- The technique briefly suspended Bitcoin purchases from March thirty first to April sixth, 2025.

- Bitcoin fell beneath $80,000 after Trump introduced new US commerce tariffs.

- The present Bitcoin Holdings technique is 528,185 BTC.

Michael Saylor’s firm Technique has stopped shopping for Bitcoin for the primary time in latest reminiscence, indicating a transition from regular purchases.

The event occurred amid a speedy revision within the crypto market, falling in response to President Donald Trump’s new 10% tariffs on nearly all overseas items.

The technique’s suspension of Bitcoin accumulation confirmed in its April seventh 10-Q submitting with the Securities and Trade Fee (SEC) coincided with broader traders’ consideration after Trump threatened to double tariffs on Chinese language imports to 50%.

The technique has 528,185 BTC

In response to SEC submitting, the technique didn’t make Bitcoin purchases between March thirty first and April sixth.

The corporate nonetheless holds 528,185 BTC, which has accrued since 2020 when it first adopted a Bitcoin-centric monetary technique underneath Saylor’s management.

The corporate didn’t promote its holdings throughout this latest suspension, however recorded $59.1 billion in unrealized losses at Bitcoin Holdings within the first quarter of 2025.

This sharp drop in worth displays Bitcoin falling beneath $80,000, a reversal of the income seen after Trump’s reelection.

The SEC doc didn’t make clear whether or not the suspension is a brief, non permanent strategic change or a part of a wider strategic change, however highlighted that market situations and geopolitical uncertainty had an affect on acquisition exercise.

Trump warns China’s 50% tariff

The technique’s suspension of Bitcoin purchases was not an remoted choice.

It coincided with the market instability brought on by Trump’s tariff insurance policies, inflicting disruption in conventional monetary markets and the general digital asset alternate.

On April 7, the president posted on his earlier Twitter account, X, saying, “Robust, brave, affected person, greatness will outcome.”

Nevertheless, traders’ sentiment has escalated sharply after Trump escalated the specter of rising tariffs on Chinese language imports from 34% to 50% until Beijing removes retaliation measures.

This has added extra stress to asset costs around the globe, resulting in capital outflows and droop in risk-on property, together with cryptocurrencies.

Unrealized losses within the technique increase issues concerning the BTC monetary mannequin

The unrealized lack of $59.1 billion attracts consideration to the potential dangers of a Bitcoin-centric company monetary mannequin.

The technique has lengthy advocated Bitcoin as a useful retailer, however latest occasions have rekindled debates over volatility publicity.

The corporate’s unrealized losses within the first quarter present that geopolitical developments, resembling modifications to US commerce insurance policies, have a direct affect on the steadiness sheet linked to crypto property.

The technique didn’t touch upon future acquisition plans in SEC filings, however the absence of recent purchases in periods of accelerating market uncertainty suggests a extra cautious stance within the quick time period.

Ackman is in search of a reversal of tariffs

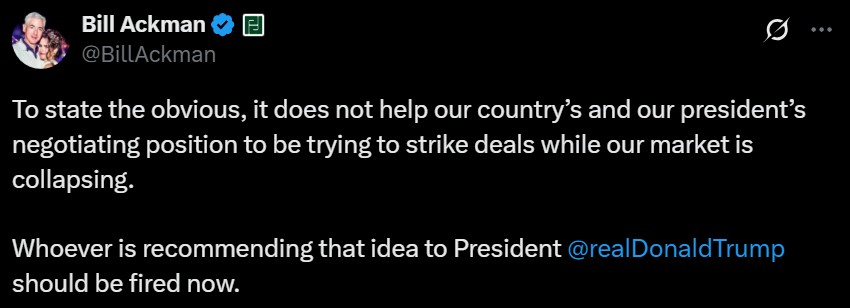

Billionaire investor Invoice Ackman, who beforehand expressed help for Trump, criticized the brand new tariffs and the affect on market stability.

On April seventh, Ackman posted a submit on X. This posted that the coverage undermines US leverage negotiations and must be reversed quickly.

His feedback mirror rising issues amongst traders concerning the broader affect of commerce insurance policies on asset markets, notably as shares and crypto property are underneath simultaneous stress.

The technique’s choice to droop Bitcoin purchases is added to this narrative, suggesting that some corporations are presently reassessing aggressive crypto accumulation methods amid macroeconomic headwinds.

Whether or not this suspension will flip right into a long-term coverage shift could rely on how Bitcoin costs reply to the evolving world financial setting and additional political developments.

The submit technique hits the Bitcoin pause button after the $5.9 billion loss first appeared on Coinjournal.