- Stellar’s worth stability close to $0.40 signifies balanced market momentum and hesitation.

- The rise in open curiosity of over $300 million signifies elevated dealer participation and confidence.

- A sustained influx close to $0.40 may set off a rebound in Stellar to resistance at $0.42.

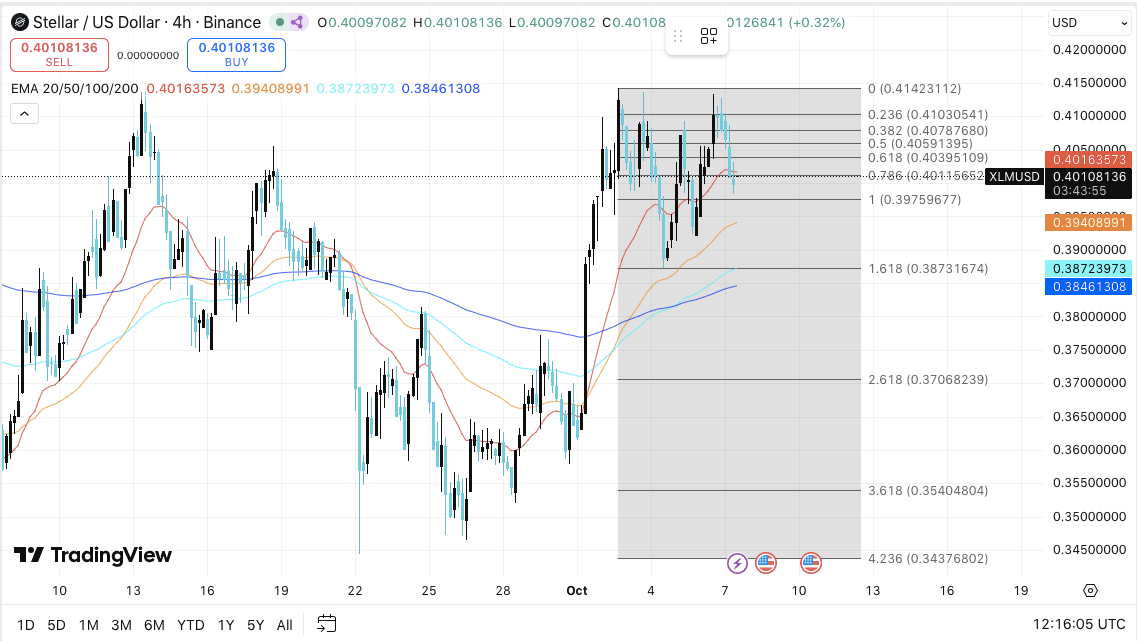

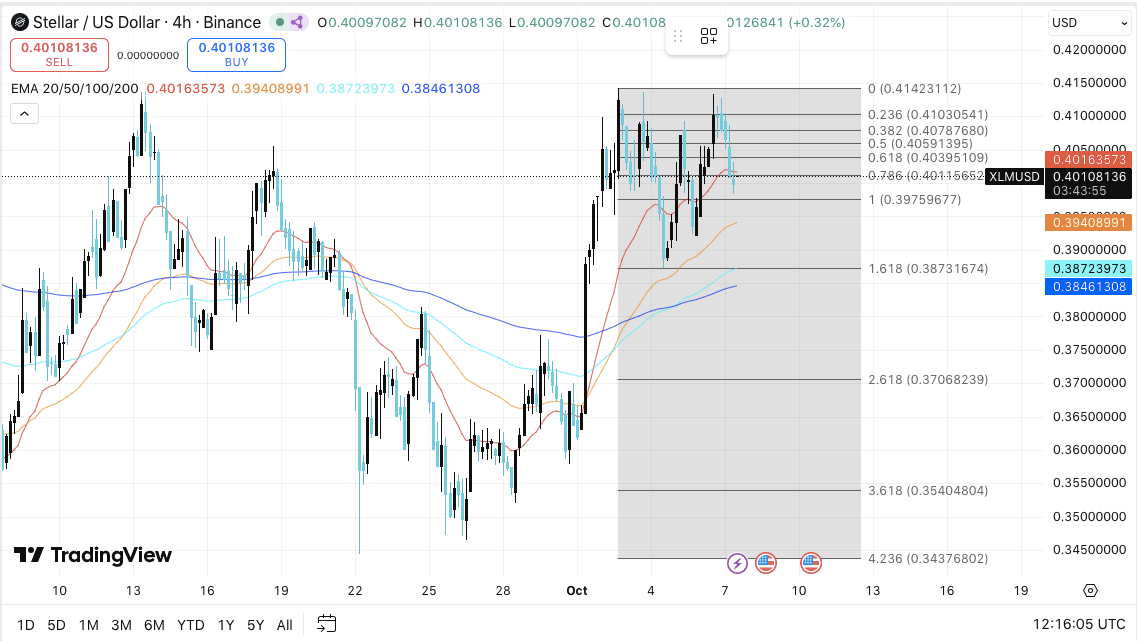

Stellar (XLM) is presently consolidating close to the $0.40 area and merchants are watching intently for any indicators of a breakout or breakdown. The cryptocurrency has been oscillating inside a slender vary, displaying each resilience and hesitation after the rebound in late September.

The 4-hour chart displays powerful buying and selling exercise from $0.397 to $0.414, suggesting that patrons and sellers are evenly matched. The path of the market now relies on whether or not the Bulls can defend the $0.40 mark lengthy sufficient to set off psychological momentum.

Technical setup refers to balanced momentum

The XLM/USD pair stays in a short-term consolidation part, with clear Fibonacci ranges forming a key response zone. The value repeatedly fails to interrupt above $0.414, forming a brief ceiling, and $0.397 continues to function instant assist.

The 50 ema at $0.394 and the 100 ema close to $0.387 point out that the short-term development energy stays intact. Nevertheless, falling beneath these averages can tip the steadiness in direction of the bears.

Quick resistance is $0.405 and $0.410, comparable to the 0.5-0.382 Fibonacci retracement zone. A profitable breakout above these ranges may open a path in direction of $0.420, whereas a failure to maintain above $0.397 would reveal the $0.387 and $0.370 ranges.

Associated: Cronos (CRO) Worth Prediction: Breakout in Merchants’ Eyes Open Curiosity Surges

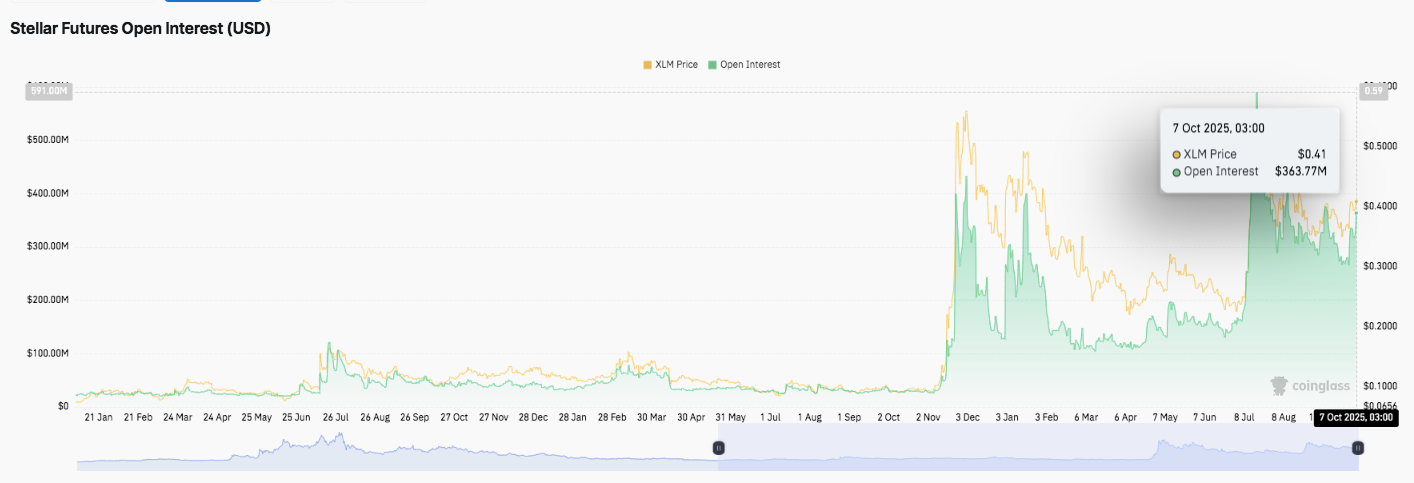

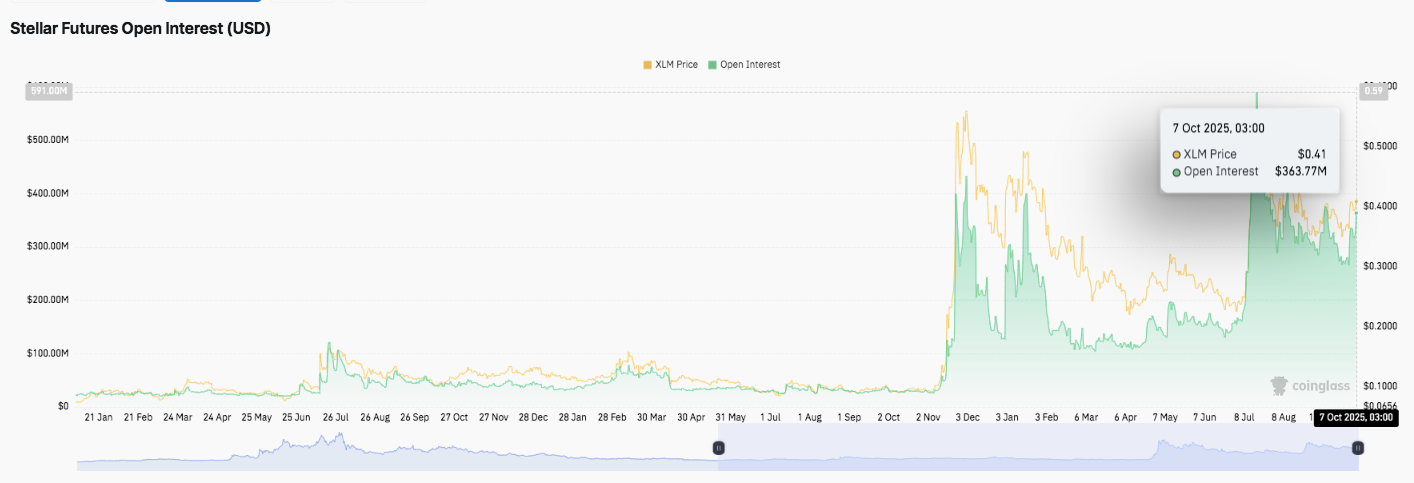

Elevated open curiosity displays market engagement

Along with worth consolidation, the futures market is displaying robust exercise. In 2025, Stellar’s open curiosity rose sharply, rising from lower than $100 million originally of the 12 months to greater than $360 million by early October. This surge signifies elevated participation from each retail and institutional merchants.

The alignment of worth appreciation and open earnings progress suggests speculative positioning favors a possible continuation of the bullish development. Sustained curiosity of greater than $300 million may strengthen market confidence, whereas a pointy decline may sign a achieve or a discount in leverage publicity.

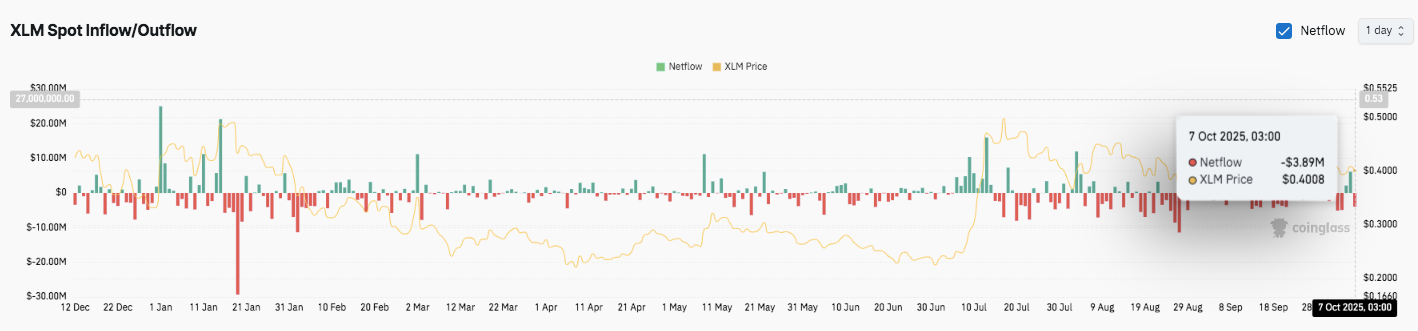

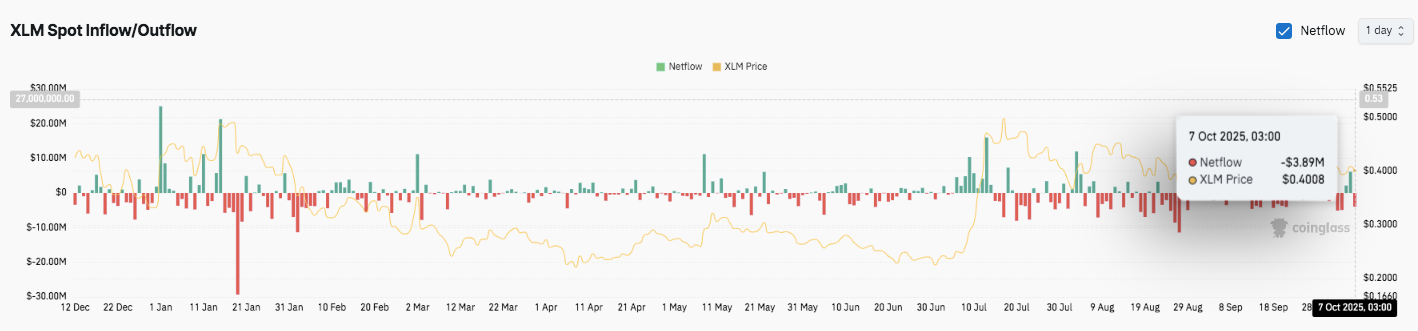

Inflows and outflows reveal combined feelings

Moreover, Spot Netflow information reveals alternating inflows and outflows all year long, reflecting adjustments in sentiment. On October seventh, Stellar recorded a web outflow of $3.89 million, implying short-term promoting stress as merchants have been trapped in earnings round $0.4008.

Traditionally, related outflows have preceded minor pullbacks, whereas robust inflows have typically triggered restoration phases. Because of this, market contributors see new inflows as a sign of latest accumulation. If sustained shopping for returns close to $0.40, Stellar may resume its upward trajectory to $0.42 within the coming classes.

Associated: Ethereum Worth Prediction: Samsung Staking and Bitmine Treasury Gas Demand

Technical outlook for Stellar (XLM) worth

The important thing stage for Star (XLM) is effectively outlined because it continues to consolidate across the $0.40 area heading into mid-October.

- Upside stage: $0.405 and $0.410 are instant hurdles and align with the Fibonacci 0.5–0.382 zone. A breakout above $0.410 may transfer to $0.414 and $0.420, the place current highs and former provide converge.

- Defect stage: Quick assist is at $0.397, adopted by $0.387 and $0.384. A definitive closure beneath $0.397 may open a path to $0.370, marking the decrease certain of the present consolidation construction.

- Ceiling of resistance: The $0.414 zone stays a key stage to flip for medium-term bullish continuation, representing the newest rejection level on the 4-hour chart.

The broader technical setup means that the XLM is compressed inside a symmetric vary. It’s because unstable contraction typically precedes growth. The subsequent transfer available in the market will rely on how the worth reacts on the $0.40 psychological stage.

Will stellar costs rebound?

Stellar’s worth outlook for October relies on whether or not the bulls can defend the $0.397-$0.400 assist vary. Sustained energy above this stage may spark momentum in direction of $0.420, supported by elevated open curiosity and improved market participation.

Associated: SUI Worth Prediction: Mainnet Improve Positive aspects Momentum

Conversely, failure to interrupt above $0.397 may entice promoting stress, exposing decrease assist at $0.387 and $0.370. Historic seasonality and up to date outflow patterns counsel short-term warning, however a rebound stays believable if inflows strengthen.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred because of the usage of the talked about content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.