Spot Ethereum (ETH) exchange-traded funds (ETFs) with staking plans could possibly be accepted within the US, probably amplifying focus dangers inside the Ethereum community, S&P World Scores mentioned in a latest evaluation. He identified that there’s.

The SEC might approve an ETH ETF as early as Could, in line with the report. Nonetheless, the entry of ETFs might considerably shake up the steadiness of energy amongst validators on Ethereum, creating new challenges and alternatives as monetary giants vie for stakes on this rising sector.

The SEC has till Could twenty third to resolve on VanEck's utility, and will resolve on different ETH ETF purposes by that deadline.

focus threat

The Spot Ethereum ETF proposal by Ark Make investments and Franklin Templeton goals to generate extra yield by staking ETH. Nonetheless, if these staking-enabled ETFs see sufficient inflows, they may influence participation charges in Ethereum's verification community, S&P World analysts wrote.

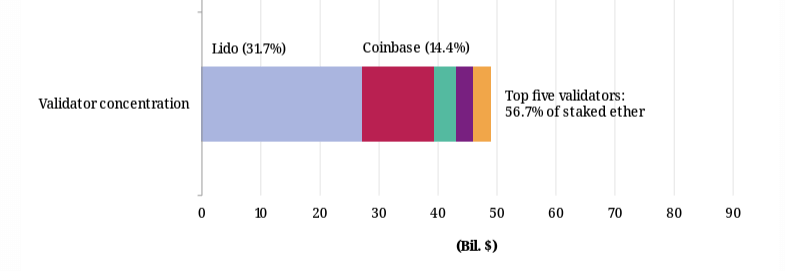

Based on the report, Lido presently accounts for just below a 3rd of the ETH staked and is Ethereum's largest validator. Nonetheless, this report raises questions concerning the probability of those ETFs choosing decentralized staking protocols like Lido.

Moderately, we advise that institutional cryptocurrency custodians are more likely to be prioritized, which differentially impacts validator focus relying on the issuer's diversification technique.

The report additionally highlighted that if Coinbase, which acts as a custodian for some funds, had been to just accept new ETH on behalf of U.S. ETFs, it might pose focus dangers.

The trade is presently accountable for round 15% of staked ETH, making it the second-largest validator total. It additionally serves because the custodian for 3 of the 4 largest Ethereum ETFs staking exterior the US.

The report says these points are vital as a result of counting on a single entity or software program consumer can put validators vulnerable to outage or assault. The report known as for strengthened monitoring of focus dangers and emphasised its significance.

The emergence of latest digital asset custodians might present an avenue for ETF issuers to extra broadly diversify their holdings, which might additionally cut back focus threat.

JP Morgan additionally expresses issues

S&P World's report echoes issues lately raised by JPMorgan in an analogous evaluation of Spot Ethereum ETFs. The lender's report additionally concluded that Lido and Coinbase's dominance poses important focus dangers to the ecosystem.

JPMorgan argued {that a} concentrated variety of validators might turn into a single level of failure, jeopardizing the steadiness and safety of the community. Such centralization additionally makes it a pretty goal for malicious assaults, starting from hacking makes an attempt to systematic disruption of community operations.

Moreover, JP Morgan analysts warned of doable collusion amongst main validators. An oligopoly of validators might manipulate the community’s governance and operational parameters to their benefit on the expense of Ethereum’s broader consumer base.

This could manifest as actions that undermine belief in Ethereum's equity and transparency, reminiscent of censoring transactions, preferential therapy of sure operations, or partaking in front-running.

To make sure that Ethereum stays a sturdy and safe decentralized platform, collaboration is required to cut back focus dangers and foster an setting during which no single validator or group of validators can wield disproportionate energy. effort is required.

(Tag translation) Ethereum