- Solana is testing the two-month trendline close to $140 and the important thing EMA is above the value, protecting the construction in a correction moderately than bullish.

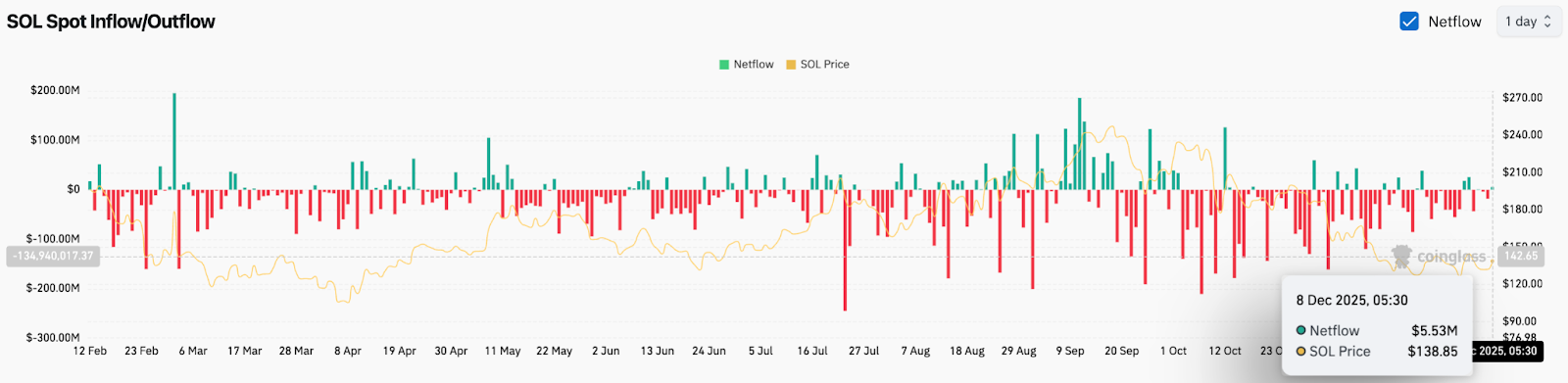

- Spot flows turned constructive with inflows of $5.53 million, whereas derivatives buying and selling surged as merchants took leveraged lengthy exposures.

- Above $140-146, the goal shifts to $160-163, however on failure there’s a threat of going again to $134 and even $128.

Solana worth is buying and selling round $139, up 5.5% at this time, extending the rally that began on the $128 zone earlier within the week. The restoration is about to interrupt by way of the two-month downtrend line, however the worth continues to be constrained under the shifting common that has served as resistance all through the downtrend.

Rejection of development line limits restoration makes an attempt

On the 4-hour chart, Solana is approaching the downtrend line close to $140, a barrier that has denied all makes an attempt to maneuver greater since October. The transfer represents the third retest of the road prior to now two weeks, indicating not solely constant shopping for curiosity but in addition steady provide at greater ranges.

The worth is above the 20-day EMA of $134.93 and 50-day EMA of $135.65, which is at present performing as short-term assist. The 100-day EMA of $137.53 has been examined intraday, however the 200-day EMA of $145.98 stays a serious reversal barrier. Till the value clears the 200-day EMA, the construction stays in a correction moderately than a development reversal.

Associated: Dogecoin Worth Prediction: Doge faces strain as downtrend continues…

Parabolic SAR signifies that consumers are attempting to manage momentum, however earlier situations of SAR reversal have failed to provide a sustained development reversal. Due to this fact, the technical setup displays an tried restoration inside a broader downtrend moderately than a confirmed breakout.

Intraday momentum exhibits power, however follow-through is required

On the 1-hour chart, Solana reclaimed the $134.33 supertrend reversal zone and turned it into short-term assist. The latest rally pushed the value into the $139 vary, the candlesticks accelerated, and the RSI briefly reached overbought ranges, indicating momentum moderately than drift.

The RSI is at present hovering round 68, leaving room for continuation, however growing the potential for a rejection on resistance if quantity stalls. Intraday merchants want a clear shut above $140 to maintain a breakout try in the direction of the 200-day EMA. If this stage fails, the value is prone to fall again in the direction of $135-$134, testing assist.

The present construction tends to focus on upside with shallow pullbacks, however the overhead of the trendline makes any transfer susceptible till confirmed.

Spot movement improves however stays modest

Spot flows have turned constructive, however the magnitude stays modest. Solana recorded web inflows of roughly $5.53 million on Dec. 8, reversing every week of principally detrimental evaluations.

Associated: Ethereum worth prediction: ETH compression deepens as futures exercise…

The change in flows helps clarify the rebound from $128, however the measurement of the inflows is small in comparison with the earlier accumulation section, when inflows per session often exceeded $50 million.

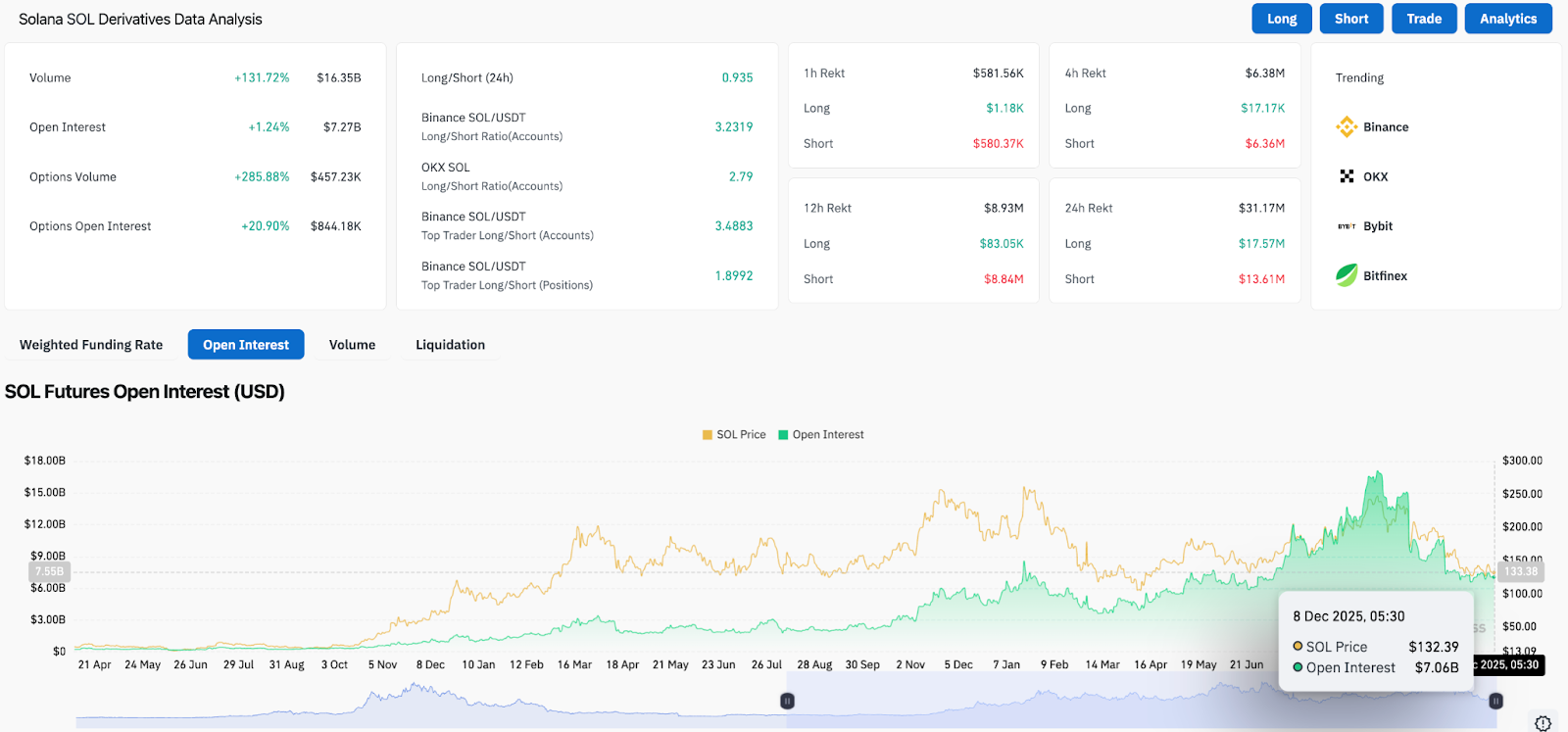

Derivatives present growth as dealer positions transfer greater

Derivatives knowledge exhibits a transparent shift in positioning. Open curiosity in Solana futures elevated by 1.24% to $7.27 billion, and buying and selling quantity elevated by 131.72% to $16.35 billion, confirming that leveraged merchants have gotten lively once more. The choices market additionally elevated considerably, with possibility buying and selling quantity growing by 285.88% and possibility open curiosity growing by 20.90%.

The place bias stays web lengthy, with a number of exchanges exhibiting a ratio of over 2.5:1, and the Binance account exhibiting a ratio of three.23. A broad lengthy bias suggests merchants wish to get forward of a breakout moderately than hedge towards the draw back.

Liquidation knowledge reinforces that bias. In 12 hours, Solana recorded a liquidation worth of $8.93 million, with a lot of the losses absorbed by brief gross sales. This positioning flash might have allowed the value to interrupt above short-term resistance.

On-chain actions assist narrative power

Past worth, Solana continues to reveal superiority in networking actions. In line with DeFiLlama knowledge, Solana recorded $24.2 billion in DEX buying and selling quantity for the week from December 1st to seventh, outpacing Ethereum and all different chains for 16 consecutive weeks. The subsequent closest chain, Ethereum, was reported at $13.4 billion and Binance Sensible Chain at $13.08 billion.

This monitor document strengthens Solana’s management in base layer buying and selling exercise, an element that has traditionally supported costs in periods of macro uncertainty. Sustained throughput and liquidity make it straightforward to switch funds again to SOL after technical boundaries break down.

outlook. Will Solana go up?

The bullish case hinges on a breakout above $140-$146 with elevated spot inflows and continued derivatives buying and selling volumes. This construction would present confidence and shift the goal to $160-$163.

If the value fails the trendline and loses $134, the bearish case will probably be triggered and a return to $128 will grow to be evident, probably resulting in a retest of the decrease liquidity zone.

Associated: Cardano Worth Prediction: Merchants deal with key ranges as market waits for Hoskinson’s ‘higher day’ sign

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.