- SUI worth is buying and selling round $1.78 right now, combating repeated rejections from the downtrend line and key EMA.

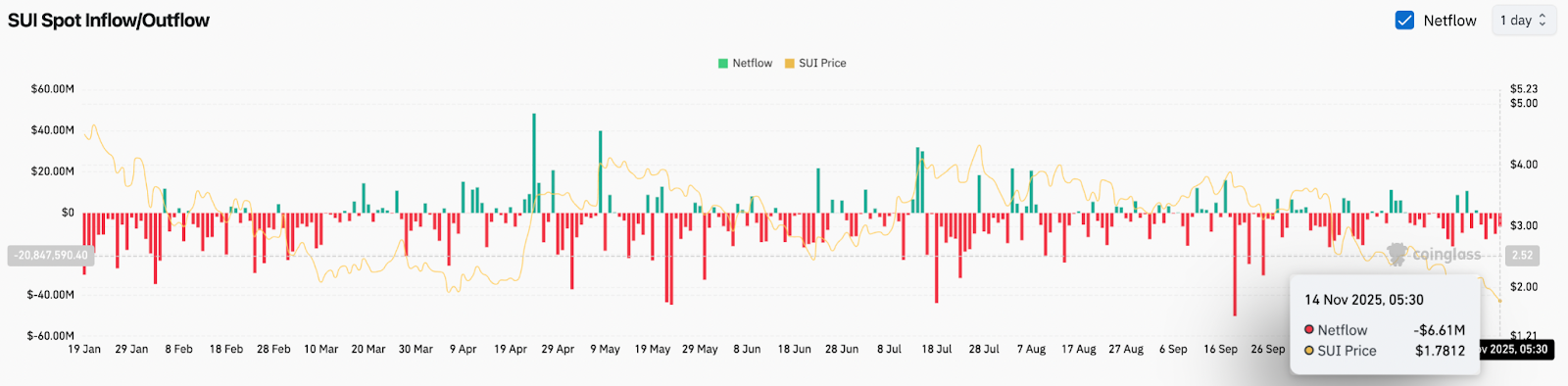

- In line with Coinglass knowledge, there was an outflow of $6.61 million and the distribution interval has been prolonged by a number of months as merchants proceed to cut back their publicity.

- A lack of assist at $1.65 may pave the way in which to $1.50, however a rally above $2.00 is required to substantiate stability.

SUI worth is buying and selling round $1.78 right now, a multi-week low after a pointy drop on intraday assist. This decline follows continued damaging spot movement and one other rejection from the downtrend line on the every day chart.

Outflows improve quickly as liquidity disappears from the market

In line with Coinglass knowledge, web outflows on November 14 had been $6.61 million, marking a chronic interval of damaging buying and selling. Outflows have been predominant since late September, and the latest scale of withdrawals displays merchants’ decisive threat discount.

SUI has not recorded sustained constructive movement stress in latest months. Repeating crimson prints point out that market individuals are sending tokens to the alternate relatively than accumulating them.

Every day chart exhibits the depth of the downtrend

After the SUI fell beneath the rising assist zone from the start of this 12 months, the every day construction continues to deteriorate. This token is presently buying and selling in any respect main EMAs.

- 20EMA, $2.17

- 50EMA at $2.55

- 100EMA, $2.87

- 200EMA, $3.04

This association kinds a robust resistance wall. The entire rallies over the previous two weeks have been rejected on the 20 or 50 EMA, indicating that sellers are constantly defending the downtrend.

The downtrend line from April stays intact. SUI tried a take a look at earlier this month, however was withdrawn earlier than reaching the cap. The supertrend indicator turned bearish a couple of periods in the past however has not reversed since then, confirming directional stress.

The worth is presently testing the sturdy demand zone between $1.75 and $1.65 that was held twice earlier this 12 months. A detailed beneath this band could be important and would expose deeper ranges in the direction of $1.50.

Brief-term charts spotlight stress

The 30-minute chart exhibits a continued decline from the $2.05 rejection space. The worth is beneath the VWAP band and all makes an attempt to retest the midline round $1.82 to $1.85 have failed. This means continued management by the vendor within the intraday timeframe.

Parabolic SAR continues to outperform the worth and the downward momentum is rising. Merchants will proceed to deal with all pullbacks as corrections till SAR reverses and SUI closes above the VWAP midline.

The subsequent intraday pivot is $1.85. A break above this stage would be the first signal of stabilization, however the total development will stay unchanged until the worth closes above $2.00.

outlook. Will SUI go up?

In the meanwhile, SUI stays underneath widespread promoting stress as outflows improve and the worth stays beneath the higher EMA. Bulls must regain management of the short-term construction earlier than making an attempt a bigger reversal.

- Bullish case: An increase above $1.85 and a subsequent shut above $2.00 would point out stabilization. Sturdy affirmation will solely come if SUI breaks via the 20 and 50 EMAs between $2.17 and $2.55, opening the door to $2.80.

- Bearish case: A detailed beneath $1.65 would recommend a deeper breakdown and the following assist might be round $1.50, with the draw back extending to $1.32 if flows stay damaging.

The sellers preserve management and the downtrend stays intact till the worth regains $2.00.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.