Solana is trying to stabilize after a pointy decline that despatched the asset towards the $121.50 Fibonacci zone earlier within the week. The market is now watching to see if this restoration beneficial properties momentum as merchants consider new ETF developments and adjustments in derivatives positioning.

Worth motion on the 4H chart exhibits Solana regaining momentum indicators and difficult acquainted resistance areas, with a mixture of optimism and warning throughout the market. The broader setting provides additional complexity as curiosity in futures will increase and spot circulate participation turns into uneven.

SOL assessments mid-range resistance as momentum builds

Solana has rebounded from latest native lows and is buying and selling round $137 to $138. A transfer above the mid-band of the EMA9 and DKC channels brings the early power into focus.

Nonetheless, costs are nonetheless struggling to interrupt via near-term ceilings, with a few of this month’s beneficial properties stalled. The resistance close to $139.80 to $140 stays the primary main take a look at earlier than a stronger construction types.

Moreover, the help between $133.50 and $134.80 now serves as an essential axis. Holding this zone will preserve your present push increased. A deeper retest close to $129.80 might create additional stress and threat one other transfer in direction of the latest backside. Due to this fact, market confidence will rely upon how Solana performs round these midrange ranges.

Derivatives to place builds in a mixture of spot flows

Open curiosity in Solana futures has elevated considerably this 12 months. The newest studying is near $7.04 billion, indicating sturdy participation in a broader market enlargement.

Moreover, merchants continued to carry important positions throughout the pullback, demonstrating confidence regardless of the volatility. This development means that leveraged members are anticipating bigger swings because the market approaches main resistance clusters.

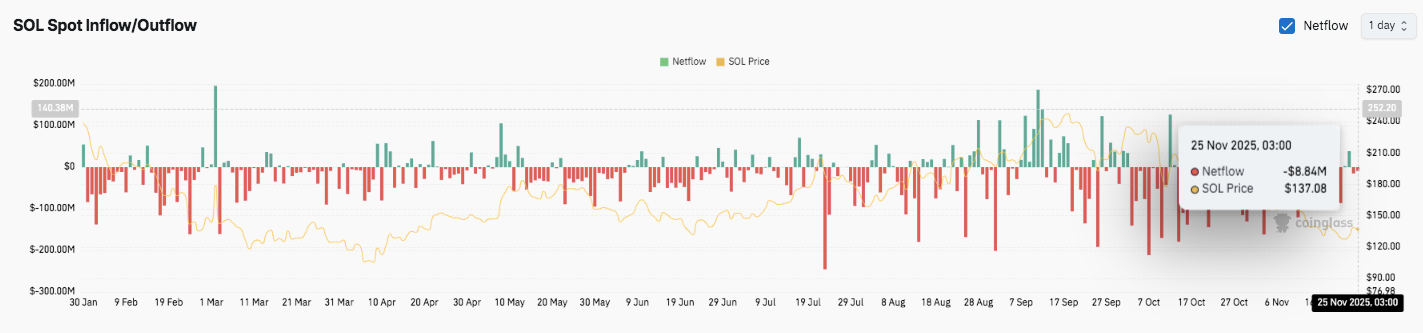

Nonetheless, spot circulate is a distinct story. Outflows dominated a lot of the 12 months, with heavy promoting in July and September. The drop was adopted by a surge in smaller inflows, suggesting opportunistic accumulation somewhat than regular demand.

In line with the most recent knowledge, Solana traded round $137 on November twenty fifth, with $8.84 million outflowing. In consequence, sentiment stays fragile regardless of enhancing technical alerts.

ETF adjustments add new layer to story

Franklin Templeton has introduced plans to increase its cryptocurrency index ETF beginning December 1st. The additions of Solana, XRP, Dogecoin, Cardano, Stellar, and Chainlink are per latest Cboe rule updates.

Associated: Monad (MON) Worth Prediction 2025, 2026, 2027, 2028-2030

The broad inclusion of key property will increase Solana’s visibility as institutional merchandise penetrate deeper into the market. Furthermore, this transfer strengthens the long-term curiosity story, though the short-term charts stay combined.

Technical Outlook for Solana Costs

Even because the market enters a brand new buying and selling part, Solana’s key ranges stay clearly outlined.

- Prime degree: The primary resistance cluster is between $139.80 and $140.00, adopted by $148.80 (Fib 0.236) and $165.82 (Fib 0.382). A escape of those areas might push the inventory towards its medium-term targets of $179.50 and $193.20.

- Lower cost degree: There’s help at $134.00 within the EMA9 area and $129.80 as a deeper retest space. A lack of $129.80 would expose the latest swing low of $121.50.

- Essential resistance higher restrict: $148.80 stays the important thing degree that Solana should get well to return sentiment to a near-term bullish development.

The technical picture exhibits SOL trying to construct a base after touching the Fibonacci 0% zone at $121.50. Worth motion is beneath the $140 barrier, making a construction the place a decisive transfer can set off elevated volatility in both route.

Will Solana break even increased?

Solana’s value outlook now hinges on whether or not patrons can defend the $134 zone lengthy sufficient to problem the $140-$148.80 resistance. Whereas futures open curiosity continues to stay above $7 billion, suggesting elevated positioning, bodily outflows stay a trigger for alarm.

If patrons regain momentum and push the worth above $148.80, Solana might retest $165.82 and lengthen in direction of $179.50. Nonetheless, failure to maintain $134 or $129.80 dangers resetting the whole restoration and paving the way in which again to $121.50.

For now, Solana is at a pivotal inflection level. Worth compression, elevated leverage, and adjustments in ETF flows counsel extra volatility forward. The subsequent decisive transfer will decide whether or not the short-term pullback develops right into a stronger development reversal.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.