that patrons stay managed so long as costs are held above these thresholds. If the depth continues, the following take a look at will probably be on the $241 stage and might be prolonged to $254. Conversely, a breakdown of lower than $222 might invite a pullback to $215 or $205.

Associated: As Bitwise CEO says, Solana Worth Eyes Breakout says that not sooner provides ETF edges greater than Ethereum

Surge in participation within the futures market

Along with spot restoration, futures knowledge highlights a pointy enhance in market exercise. Public curiosity on the Solana deal had risen to $14.644 billion by October third, marking one of many highest ranges. This enhance displays aggressive speculative positioning and elevated liquidity.

Traditionally, such an enlargement of curiosity has coincided with a interval of excessive volatility. So merchants must be ready for a sharper swing, particularly if value momentum continues.

Spot circulation signifies revenue

The futures market exhibits rising enthusiasm, however spot knowledge attracts extra cautious photos. The online spill reached $110 million on October third. This is among the largest every day strikes in months. These exits recommend that they may make earnings as costs have recovered strongly from current lows.

Earlier this 12 months, comparable spikes of the spill usually occurred close to the native high. Nevertheless, inflow on the delicate stage revealed a gradual accumulation and highlighted the continued curiosity in Solana amongst long-term contributors.

Solana (SOL) Worth Technical Outlook

Key ranges stay clearly outlined in October:

- Upside Stage: $230-$231 (0.618 FIB retracement) is a instant hurdle. A sustained breakout right here might lengthen the revenue to $240.69 (0.786 FIB) and in the end retest the peak of $254.

- Drawback stage: $222-$223 (20-EMA and 0.5 FIB) is the primary line of protection, adopted by $215. A sharper discount might expose $205 (0.236 FIB).

- Ceiling of resistance: $230 is a key zone to flip for short-term bullish continuation. Profitable above will improve instances of journey to over $240.

The technical scenario means that Sol is consolidating inside the restoration channel, suggesting that EMAS presents strong help and futures are open to hypothesis. This compressed part could cause elevated volatility in both route.

Associated: Solana Worth Forecast: Can Sol keep momentum above $200?

Outlook: Do you push Solana excessive?

Solana’s value forecast for October relies on whether or not patrons are capable of defend their $222-$223 help cluster. Holding this zone encourages the Bulls to attempt breakouts above $230 and goal $240-$254.

Moreover, the situation of report futures provides gas to the amplified motion potential. Nevertheless, if you cannot keep dangers above $222, you’ll pull the market again to $215 and $205. For now, Solana is buying and selling to a important extent the place each accumulation and earnings stay lively.

Disclaimer: The knowledge contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version isn’t responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.