- Cryptocurrency markets are as soon as once more exhibiting liquidity tensions because the US Spot Ethereum ETF information sustained outflows.

- Wintermute analyst Jasper de Meere says the market has entered a “self-funding” part.

- With out new progress in ETFs, stablecoins, and digital asset bonds, the crypto market is more likely to stay unstable in a spread.

Cryptocurrency markets are exhibiting new indicators of liquidity pressure because the US Spot Ethereum ETF information sustained outflows whereas stablecoin issuance progress slows sharply.

The development highlights what Wintermute analyst Jasper de Meere describes as a transfer right into a “self-funding” part, a interval during which market exercise depends closely on present capital relatively than new capital inflows.

Associated: Why are cryptocurrencies down? Knowledge exhibits Bitcoin monitoring US liquidity drain

Regardless of sturdy international liquidity circumstances, traders are more and more favoring conventional belongings akin to U.S. Treasuries resulting from excessive secured in a single day financing price (SOFR) yields, in response to Demere’s evaluation. This variation has lowered the circulation of funds into the crypto market, limiting exterior progress.

Development in key influx channels slows

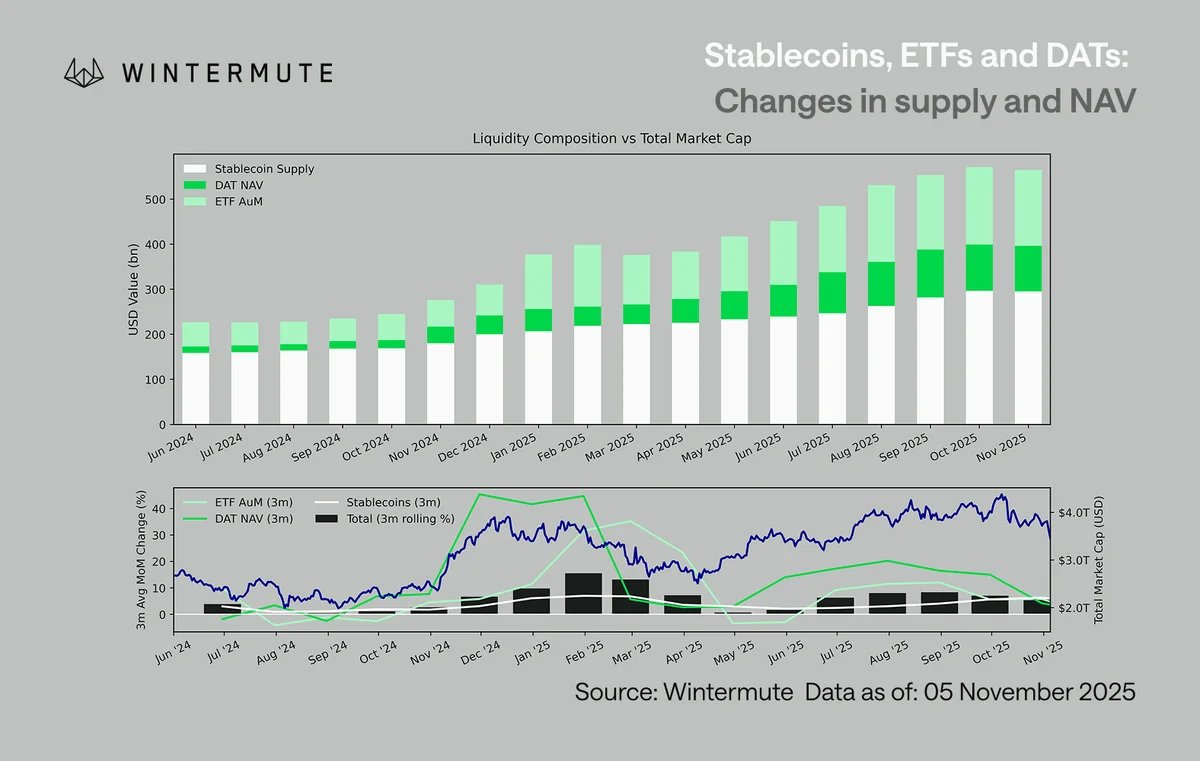

For the reason that starting of 2024, the mixed worth of ETFs and DATs has elevated from $40 billion to $270 billion, in response to the information. In the meantime, stablecoin provide practically doubled from $140 billion to $290 billion. Nevertheless, each classes are at the moment exhibiting clear indicators of stagnation.

This slowdown means that new capital flowing into the market is weakening, forcing the trade to depend on present liquidity. Analysts say this inner circulation of funds has led to short-term good points and elevated volatility throughout main crypto belongings akin to Bitcoin and Ethereum.

Latest knowledge provides much more context. The Spot ETH ETF recorded internet outflows for the sixth day in a row. On November 5, complete withdrawals reached $118.5 million, with BlackRock funds main the cost.

Regardless of broader developments, some funds continued to draw capital. Grayscale’s Mini ETH recorded inflows of $24.06 million, whereas Constancy’s FETH added $3.45 million. This partially offsets the excessive redemptions seen in BlackRock’s merchandise.

The combined efficiency suggests some establishments are rotating away from large-cap ETFs, whereas others are gaining confidence in smaller, extra versatile merchandise.

Stablecoin progress loses momentum

Stablecoin enlargement has slowed after hovering earlier this 12 months. Complete provide practically doubled from $140 billion to $290 billion, however has now plateaued. Weekly issuance fell to about $1.1 billion, nicely under 2024 increase ranges.

This slowdown means that one of many foremost funding channels for cryptocurrencies is in decline. Many stablecoins are backed by short-term U.S. authorities bonds, so rising conventional yields are drawing capital away from digital belongings.

With fewer new stablecoins in circulation, liquidity is diluted, contributing to shorter and extra unstable market swings.

Analysts warn of “personal funds” market part

In the end, slowing ETF inflows, flat stablecoin provide, and lowered treasury exercise for digital belongings are pushing cryptocurrencies right into a closed liquidity loop, Demere notes. Fairly than attracting new inflows, merchants are actually recycling present funds, fueling a short-term bull market that rapidly evaporates.

Associated: U.S. authorities shutdown stalls 90 crypto ETF approvals in October, freezing $10 billion in inflows

With out stablecoin issuance, ETF creation, or new will increase in Treasury funding, the market will stay constrained. A rebound in any of those channels might reignite liquidity and sign the beginning of a brand new expansionary cycle.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.