- The ECB has warned that if stablecoin enlargement continues unchecked, its progress may threaten monetary stability.

- USDT and USDC dominate the market. Euro-denominated stablecoins stay at their limits.

- The hyperlink between conventional finance and regulatory gaps will increase dangers for banks and world markets.

New evaluation from the European Central Financial institution (ECB) warns that the scale of stablecoins within the eurozone stays comparatively small. Nevertheless, their fast world enlargement and deepening ties to conventional finance may create vital spillover dangers if progress continues unchecked.

Stablecoin market reaches document ranges

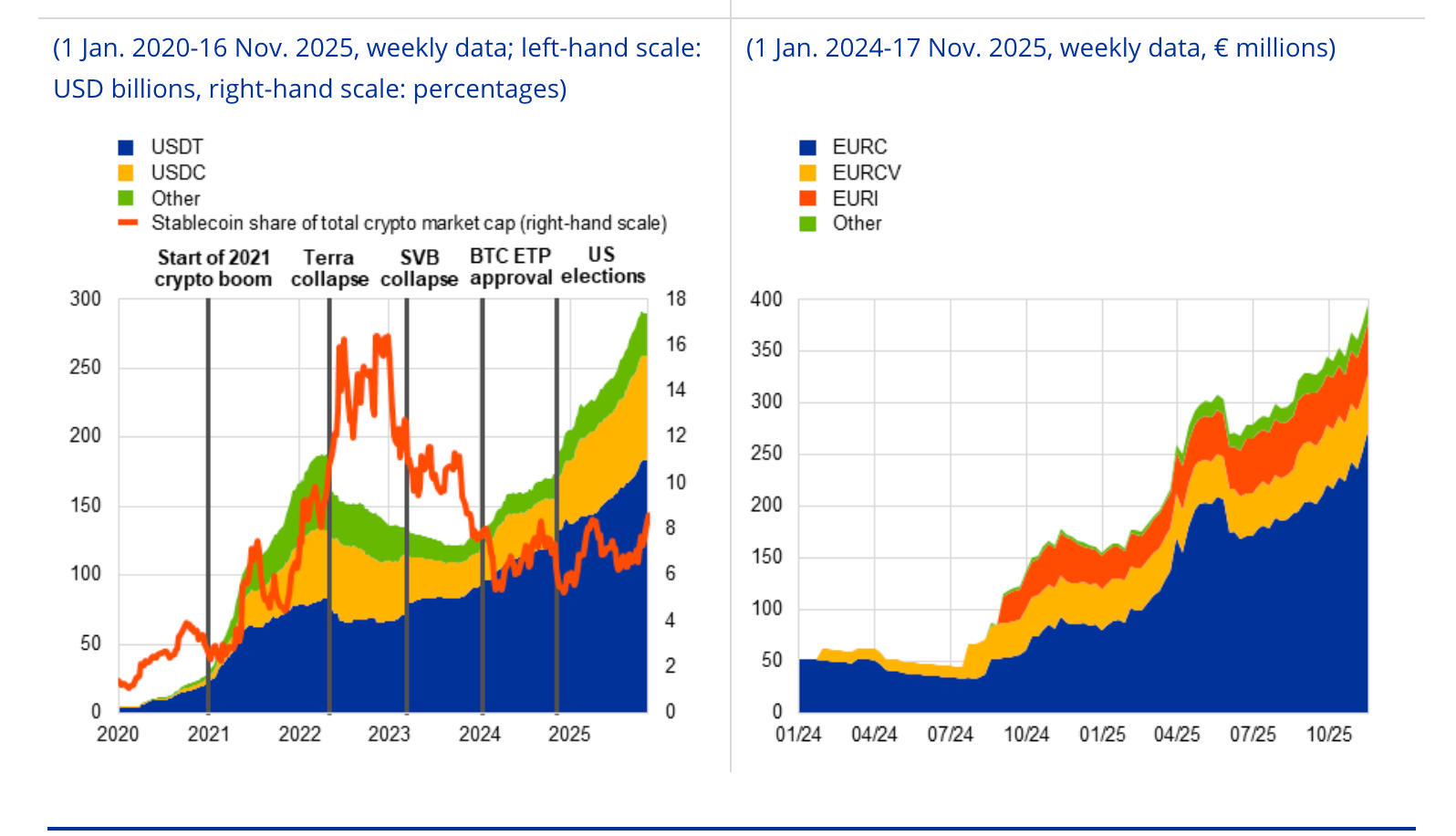

In keeping with the ECB, the entire stablecoin market has surged previous $280 billion, reaching a brand new all-time excessive and now accounts for about 8% of the entire cryptocurrency market. Two USD stablecoins, Tether (USDT) and USD Coin (USDC), overwhelmingly dominate the house, accounting for practically 90% of the availability.

Regardless of the EU absolutely rolling out its MiCA (MiCAR) regulatory framework, euro-denominated stablecoins stay few and much between, with solely €395 million in circulation.

The ECB has instructed that clearer world rules, together with the US’s GENIUS regulation, and new guidelines in areas comparable to Hong Kong, are contributing to the latest acceleration in stablecoin demand.

Cryptocurrency buying and selling stays a core use case

The ECB observes that stablecoins are nonetheless not mainstream funds and are primarily used throughout the cryptocurrency ecosystem. Roughly 80% of all transactions on centralized exchanges contain stablecoins.

Though greater than 70% of stablecoin flows cross geographies, there may be little proof that stablecoins are broadly used for remittances. Lower than 1% of stablecoin exercise is prone to come from retail-level transfers. The ECB concludes that stablecoins stay an “inner plumbing” for crypto transactions moderately than a widespread monetary device.

Elevated linkage with conventional finance and heightened danger issues

Furthermore, the central financial institution has highlighted the rising overlap between stablecoins and conventional markets, significantly US Treasuries, as a possible spillover channel.

USDT and USDC issuers are presently among the many largest holders of U.S. Treasury payments, comparable in measurement to giant cash market funds. The ECB has famous {that a} sudden spike within the worth of main stablecoins may trigger fast asset gross sales and squeeze liquidity in authorities bond markets.

There are predictions that stablecoins may attain $2 trillion by 2028, and with simply two issuers presently controlling about 90% of the market, focus danger is a significant concern.

Impression on financial institution deposits

EU rules (MiCA) forestall stablecoin issuers from paying curiosity, making stablecoins much less engaging, however banks may nonetheless face stress if many depositors swap. The ECB has warned that stablecoin-related funding is extra unpredictable and a sudden rush of withdrawals may pressure banks’ liquidity.

Regulatory loopholes are the principle concern

Even with strict EU guidelines, the ECB sees cross-border loopholes as the most important danger. Variations in guidelines world wide, comparable to reserve necessities and redemption processes, can lead issuers to function in ways in which cut back investor safety.

In spite of everything, stablecoins are usually not but broadly utilized in euro transactions and have little connection to the euro market. However fast progress can improve dangers. The ECB emphasizes the necessity for world regulatory alignment and help for the G20 Crypto Roadmap to stop loopholes and restrict dangers from much less regulated areas.

Associated: ECB stablecoin warning will increase danger of sudden rate of interest adjustments in euro space

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.