- A pointy breakout in TNSR ends months of compression and varieties a brand new bullish construction.

- An increase in open curiosity signifies that merchants are bracing for elevated volatility forward.

- Though capital outflows proceed, the easing of promoting stress suggests early indicators of stabilization.

Tensor’s market construction modified quickly this week as TNSR recorded one of many strongest strikes in current months. The token has spent weeks dealing with stiff resistance as merchants look ahead to a decline in exercise and continued outflows.

Nonetheless, the value development reversed as an sudden breakout pushed TNSR larger from its month-to-month lows. The transfer sparked contemporary debate over whether or not the rebound might be sustained after months of promoting stress. The chart exhibits {that a} tug of battle is at present unfolding between new purchaser curiosity and key resistance ranges from the earlier decline.

Pimples seem after a number of weeks of stress

TNSR traded inside a slender band for many of October and November as sellers managed rebound makes an attempt. Throughout this era, the token remained beneath $0.05. It struggled to outperform development indicators that suppress any pullbacks.

Moreover, supertrend readings continued to indicate robust bearish stress. This quiet development ended when the value accelerated quickly, leaping from $0.04 to over $0.20.

This surge took TNSR via a number of Fibonacci ranges earlier than encountering robust resistance across the 0.618 retracement at $0.26. That zone fashioned the primary robust response area after vertical migration.

The chart exhibits $0.15 because the closest help. This coincides with the breakout wick and the 0.382 retracement. A break beneath this space exposes $0.10 earlier than consideration returns to the previous base round $0.04. On the upside, patrons want to transfer above $0.22 and revisit the subsequent resistance space at $0.30.

Merchants re-enter as open curiosity rises

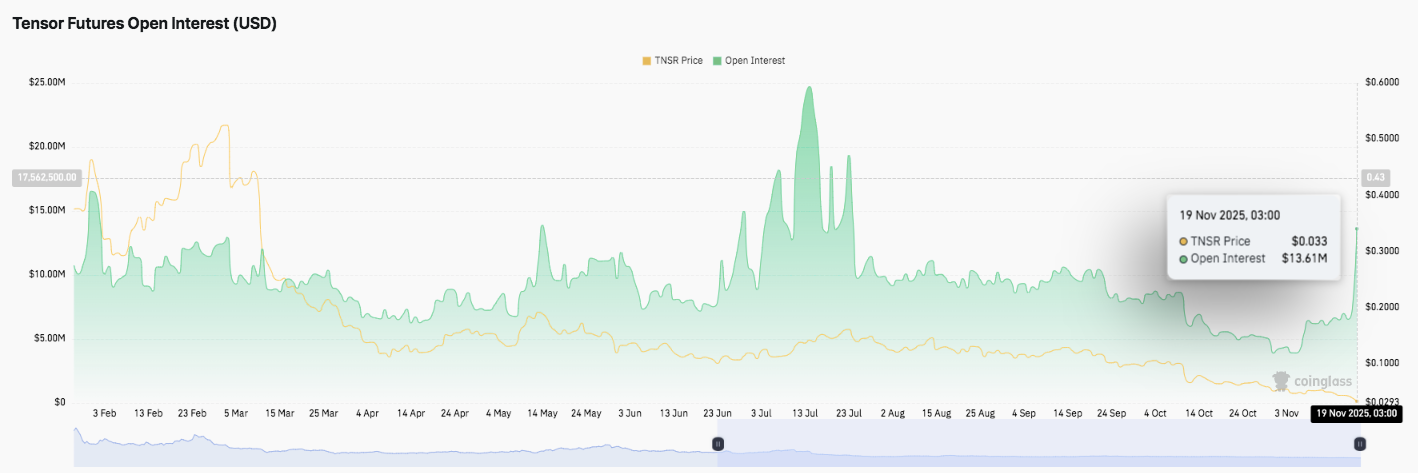

Open curiosity additionally fluctuated. With fewer contributors, futures positions have steadily declined from a peak of $17.5 million in March. Exercise remained calm till late summer season. Open curiosity hardly ever exceeded $10 million throughout September and October.

Nonetheless, November introduced a modest rebound as merchants returned to the market. The newest studying exhibits $13.61 million, with TNSR buying and selling near $0.033. This enhance means that merchants are bracing for elevated volatility.

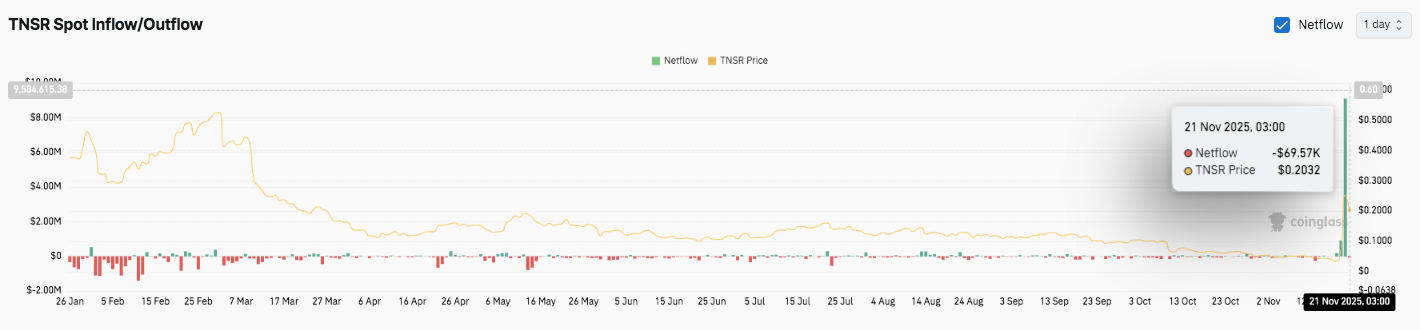

Capital outflows proceed, however promoting stress eases

Movement information present an extended interval of web outflows all through a lot of the 12 months. The promoting intensified from March to June, coinciding with a deepening value decline. Outflows subsequently decreased, however remained at a constant degree. The newest readings point out a web outflow of $69.57,000 as TNSR is buying and selling round $0.2032. Though costs are beginning to stabilize, there stays a way of warning.

Technical outlook for Tensor (TNSR) value

After Tensor’s explosive breakout from months of compression, key ranges stay well-defined.

- Prime degree: The subsequent massive hurdles are $0.22, $0.26, and $0.30. If the momentum strengthens, a clear break above $0.30 may pave the best way for $0.34 or $0.38.

- Lower cost degree: $0.15 holds as a direct help zone, adopted by $0.10 and deeper structural foundations round $0.04.

- Pattern pivot: $0.22 serves as the primary key degree that patrons must regain to keep up medium-term bullish momentum.

The technical image exhibits that TNSR is stabilizing after a vertical breakout that pushed the value from $0.04 to over $0.20 in a single impulse. Value is at present buying and selling inside a retracement construction, with $0.15 defining the dividing line between a wholesome consolidation and a deeper correction. A decisive restoration above $0.22 may set off contemporary volatility, particularly because the Fib cluster coincides with short-term resistance close to $0.26 and $0.30.

Will Tensor proceed to rise?

Tensor’s near-term trajectory will rely upon whether or not patrons maintain onto the $0.15 help zone lengthy sufficient to problem the $0.22-$0.26 resistance cluster. Continued compression between these ranges suggests an upswing in the direction of a bigger transfer. If bullish momentum expands together with stronger futures positioning, TNSR may try a retest of $0.30 after which $0.34.

If the value fails to carry at $0.15, the danger of a pullback to $0.10 will increase and presumably a revisit to the pre-breakout ground close to $0.04. For now, TNSR stays a vitally necessary space. Whereas the current breakout has improved sentiment, confidence flows and sustained restoration ranges will decide the subsequent massive route.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.