- TEL stays sturdy above the breakout stage as patrons defend key Fibonacci assist zones.

- Futures charges have soared above $1 million, suggesting merchants are bracing for vital volatility.

- Telcoin’s banking constitution supplies long-term credibility as US laws increase.

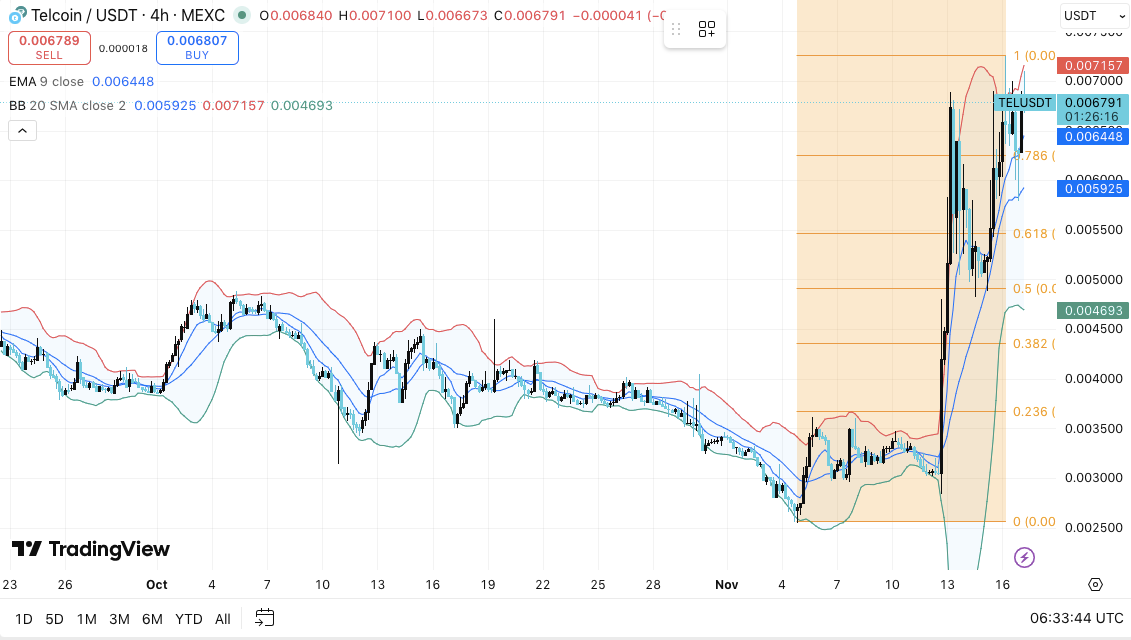

Telcoin continues to point out sturdy upward momentum this week, with the token firmly above current breakout ranges. The transfer comes as merchants elevated futures publicity following a pointy restoration from mid-November lows.

The rise additionally comes amid renewed curiosity in Telcoin’s progress in regulated banking within the US, which is a key a part of its long-term roadmap. A mix of technical power, elevated open curiosity and elevated regulatory traction has refocused the venture after a number of months of sluggish exercise.

Patrons take management and the worth freezes close to the excessive.

TEL broke out of its multi-week vary in early November and rose sharply to regain the $0.0060 space. The rebound created a powerful development construction and the worth remained above the 9-EMA.

Moreover, the token continued to commerce throughout the higher Bollinger Bands, exhibiting stable momentum as volatility widened. These situations indicated sturdy purchaser curiosity regardless of periodic profit-taking close to $0.00710.

The market repeatedly defended the 0.786 Fibonacci zone round $0.00606. This zone served as a short-term reference level each time costs have been about to fall.

Moreover, the 0.618 and 0.5 Fibonacci space remained a deeper zone the place patrons might rally if volatility picks up. The broader uptrend held so long as TEL remained above $0.0060, however the token nonetheless confronted short-term resistance between $0.00710 and $0.00720.

Futures buying and selling expands as merchants place towards volatility

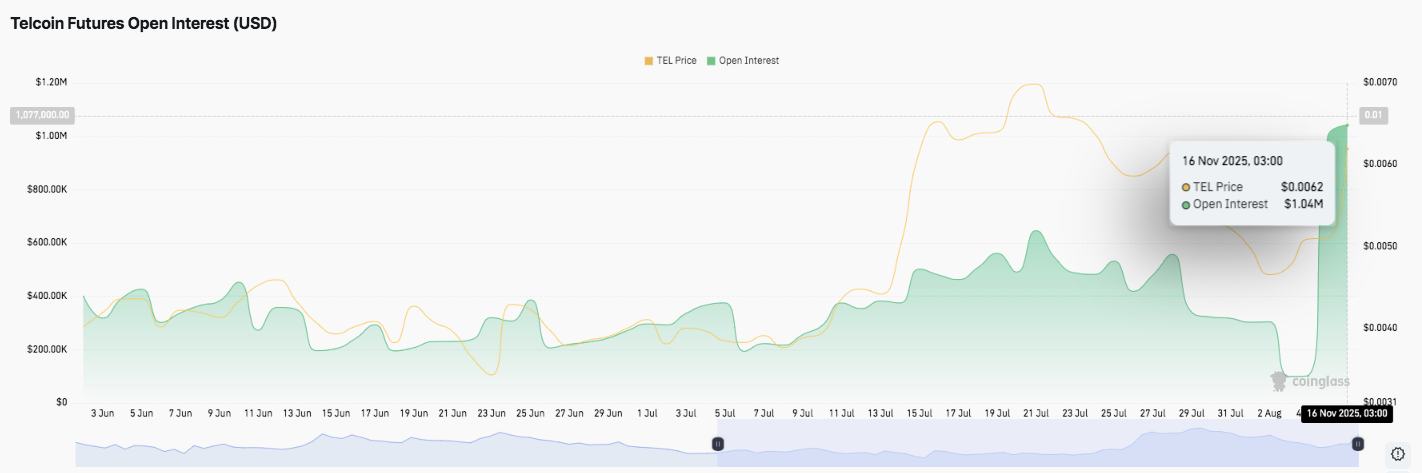

Open curiosity has proven notable modifications over the previous month. It has hovered quietly between $200,000 and $500,000 for a lot of the yr, suggesting cautious participation. Nevertheless, futures positions skyrocketed in early November, topping $1 million whereas TEL was shifting in direction of $0.0062.

Associated: XRP Worth Prediction: Bears achieve grip as XRP struggles to interrupt above $2.30

In consequence, the market has seen the strongest buildup of derivatives buying and selling since mid-year. This development means that merchants are positioning for greater strikes, including momentum to the present rally.

Spot circulation advised a special story. Accumulations dominated early February, however inflows weakened all year long as costs fell. Exercise has been blended since then, with current readings exhibiting slight web outflows as TEL hovered round $0.00679. Due to this fact, though costs rose, patrons remained selective.

Regulatory developments add long-term context

Telcoin took regulatory motion when it acquired a banking license in Nebraska. This approval permits the venture to construct a regulated digital asset service supported by the eUSD stablecoin.

Moreover, the constitution locations Telcoin amongst a small group of crypto firms pursuing nationwide monetary authority. This growth provides the venture a long-term choice as broader stablecoin laws proceed to evolve throughout the US.

Technical outlook for Telecoin costs

Key ranges stay clearly outlined as TEL consolidates after surging in November.

- High stage: The speedy hurdles are $0.00710 and $0.00720. A clear shut above $0.00720 might pave the best way to $0.00750 and in the end $0.00810 if momentum will increase.

- Cheaper price stage: $0.00645 acts as short-term dynamic assist, adopted by $0.00606 at 0.786 fib. If volatility accelerates, a deeper pullback might revisit $0.00552 and $0.00493.

- Momentum set off: TEL must recuperate $0.00720 to substantiate a brand new development continuation on the 4-hour construction.

The technical image reveals Telcoin compressing inside a good consolidation band close to the highest of the Bollinger Zone. This construction is much like the preliminary section of momentum fading after a vertical rally, the place the market usually pauses earlier than selecting a route. So long as the 9-EMA holds, short-term power stays intact.

Will Telcoin increase its rise?

Telcoin’s subsequent transfer will depend upon whether or not patrons can defend the $0.00606 to $0.00645 area lengthy sufficient to retest the $0.00710 to $0.00720 ceiling. The rise in open curiosity helps the potential for additional upside if spot demand improves.

If bullish momentum returns, TEL might try a breakout in direction of $0.00750 earlier than focusing on $0.00810. Nevertheless, failure to maintain the 0.786 Fib dangers a deeper decline into the $0.00552 liquidity zone the place stronger development assist exists.

Associated: Monero Worth Prediction: XMR Eyes Multi-Month Vary Reversal, Bulls Driving Restoration

For now, Telcoin is buying and selling in a pivotal zone. The current surge in derivatives positioning suggests extra volatility forward, however the route will depend on how costs behave round key assist bands. Patrons should reveal sustained conviction to succeed in new highs.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.