- The market capitalization of stablecoins has surpassed $307 billion, with the sector rising from its area of interest standing.

- Ripple coverage chief advocates central financial institution consolidation over regulatory resistance.

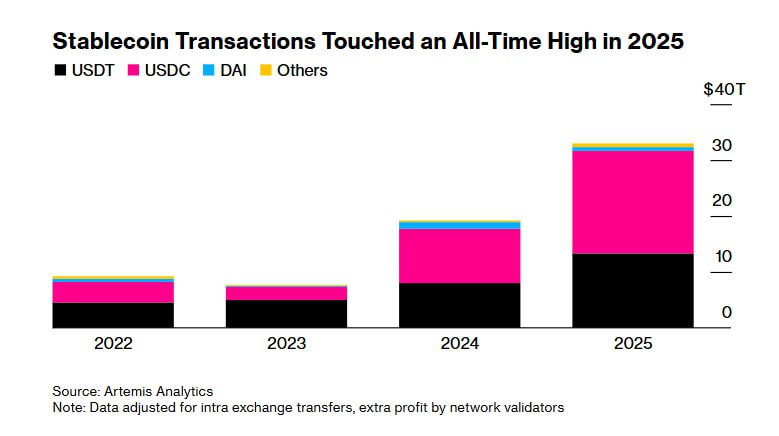

- Led by funds, transaction worth reached an all-time excessive of $33 trillion.

In accordance with knowledge referenced by the Authorities Financial and Monetary Establishments Discussion board (OMFIF), the market worth of stablecoins has exceeded $300 billion, marking their transition from experimental instruments to established monetary infrastructure.

Matthew Osborne, director of UK and European coverage at Ripple, highlighted the findings and argued that central banks ought to combine with stablecoin momentum moderately than resist it. He mentioned the main target needs to be on introducing stablecoins into the regulated monetary system to assist stability and innovation.

Coverage framework debate intensifies on large-scale threshold

Business observers say stablecoins have a market capitalization of $307 billion, a dimension that requires regulatory readability. Whereas tokenized real-world property have turn into one of many quickest rising segments within the cryptocurrency house, stablecoins proceed to guide adoption metrics throughout on-chain finance. Analyst MANDO questioned which initiatives on this house deserve consideration because the class expands.

Central banks’ digital forex growth packages are operating in parallel with the expansion of stablecoins throughout a number of jurisdictions. The connection between government-issued digital cash and privately-issued stablecoins stays underneath debate amongst policymakers. Some policymakers see privately issued digital currencies as rivals, whereas others consider there may be room for complementary methods.

Enhance in transaction quantity resulting from fee actions

In accordance with analyst U-Can, stablecoin buying and selling quantity reached $33 trillion, a file excessive. USDC leads the best way in buying and selling quantity amongst main stablecoins this quarter. Analysts questioned what’s driving this motion, noting the absence of hypothesis, NFT exercise, or DeFi yield farming as the primary catalysts.

“What’s actually rising is what you see: on-chain funds and settlements. Cheaper gasoline, extra frequent transfers, fewer tickets, extra addresses, and actual consumer exercise,” Ucan mentioned. Market decline masks the infrastructure growth that’s quietly going down via the introduction of funds and settlements.

In accordance with this evaluation, stablecoins operate as programmable money, moderately than simply buying and selling devices or “crypto {dollars}.” Stream patterns point out true utilization development via funds and on-chain funds, moderately than risk-averse conduct. Low transaction prices make it attainable to switch small quantities that have been beforehand economically unimaginable.

Regardless of the broader market downturn, the infrastructure layer supporting these transactions continues to develop. Extra frequent transfers, elevated deal with exercise, and diminished commerce sizes all level to retail and industrial adoption past speculative buying and selling.

This utilization sample differs from earlier cycles, which have been dominated by buying and selling and yield-seeking conduct. A mixture of coverage discussions and utilization metrics means that stablecoins are shifting from an experimental stage to a longtime infrastructure that requires formal regulatory integration.

Associated: Bermuda plans to maneuver nationwide economic system on-chain with assist from Coinbase and Circle

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.