The approval of a spot Bitcoin ETF in america marks a big milestone for the cryptocurrency market, representing a victory after years of regulatory hurdles and debate. The street to approval was lengthy and troublesome, fraught with issues about market manipulation, liquidity and investor safety. Nonetheless, its eventual approval by the Securities and Change Fee (SEC) heralds a brand new period of mainstream acceptance of Bitcoin in conventional monetary markets.

Solely six months after starting buying and selling in america, Bitcoin spot ETFs have emerged as a strong drive within the cryptocurrency market. These ETFs have rapidly amassed important holdings, with over $50 billion in belongings held as of July 2024. This progress makes them the fastest-growing ETFs ever launched in america, completely illustrating their immense attraction to each retail and institutional buyers.

Their speedy rise has not solely made BTC extra reliable and accessible, but in addition introduced a brand new dimension to the cryptocurrency market and investor conduct. Understanding the flows and balances of those ETFs is essential to understanding the cryptocurrency market.

It’s been six months for the reason that spot Bitcoin ETF was launched in america, making it the right time to assessment and analyze traits over the primary half of the yr.

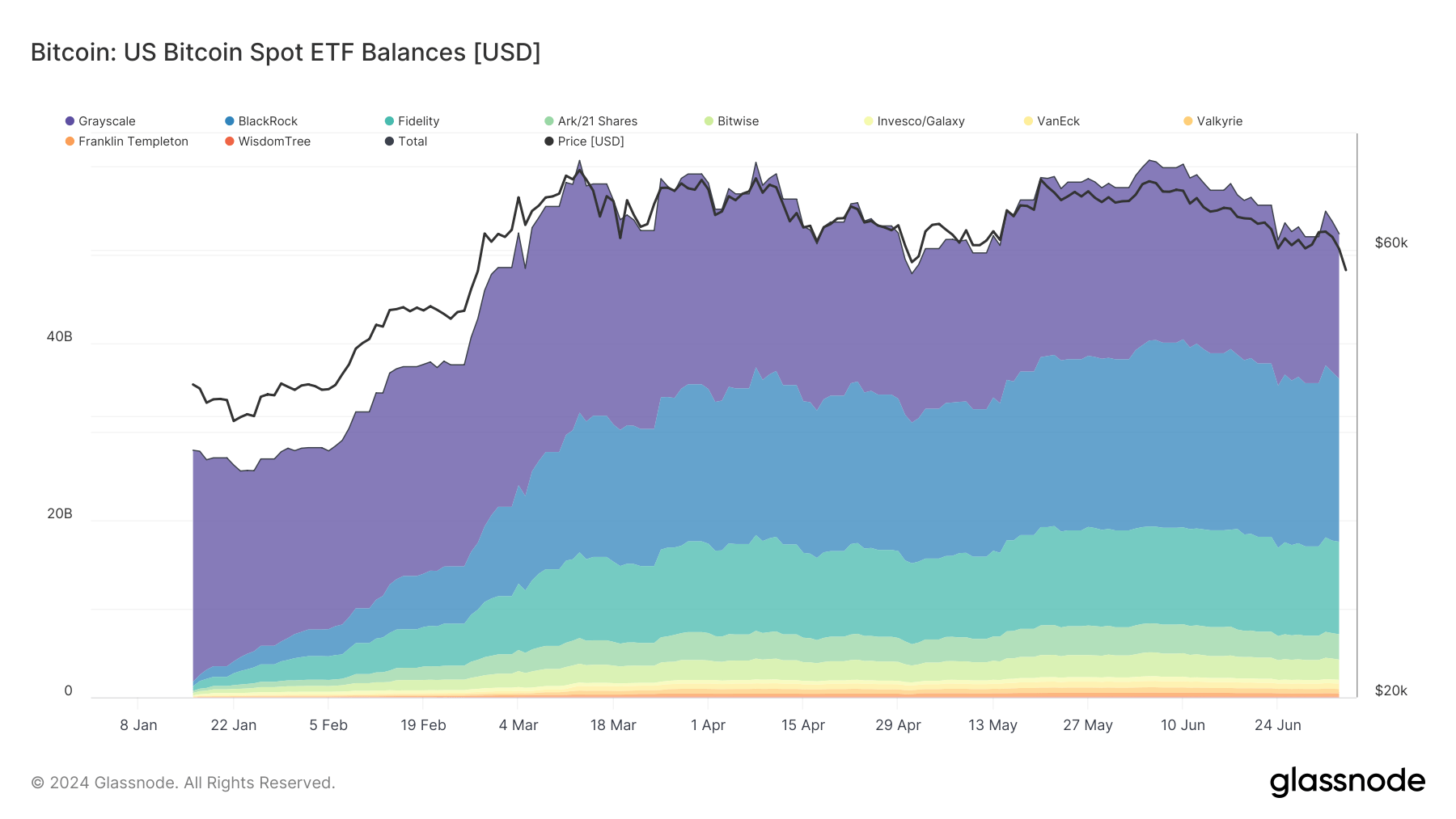

Trying on the greater image, we will see that Bitcoin ETF balances noticed an general upward pattern from January to June. Complete balances began at round $27.89 billion in mid-January, fluctuated between peaks and troughs, after which settled at over $52 billion by early July.

Grayscale's GBTC had the most important quantity of belongings amongst ETFs, initially exceeding $26 billion, however misplaced its lead on the finish of Could when BlackRock's IBIT overtook it as the most important ETF. Constancy's Bitcoin Belief has seen important progress, beginning the yr with round $517 million in belongings and exceeding $10 billion in July.

Most ETFs confirmed progress by way of the primary half of the yr. Nonetheless, there have been intervals of volatility and investor exercise out there that led to giant fluctuations in belongings. Bigger belongings skilled increased volatility, whereas smaller asset courses skilled considerably much less volatility all year long.

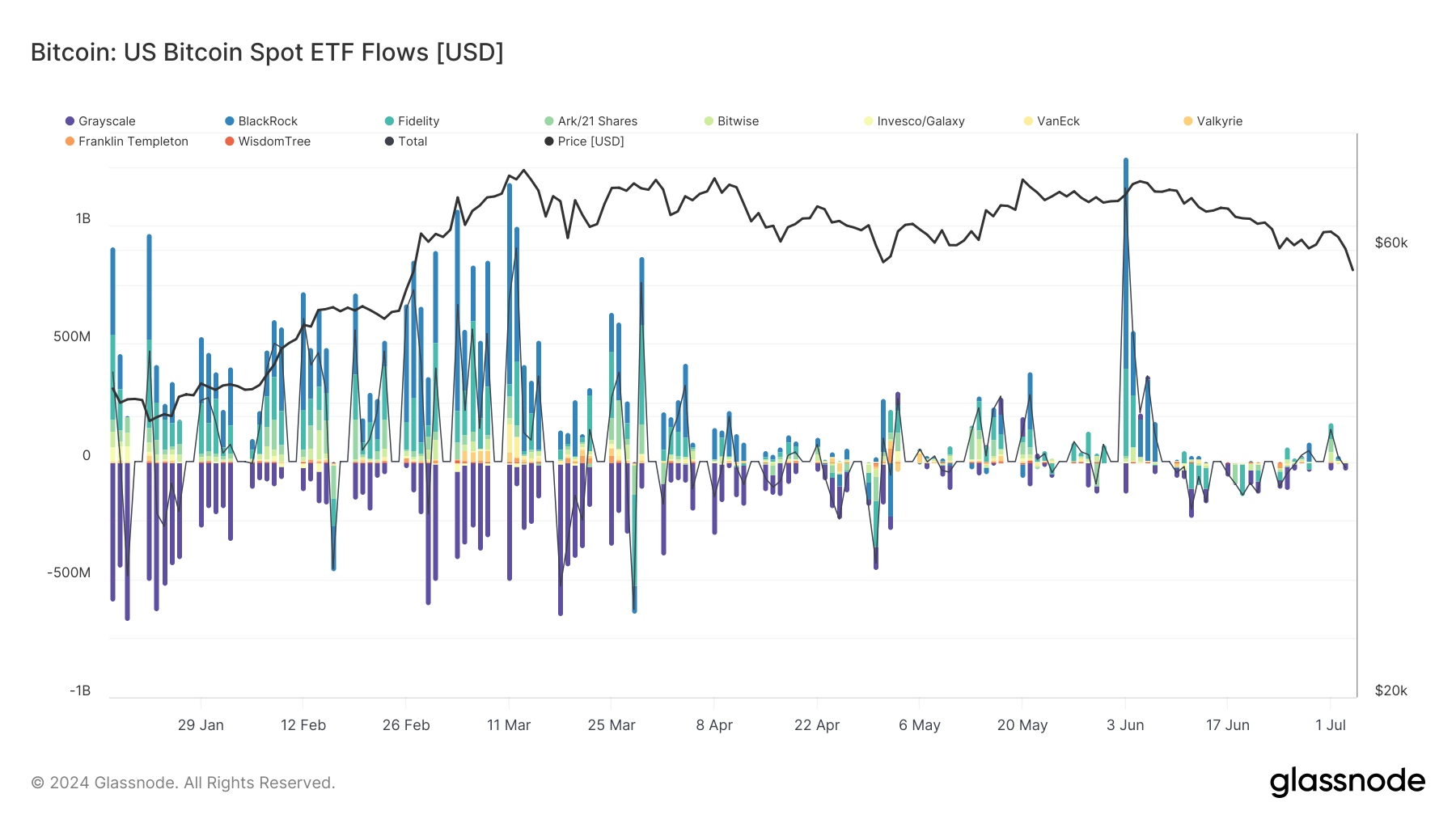

Circulation evaluation helps present a extra detailed image of how the market is buying and selling. The start of the yr noticed important inflows, benefiting from constructive market momentum and investor confidence. This robust influx momentum continued by way of March, with BlackRock's IBIT recording the best influx charge amongst all ETFs. Because the second quarter of the yr started, the market noticed a notable decline in inflows. This was possible brought on by various components, however the primary one was the Bitcoin value stabilizing at round $62,000.

The primary quarter of the yr was additionally marked by giant outflows from GBTC, reaching over $672 million in late January. Excessive outflows, typically exceeding $200 million, continued into the second quarter, when comparatively calm market circumstances appeared to have contained the outflows.

In June, the market appeared to have generated new demand for ETFs. Nonetheless, this demand was solely directed at BlackRock's ETFs, with IBIT recording inflows of over $894 million on June 3. The surge in inflows possible exhausted the market. The market was sluggish all through the month, and entered July with none notable figures.

The publish Spot Bitcoin ETFs Have Exploded After Six Months and Modified the Recreation for Traders first appeared on currencyjournals.