Sturdy Finance suspended the market on June 12 following protocol abuse – losses estimated at round 442 ETH ($800,000) per transaction pec protect.

and assertionThe staff confirmed it was conscious of the exploit, including that no extra funds had been in danger and no consumer motion was required right now. Additional data will comply with pending findings.

Starter Finance not but prepared of crypto slate Further feedback are solicited on the time of writing.

Blockchain Safety Agency Explains How Sturdy Finance Was Abused

Initially owned by blockchain safety firm Peckshield report Sturdy Finance abuses are linked to flawed worth oracles.additional away evaluation “The foundation trigger was resulting from a flaw within the worth oracle for calculating the asset worth of cb-stETH-STABLE.”

Web3 Data Graph Protocol 0xScope backed up The report provides that the hackers transferred the stolen funds to crypto-mixed protocols, Twister Money, and Change Now exchanges.

Alternatively, the sensible contract auditor BlockSec I obtained it Along with the Oracle worth manipulation reported by Peckshield and 0xScope, the exploit additionally confirmed indicators of a “classical balancer read-only reentrancy” assault.

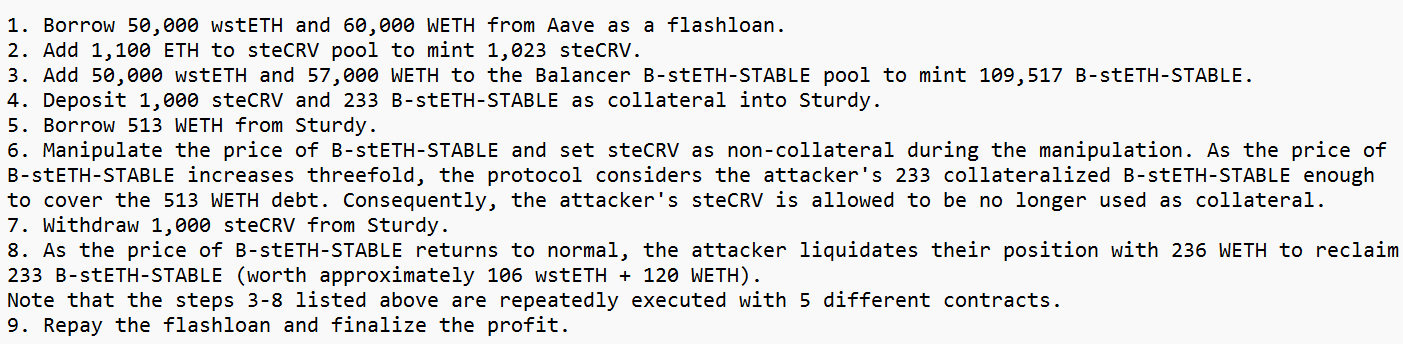

Utilizing assault transaction hashes, BlockSec explains how the attackers first borrowed over 100,000 stakes of Ethereum from Aave in a flash mortgage after which exploited a liquidity pool managed by the staff at Sturdy Finance in Balancer. backside.

In response to CertiK, reentrancy assaults enable attackers to empty funds from susceptible contracts by repeatedly calling withdrawal features earlier than updating balances.

Article after Sturdy Finance halted the market after an $800,000 exploit involving a flawed worth oracle first appeared on currencyjournals.

(Tag Translation) Ethereum