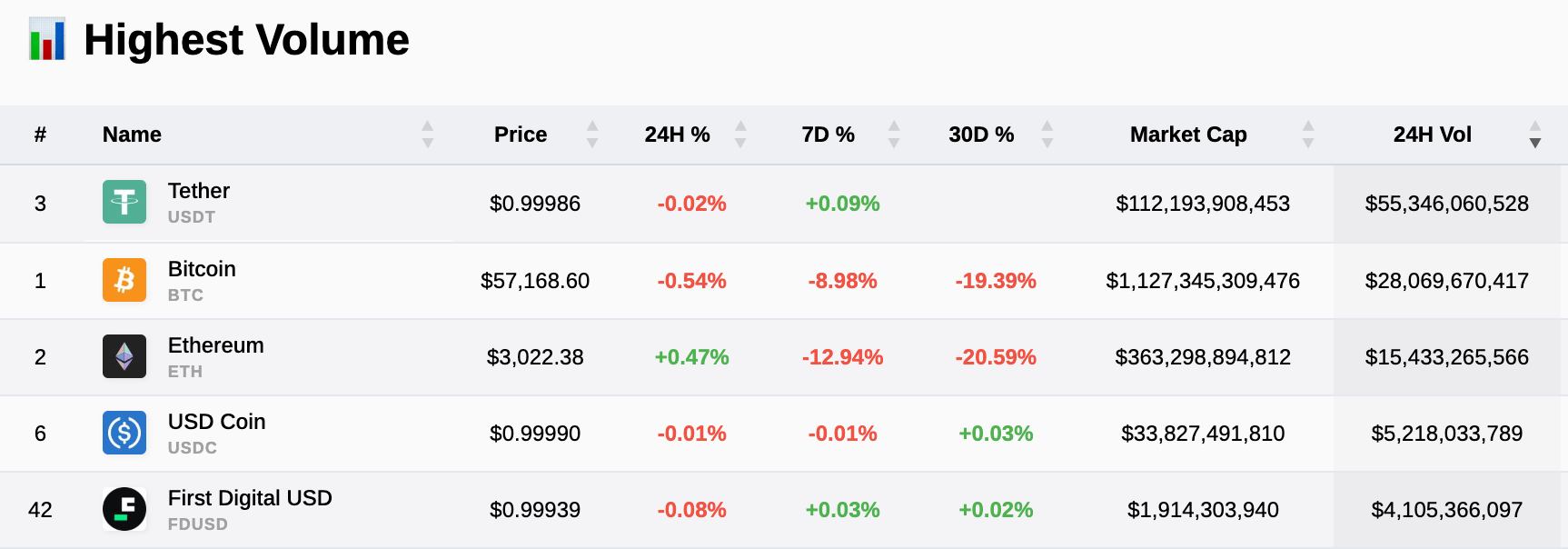

Tether USDT's 24-hour buying and selling quantity is larger than the mixed whole of the next 5 digital belongings, together with Bitcoin and Ethereum:

Contemplating Tether’s dominance in buying and selling quantity gives perception into market liquidity. currencyjournals In accordance with the information, Tether (USDT) maintains a better buying and selling quantity than Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Solana (SOL), and First Digital USD (FDUSD), giving it a big presence available in the market. Particularly, Tether has a 24-hour buying and selling quantity of over $55 billion, far surpassing Bitcoin's $28 billion and Ethereum's $15 billion.

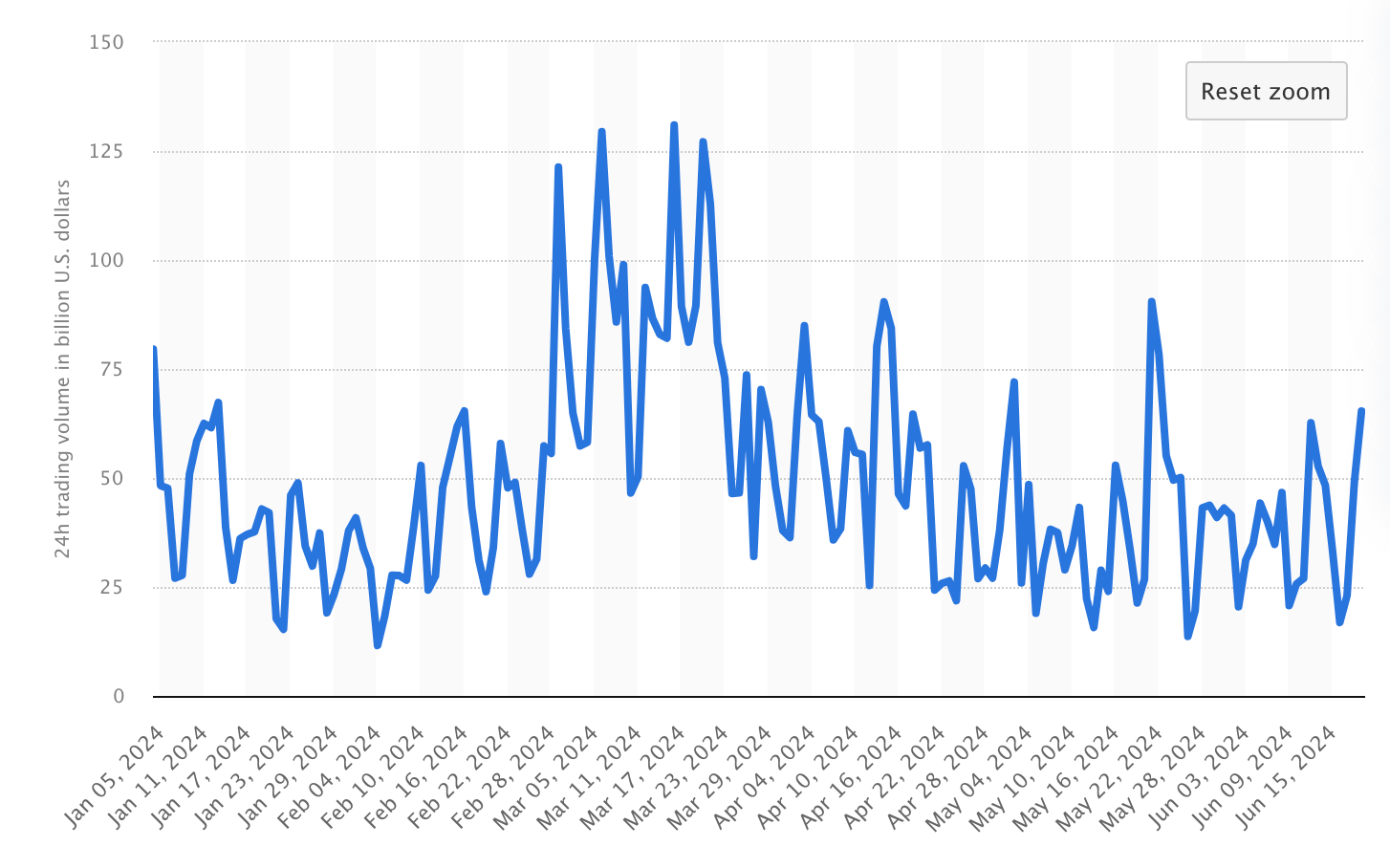

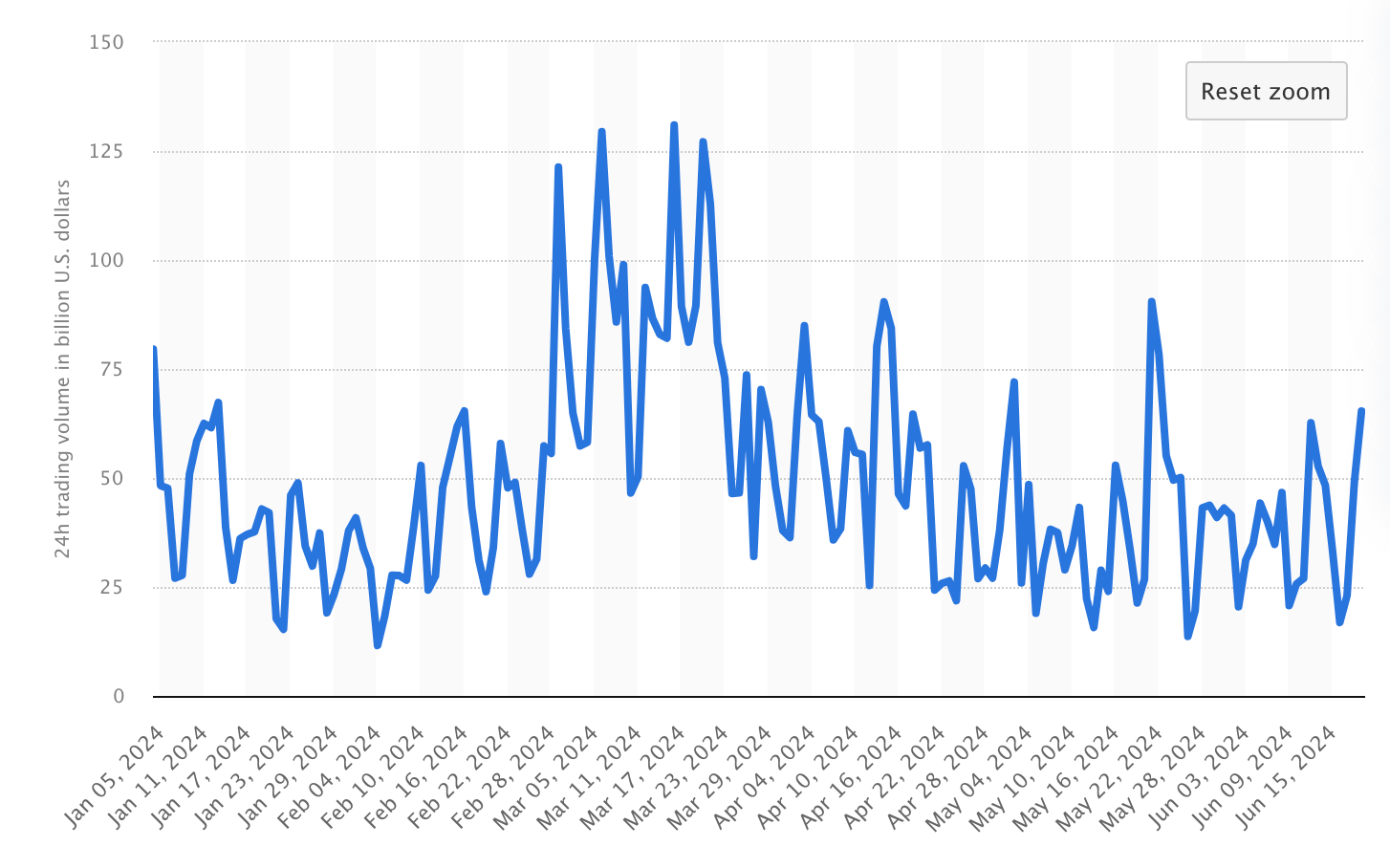

With a market capitalization of over $112 billion, a take a look at Tether's buying and selling patterns reveals that buying and selling volumes have remained constantly sturdy all through 2024, peaking at $130 billion on March 16. Tether's stability and frequent use in buying and selling pairs make it a popular alternative for merchants trying to hedge towards volatility.

With a market capitalization of over $112 billion, a take a look at Tether's buying and selling patterns reveals that buying and selling volumes have remained constantly sturdy all through 2024, peaking at $130 billion on March 16. Tether's stability and frequent use in buying and selling pairs make it a popular alternative for merchants trying to hedge towards volatility.

These buying and selling quantity statistics replicate broader market developments as Tether gives liquidity and stability. Tether usually achieves each day buying and selling volumes of over $25 billion, strengthening its place as a number one liquidity supplier within the cryptocurrency ecosystem.

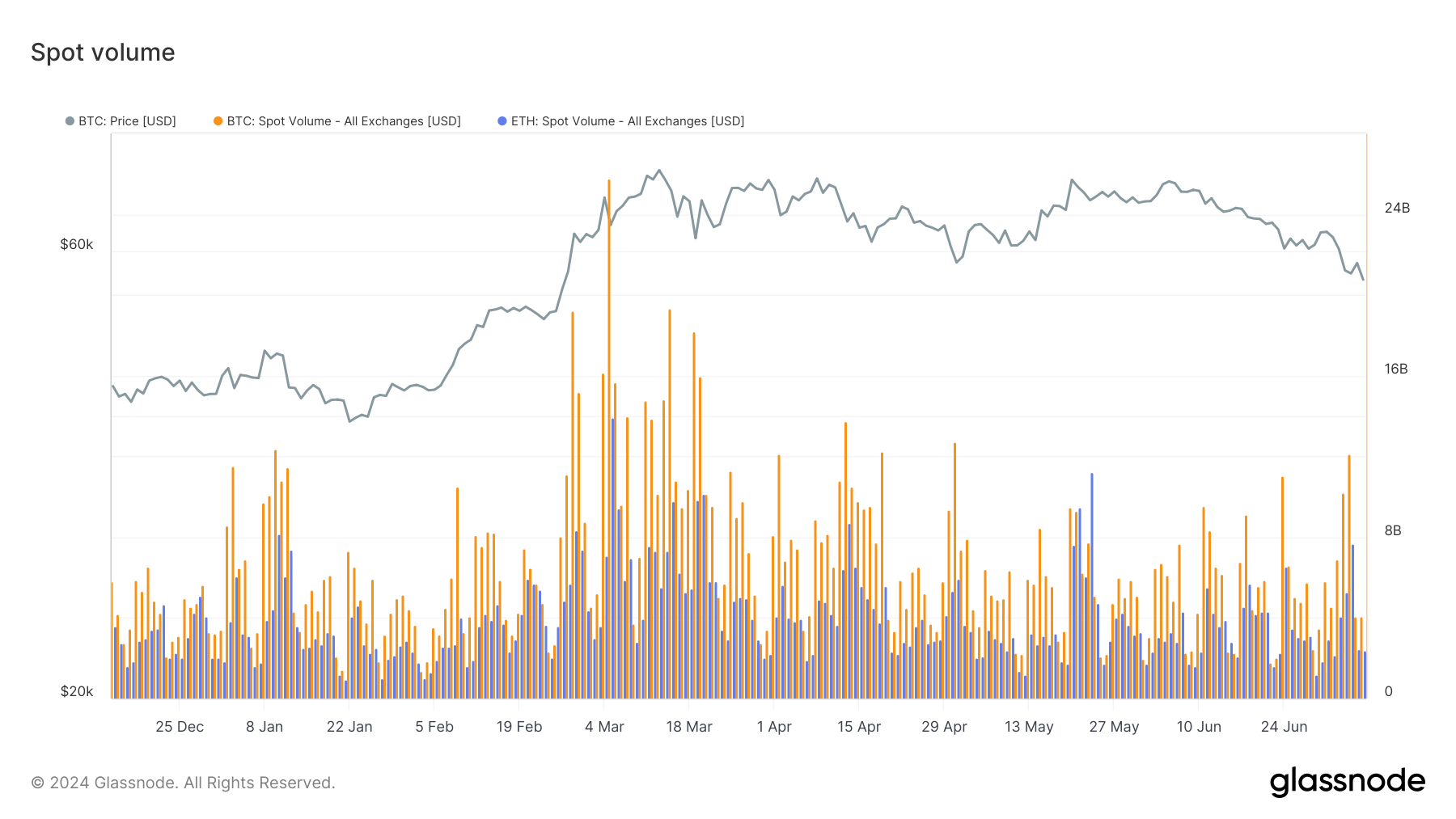

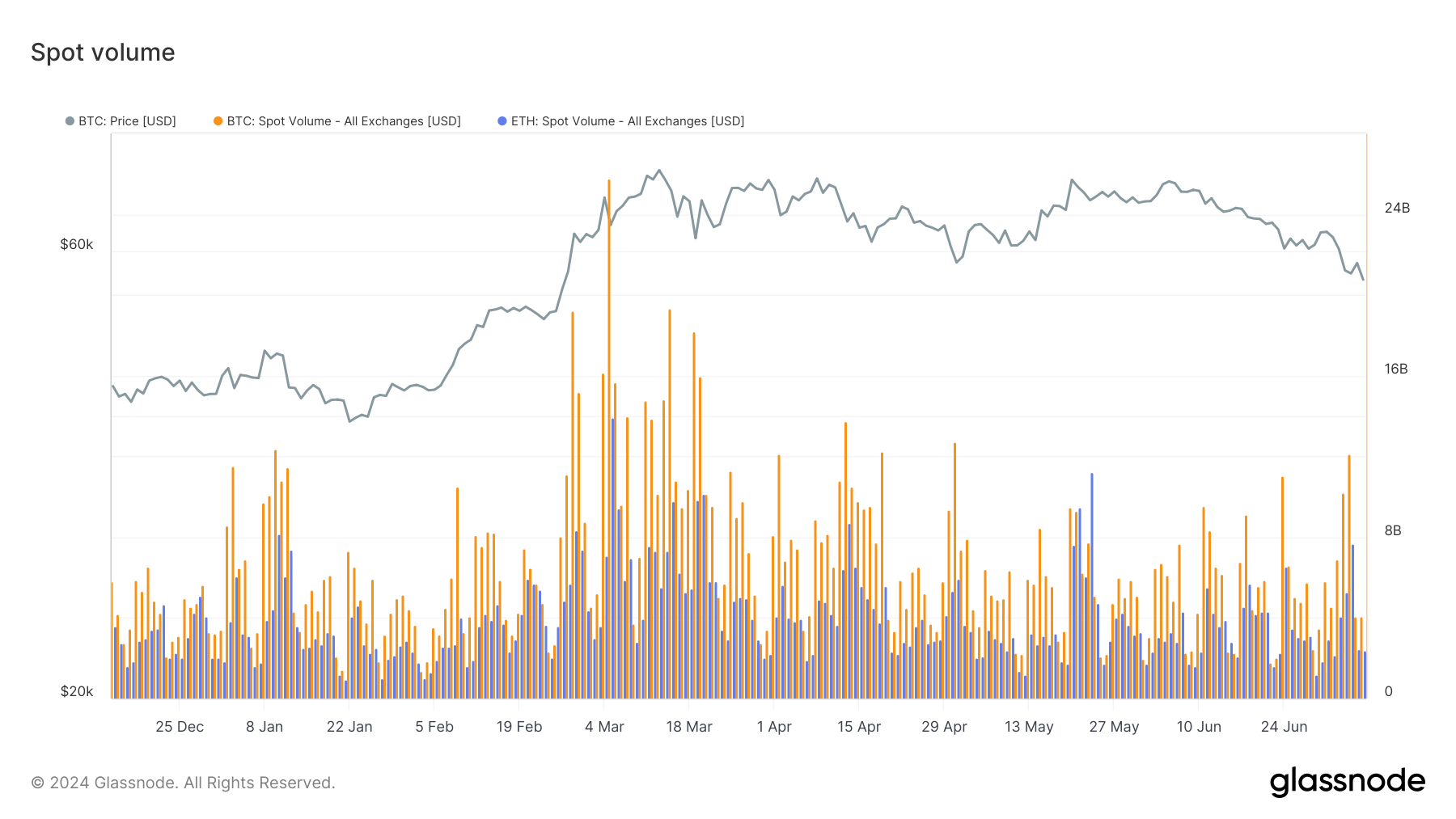

In accordance with knowledge from Glassnode, Bitcoin and Ethereum buying and selling volumes are anticipated to hover round $4 billion to $8 billion per day by way of 2024, far beneath Tether's quantity.

Tether's excessive buying and selling quantity relative to different main digital belongings demonstrates the essential position it performs in each day buying and selling exercise and the broader market methods employed by merchants and establishments. This sustained excessive quantity buying and selling signifies belief and confidence in Tether's stability and accessibility, making it important for environment friendly market functioning.

Tether has confronted quite a few points prior to now relating to its reserves and its use for illicit actions, however the quantity demonstrates the corporate's tenacity in combating these allegations. Tether CEO Paolo Ardoino just lately instructed currencyjournals that Tether is presently over-collateralized and that the corporate's earnings are being pumped again into reserves to bolster stability.

Moreover, Ardoino commented that Senator Warren's advice that accounting companies chorus from doing enterprise with Tether resulted within the firm dropping entry to one of many high 4 accounting companies in the USA for an audit. The CEO claimed that Tether is regularly searching for a contract with one of many bigger companies, however that regardless of its efforts, it has all however given up on the concept of doing so anytime quickly.