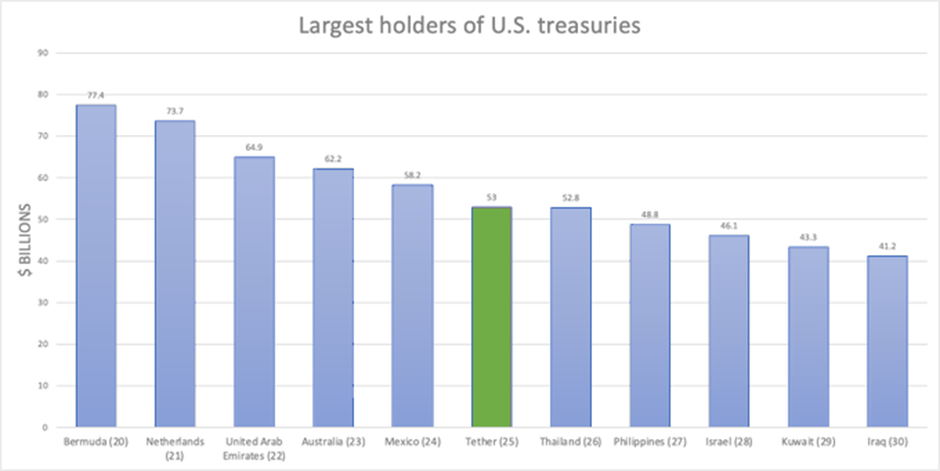

- Tether’s technique advisor in contrast the coin to the twenty fifth largest US Treasury holder.

- Gabor Grbacks shared that Tether holds $3.4 billion price of gold.

- Garbucks means that the mixture of gold and bitcoin will act as a robust safeguard towards market danger.

Tether’s strategic advisor, Gabor Garbach, stated in a current tweet that if Tether have been considered as a rustic, it will rank because the twenty fifth largest holder of U.S. Treasury bonds, citing Tether’s important affect. identified.

Garbucks pressured the significance of responsibly distributing USD-backed stablecoins, particularly in rising markets, and emphasised that such actions are within the nationwide curiosity of america. Garbucks additional recommended that Tether deserves recognition from the US because it continues to purchase U.S. {dollars} whereas different corporations are shifting away from the foreign money.

Could 12, Grubacs stated The significance of gold to Tether is steadily rising. Together with his substantial reserves of $3.4 billion on this treasured steel, the platform has emerged as a dominant pressure within the treasured metals area.

Moreover, the technique skilled emphasised that round $500 million is backing the circulating provide of Tether Gold (XAUT), which occurs to be the most important gold-pegged stablecoin issued by Tether.

Consequently, the gold share of Tether reserves is 127% bigger than Bitcoin reserves. Tether solely holds main cryptocurrencies price about $1.5 billion. In accordance with Garbucks, this mix of gold and BTC seems to behave as a robust safeguard towards potential market “catastrophic situations” and unexpected “black swan” occasions.

He added {that a} diversified portfolio ought to take into account allocating a portion of the 5-10% to gold, bitcoin and commodities.

Valuable metals historically have the bottom volatility in comparison with different funding choices obtainable to each retail and institutional traders. Furthermore, Tether (USDT) market cap has recovered nearly all of the losses attributable to the collapse of Terra (LUNA) a yr in the past. In the present day, its market capitalization exceeds $82 billion. The all-time excessive for this metric was $83 billion.

(Translate tags) Market information

Comments are closed.