- Sui has seen its worth enhance by over 44% prior to now week and 65% in 30 days.

- Grayscale Swee Belief noticed income after it opened to accredited traders.

- The overall locked worth of the SUI community exceeded $1.34 billion.

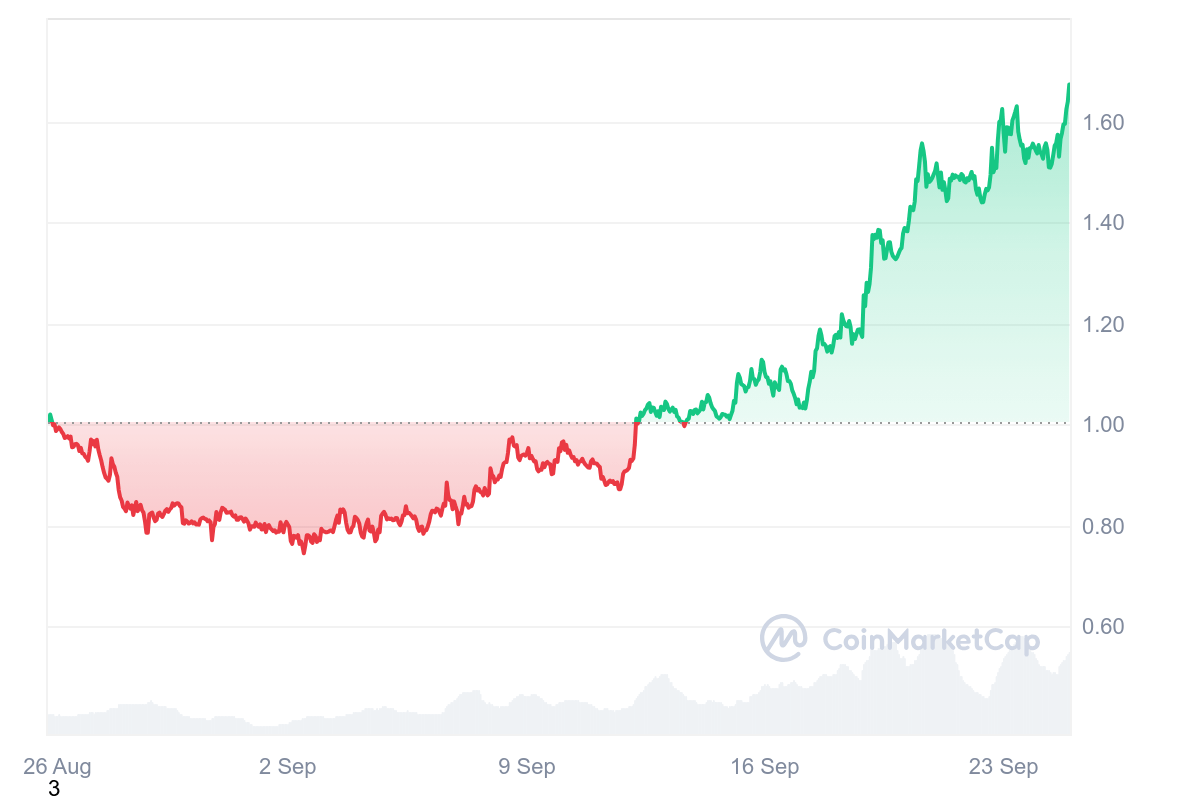

SUI's worth has surged greater than 44% prior to now week, buying and selling above $1.67. The rise features a surge of greater than 65% prior to now 30 days, which has taken the layer-1 blockchain platform's native token to a excessive final recorded in early April.

What elements precipitated the sudden rise in SUI costs?

After Grayscale introduced that Sui Belief was open to accredited traders, buying and selling quantity on Sui elevated considerably.

Following the information, SUI's day by day buying and selling quantity surged and its worth adopted go well with, reaching over $1.

The rise in Sui worth to above $1.67 coincided with a pointy enhance within the whole quantity locked in varied decentralized finance protocols inside the Sui ecosystem. OKX Ventures famous that the Grayscale Sui Belief has boosted the credibility of the SUI market, pushed by elevated institutional curiosity.

Sui TVL reaches $1.3 billion

Bullish sentiment relating to this outlook is mirrored in on-chain exercise, which has seen TVL attain $1.34 billion.

In response to DeFiLlama, Sui's TVL exceeded $1 billion in Might, up from round $250 million at the beginning of 2024. Nevertheless, it fell to $462 million by Aug. 5 because of the crypto market crash that noticed the value of Bitcoin drop beneath $50,000.

However what's notable is that it rocketed to $1 billion in lower than a month, accelerating to $1.34 billion, which represents a soar of greater than 377% year-to-date and greater than 47% up to now this month.

Behind this surge is Sui’s rising DeFi ecosystem, which incorporates growing adoption of protocols throughout lending, decentralized exchanges, real-world belongings, derivatives, and yields.

Navi Protocol's TVL has elevated 34% up to now this month to over $449 million.

Lending protocols Scallop and Suilend have TVL of $246 million and $203 million, respectively, which represents a 34% and 100% soar over their MTD, respectively.