Solana (CRYPTO: SOL) worth is hovering round $178 in the present day, registering a 3% decline because the market struggles to soak up continued outflows and weakening momentum. The token is at present testing a serious uptrend line close to $186, and this zone coincides with the 200-day EMA and the decrease certain of a long-term symmetric construction.

Solana Value Take a look at Lengthy Time period Trendline Help

The day by day chart exhibits Solana breaking beneath the $186.7 help line after a gradual decline from the $230 resistance earlier this week. The worth construction types a good symmetrical triangle, with the decrease certain coinciding with the 0.382 Fibonacci degree at $172.

The 20-day EMA is close to $205, whereas the 50-day and 100-day EMAs act as overhead resistance at $208 and $199. The 200-day EMA close to $186 stays the final line of protection till the following main retracement zone opens in direction of $172 and $142.

The supertrend indicator has turned bearish since October 12, with sellers in management. Brief-term momentum is prone to stay unfavourable until Solana regains $199.

Uniswap’s Solana growth will increase long-term attraction

In a transfer that highlights Solana’s rising DeFi presence, Uniswap has built-in the community into its core net utility. This addition will enable customers to entry Solana, Ethereum, and 13 different blockchains inside a single interface. The builders describe this as step one in deeper integration, which is able to ultimately embody full help for cross-chain swaps and Uniswap Wallets.

Associated: Ethereum Value Prediction: BlackRock’s $46.9M ETH Buy Eyes Help

This improvement strengthens Solana’s place because the second largest ecosystem in decentralized finance, with a complete of $11 billion locked in, in comparison with Ethereum’s $84.8 billion. Nevertheless, speedy market response has been muted as traders weigh short-term liquidity pressures towards long-term implementation potential.

Uniswap continues to dominate the DEX world, producing $213 million in month-to-month charges, nicely forward of PancakeSwap’s $63 million. The addition of Solana will probably additional broaden Uniswap’s person base and strengthen Solana’s belief within the DeFi ecosystem over time.

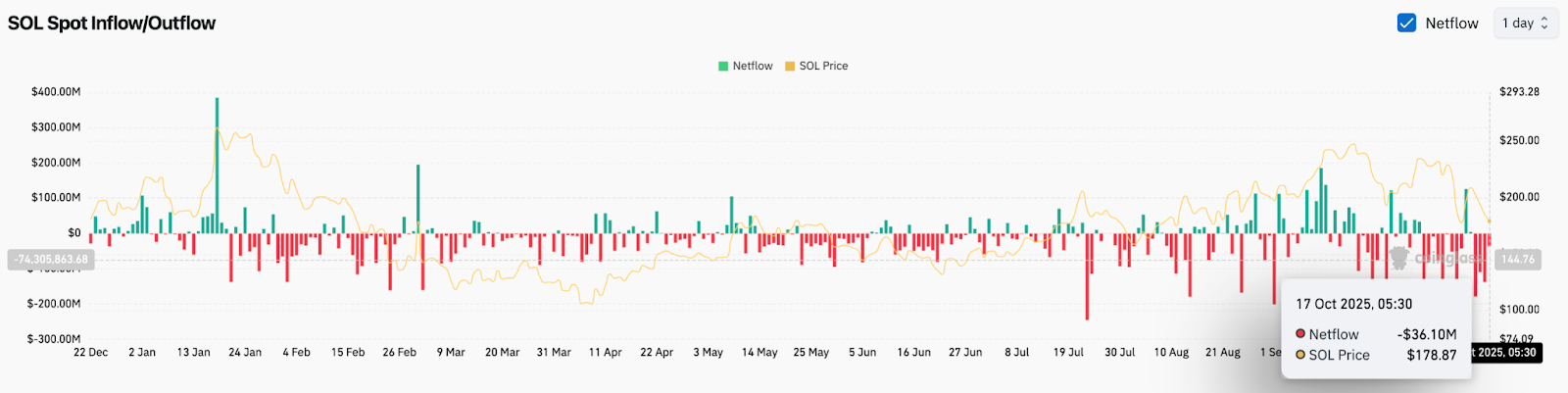

On-chain knowledge exhibits persistent leakage

Forex knowledge from Coinglass exhibits continued capital outflows from Solana over the previous week. On October 17, the community recorded internet outflows of $36.1 million, bringing the three-day cumulative withdrawal quantity to over $400 million.

The persistent pink bar on the netflow chart signifies continued promoting strain since early October. The shortage of constant accumulation, regardless of intermittent inflows throughout market upswings, underscores weakening investor confidence.

Associated: Shiba Inu Value Prediction: SHIB falls as key help faces new promoting strain

Traditionally, Solana has tended to rebound when day by day outflows fall beneath $50 million, nevertheless it has but to succeed in that mark this week. Analysts recommend that until capital inflows stabilize above $20 million, Solana might proceed to float towards the $172 Fibonacci help degree.

Technical Outlook for Solana Costs

From a technical perspective, Solana’s pattern stays robust, however failure to maintain $186 dangers a deeper correction. The subsequent main help zone is at $172, according to the 38.2% Fibonacci retracement and historic demand block from Could. Beneath that, $142 represents a 23.6% retracement and a robust psychological ground.

On the upside, speedy resistance lies at $199, adopted by the EMA cluster round $205-$208. If the closing worth sustains above $214, the market construction could flip bullish once more and goal $230 and $253, equivalent to the 61.8% and 78.6% Fibonacci ranges.

outlook. Will Solana go up?

Solana’s near-term path will depend on whether or not the bulls can defend the $186 to $172 help band. Whereas Uniswap’s growth provides long-term confidence to the Solana ecosystem, continued day by day outflows of $36 million spotlight warning amongst merchants.

If inflows begin to stabilize and the token regains the $199-$205 vary, it might rebound in direction of $230 within the coming classes. Nevertheless, a break beneath $172 will shift focus to $142, delaying any continued bullishness till stronger demand returns.

For now, Solana stays in a fragile consolidation part, balancing weak capital flows with structural help.

Associated: Bitcoin Value Prediction: BlackRock triggers $1 billion sell-off, BTC falls

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.