- The 1.57.2 improve of SUI will increase community velocity, developer instruments and ecosystem stability.

- SUI Worth is held above Keemouth in cautious optimism and merges practically $3.57.

- Quick resistance is $3.63, with potential short-term targets being $3.84-3.90.

The most recent mainnet improve to SUI model 1.57.2 and protocol model 96 has up to date the market curiosity within the mission. This replace improves community effectivity, fixes necessary bugs affecting developer instruments, and reveals the continued progress of the blockchain ecosystem.

In the meantime, SUI costs present a consolidated signal of practically $3.57 after a outstanding rebound from September lows. Regardless of this brief pause, technical indicators recommend that bullish sentiment stays intact when belongings keep assist ranges above the primary transferring common.

Strengthening networks improve ecosystem stability

Latest upgrades have launched a number of enhancements that would improve the long-term scalability of the SUI. MySticeti V2, also referred to as MySticeti FastPath, is at present reside on the mainnet, permitting quicker transaction processing. Moreover, validators and full nodes now summarise CheckPointArtifacts Digests to enhance synchronization accuracy.

Builders additionally profit from new API integrations, together with GRPC, JSON-RPC and Coinregistry assist by way of the GraphQL interface. This unified construction simplifies entry to token metadata and complete provide information. Moreover, bug fixes throughout the command line interface get rid of the early termination points brought on by protocol inconsistencies between the CLI binaries and the community model.

Associated: XRP Worth Prediction: Trump’s Crypto Recognition Causes Rippling Momentum

These modifications mirror the SUI crew’s ongoing dedication to bettering developer expertise and transaction effectivity. Each are important for community development. Subsequently, these updates could enhance investor sentiment by guaranteeing a extra steady setting for distributed purposes.

SUI costs exceed main assist ranges

Technically, SUI continues buying and selling inside a slim vary after regaining a crucial exponential transferring common. The 4-hour chart reveals costs between $3.52 and $3.59 for ranges that correspond to 50- and 20-day EMA. This vary serves as short-term assist as merchants are ready to see what strikes within the subsequent path.

Quick resistance is near $3.63 and is working with the Fibonacci extension, which concludes its latest upward try. If stress returns, subsequent targets might be between $3.84 and $3.90, marking potential profit-earning zones. Nevertheless, a crucial drop beneath $3.48 might disable bullish setups and open a path in the direction of assist round $3.20.

Associated: Bitcoin Worth Prediction: Technique’s $3.9 billion achieve boosts feelings

The momentum index stays steady, suggesting gentle cooling after a robust restoration from $3.07. Over the area of $3.48-$3.52, bulls are managed and potential breakouts above $3.63 might result in new advances into a better resistance band.

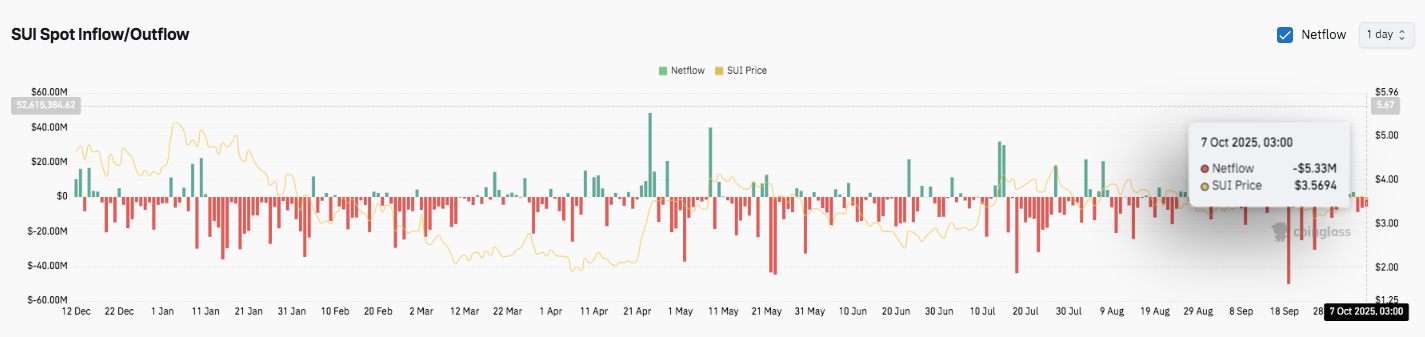

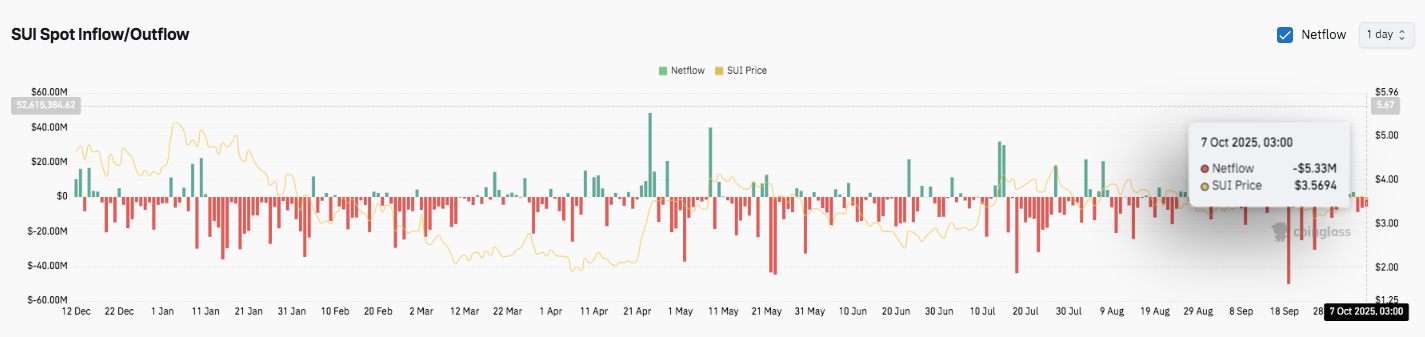

Alternate spills mirror cautious optimism

Information from the SUI Spot Influx/Outlet Chart reveals constant outflows since mid-September, reflecting the cautious but optimistic market stance. On October seventh, a web outflow of $5.33 million was recorded as tokens traded practically $3.57. This sample signifies that traders are transferring belongings off the alternate, presumably getting ready for a long-term staking or restoration in anticipated costs.

Whereas sustained outflows typically recommend a decrease gross sales stress, the shortage of robust inflows signifies that merchants are conservative. Subsequently, the market’s cautious tone coincides with the present integration section the place value stability close to the $3.5 zone precedes potential volatility.

Technical outlook for SUI pricing

As SUI integrates past short-term assist, key ranges stay strictly outlined.

- Upside Stage: $3.63 (a direct hurdle), adopted by $3.84 and $3.90. Breakouts above these could possibly be eligible for $4.10 and $4.36.

- Drawback degree: $3.52 (50 EMA) remains to be necessary, with deeper assist being $3.41 and $3.20 if the momentum is weak.

- Ceiling of resistance: $3.92–$3.97 marks the zone to retrieve for medium-term bullish continuation.

Technical setups present that SUI is compressed inside a slim built-in band, and volatility typically precedes a robust directional breakout. The four-hour construction stays constructive so long as the value exceeds $3.48, with the EMA forming a possible bullish cross.

Associated: PI Worth Prediction: Bearish Channels final when PI is fighting close to $0.26

Does SUI proceed to get better?

The October SUI value outlook will rely upon whether or not patrons can keep assist close to the $3.48-$3.52 vary, and can decisively destroy $3.63. Sustainable power might pave the best way for $3.84 and $3.90 within the brief time period. Nevertheless, in the event you fail to comply with $3.48, you could be triggered to repair it in opposition to $3.20.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version is just not answerable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.