- SUI value has elevated over 80% prior to now 7 days.

- Following the expansion pattern of the altcoin market, SEI recorded a 16% enhance.

- Nevertheless, SEI's MACD indicator suggests a attainable decline.

SUI and SEI are two altcoins which have seen a major enhance in worth over the previous week. Based on information from CoinMarketCap, SUI's value has risen 85% prior to now seven days, rating it because the highest-rising crypto asset on this interval. On the time of writing, the coin was buying and selling at $1.42.

Conversely, SEI's worth elevated by 16% over the identical interval. On the time of this writing, the coin is buying and selling at $0.72.

Demand pushes up SUI

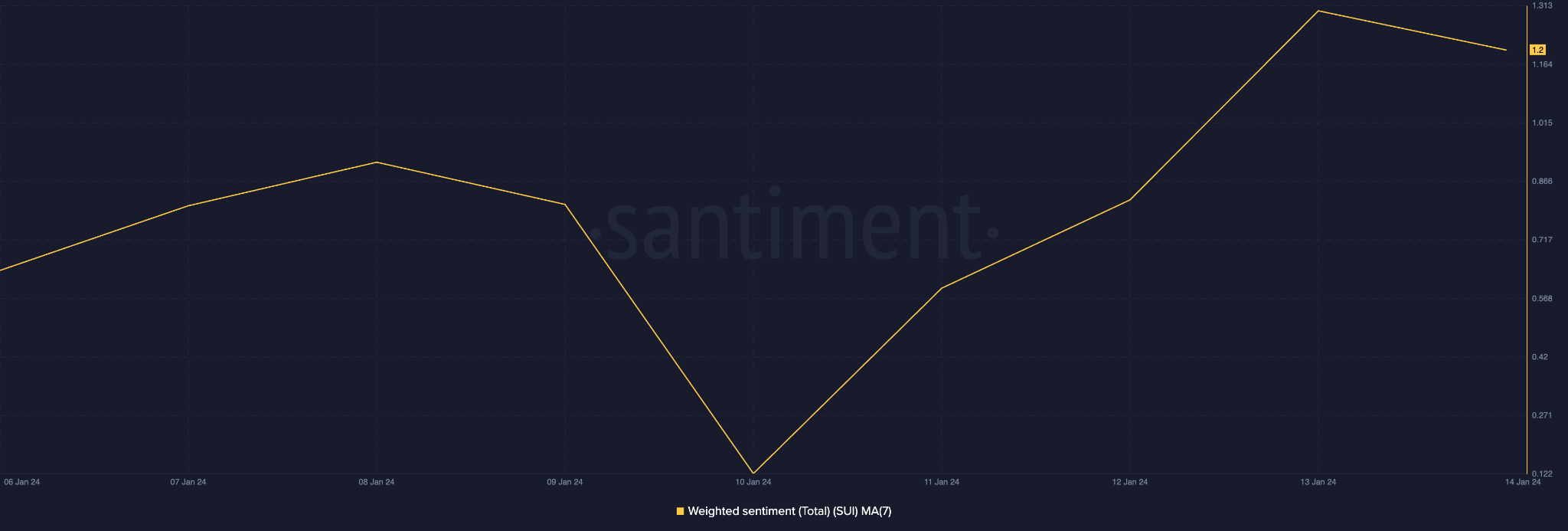

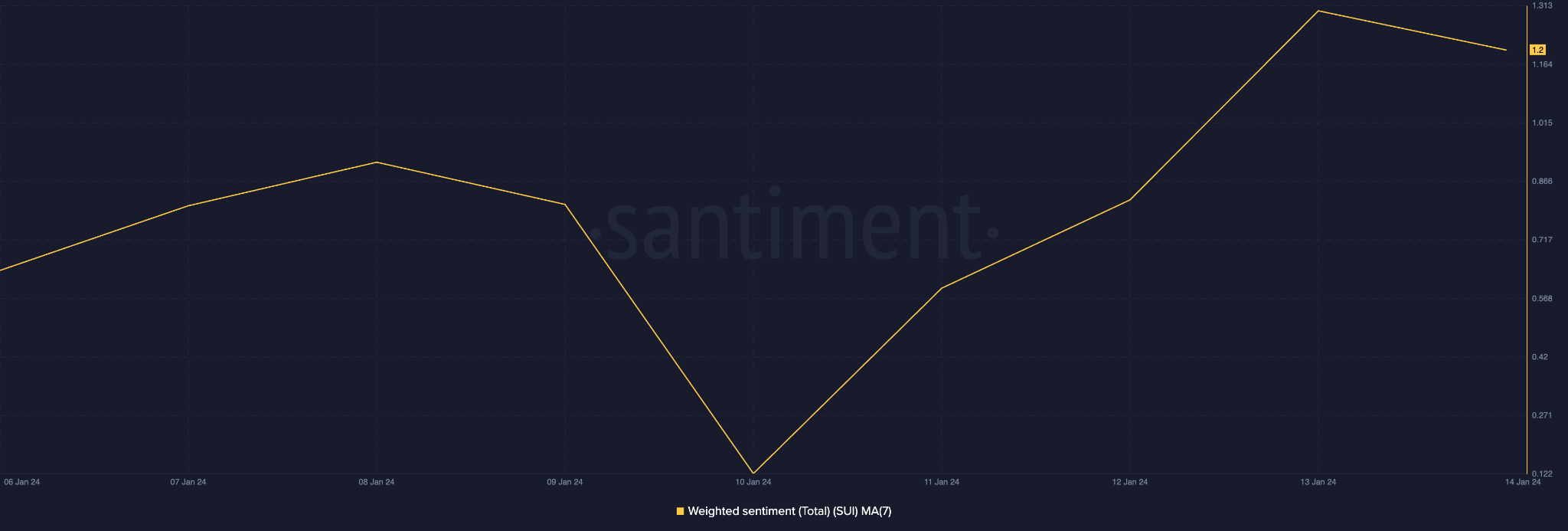

Based on Santiment information, SUI’s weighted sentiment noticed on the 7-day shifting common indicated that the coin continues to take pleasure in bullish momentum. That is manifesting itself within the type of elevated accumulation of altcoins.

The coin’s key momentum indicators have revealed that merchants proceed to favor accumulation of the coin regardless of SUI’s double-digit enhance in worth during the last week. For instance, SUI's Relative Energy Index (RSI) was 77.35, whereas its Cash Circulation Index (MFI) was 81.93.

Confirming the energy of the present bullish pattern, SUI's Aroon Up Line (orange) was at 100%. This indicator is used to determine pattern energy and potential pattern reversal factors within the value actions of crypto property. If the Aroon Up line is near 100, it signifies a robust uptrend and up to date highs have been reached comparatively not too long ago.

Nevertheless, it’s common sense to notice that on the RSI and MFI ranges of SUI, the market is commonly thought of overbought. Purchaser fatigue is typical. So a reversal may very well be across the nook.

SEI accumulation is rising, however there are pitfalls

The SEI value noticed on the day by day chart additionally revealed a rise in coin accumulation. RSI and MFI have been 60.88 and 81.44 respectively.

Nevertheless, regardless of the value enhance, the coin’s Transferring Common Convergence Divergence (MACD) studying confirmed that the SEI market remains to be suffering from bearish sentiment.

This confirmed that the value enhance and elevated coin accumulation solely mirrored the final progress of the altcoin market following ETF approval.

Based on SEI's MACD indicator, its MACD line broke beneath the pattern line on January 11, and since then, the indicator has solely returned purple histogram bars.

Thus, when an asset's MACD line falls beneath the pattern line, it alerts the beginning of a brand new bearish cycle.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.