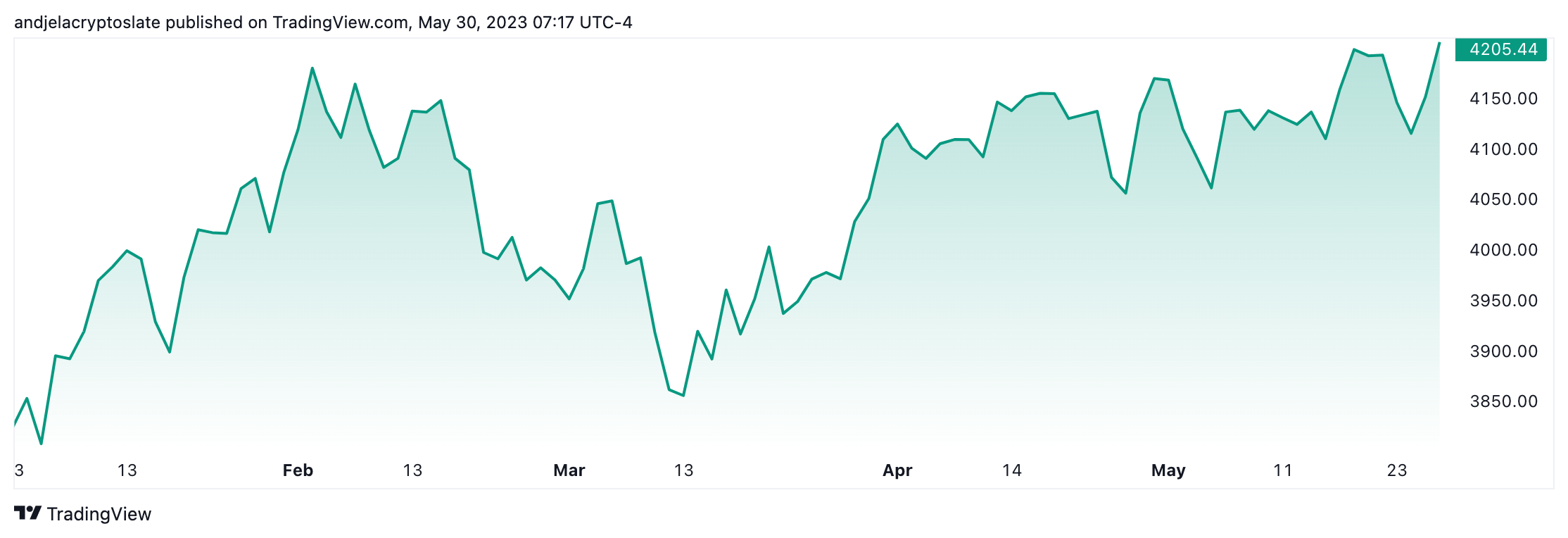

The S&P 500 Index, a key barometer of U.S. shares, reached 4,151 factors as of Could 29’s shut, exhibiting year-to-date progress of 9.15%, indicating rising inflation and a possible recession. The state of affairs is the other. .

In parallel, the cryptocurrency market, as measured by market capitalization, witnessed important volatility, ending the month with a whopping $1.16 trillion. Regardless of periodic financial downturns, the general cryptocurrency market has grown by a staggering 45.3% year-to-date.

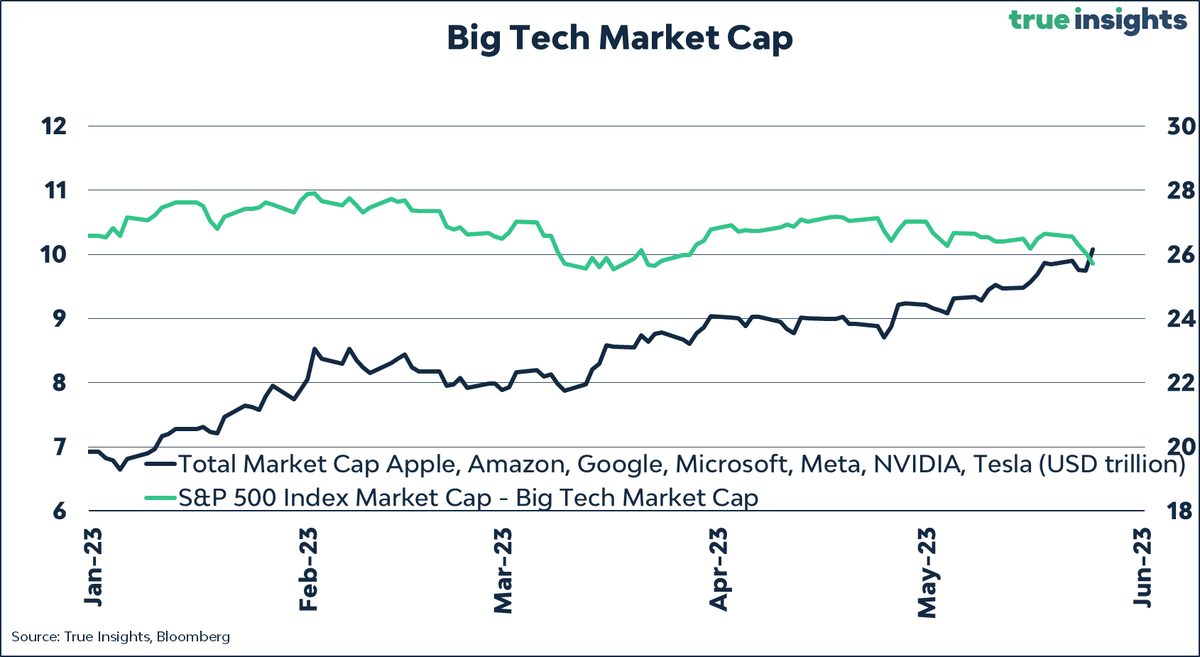

Nevertheless, the efficiency of the S&P 500 just isn’t indicative of actual market circumstances. A more in-depth look reveals that expertise giants Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla, which account for a good portion of the index’s market capitalization, have disproportionately impacted the index’s total efficiency. perceive.

Collectively, these shares added $3.16 trillion in market capitalization, representing a year-to-date progress of 46%.

When these corporations are excluded from the calculation of year-to-date efficiency, the S&P 500 paints a special image, with year-to-date progress slowing to simply 3% and powerful efficiency being closely depending on these corporations. signifies that there’s

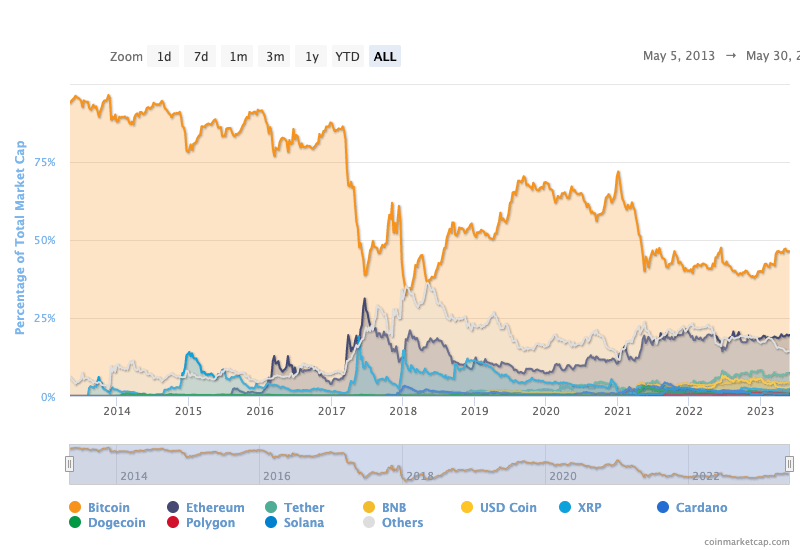

Nevertheless, the cryptocurrency market can also be dominated by a major participant, Bitcoin. As of Could 23, 2023, Bitcoin alone accounts for $542.7 billion of the cryptocurrency market capitalization. Its sheer measurement and affect usually overshadows the efficiency of different cryptocurrencies available in the market.

In truth, Bitcoin’s dominance has reached roughly 46% of the full cryptocurrency market capitalization, reflecting its standing as the unique most generally adopted cryptocurrency. This quantity has been a serious driver of cryptocurrency market traits, demonstrating the resilience and rising recognition of Bitcoin.

Excluding Bitcoin’s market cap from the full, the remaining cryptocurrency market cap is $617.3 billion, indicating a low year-to-date progress price of 29.1% for the remainder of the market, with Bitcoin taking on the whole crypto market. It was discovered to have a major affect on progress.

Evaluating the efficiency of the S&P 500 and the cryptocurrency markets yields insightful parallels. Each are extremely concentrated, with chosen corporations having a major affect on their respective market caps. This disproportionate affect presents attention-grabbing concerns concerning the variety and resilience of those markets.

Nevertheless, the resilience exhibited by the cryptocurrency market even within the midst of a worldwide disaster highlights its potential as a formidable competitor to conventional markets.

As we proceed our analysis into 2023, these market developments will undoubtedly stay beneath our lens and can be an attention-grabbing remark for market watchers and contributors.

The expansion price of the cryptocurrency market was first displayed on currencyjournals after tech giants and Bitcoin’s dominance distorted the S&P 500.

Comments are closed.