- Bitcoin stays resilient, primarily ERC-20 tokens and Artcoin.

- Altcoin’s market capitalization of 20 days EMA is $928 billion, an enormous resistance.

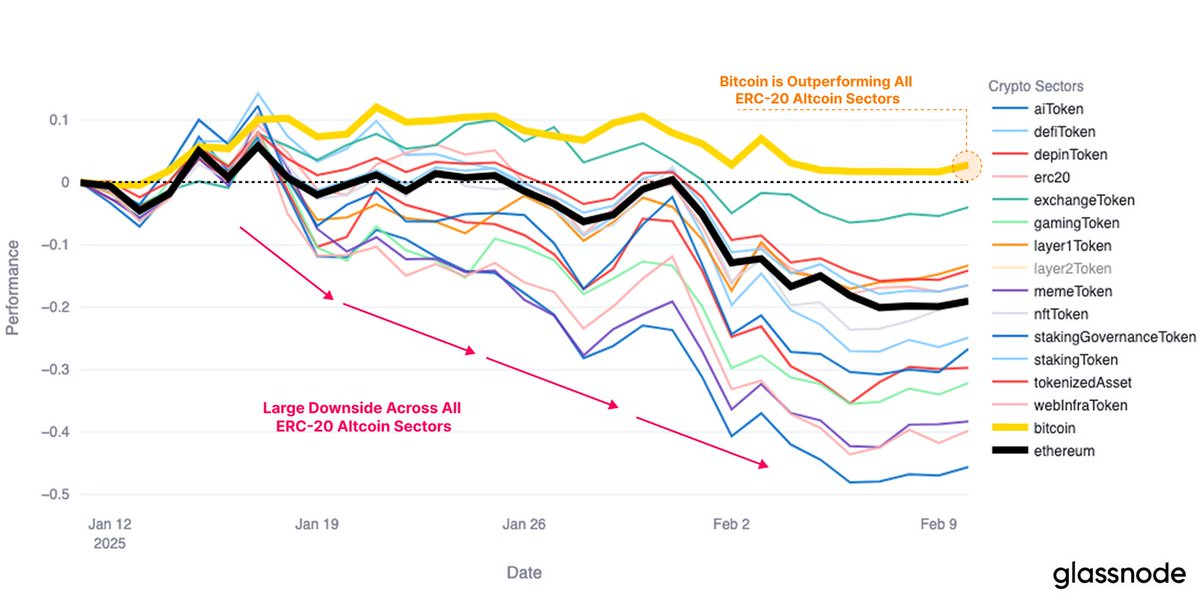

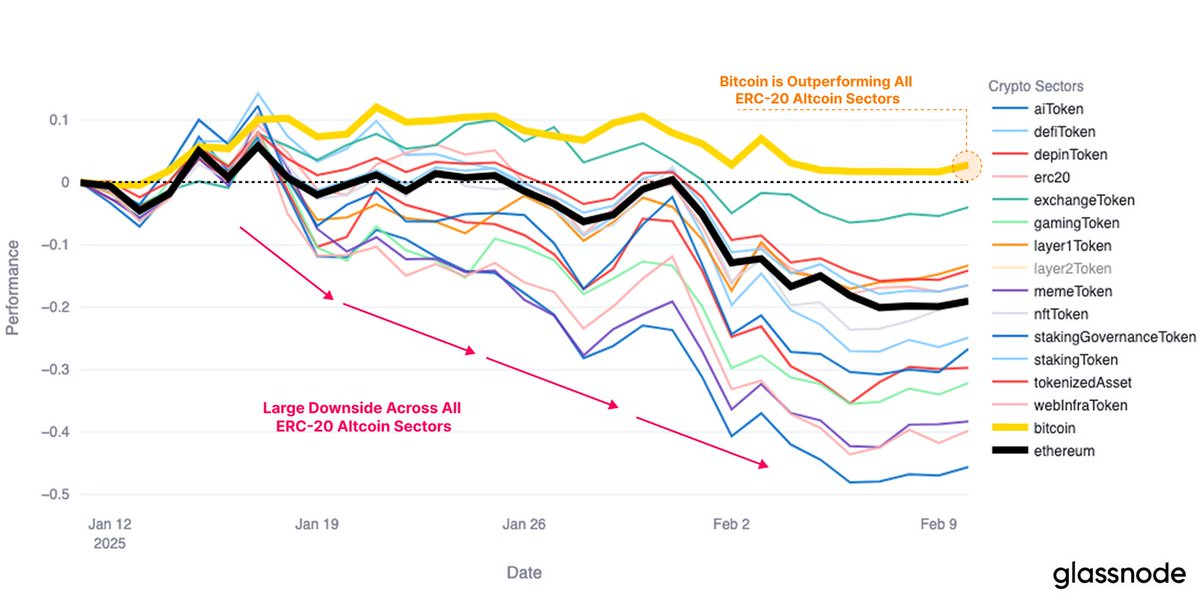

- GlassNode highlighted the tough variations between Bitcoin and Altcoins on this cycle, bringing uncertainty.

Over the previous two weeks, the Altcoin market has sluggished, eliminating roughly $234 billion in market capitalization. The sudden drop has sparked issues concerning the sturdiness of the crypto market, particularly as Bitcoin is forward of the ERC-20 Altcoins.

GlassNode knowledge revealed a transparent division. Bitcoin remained steady, with many ERC-20 Altcoins falling sharply. Moreover, CoinMarketCap experiences that whole crypto market capitalization (excluding BTC and ETH) has fallen from a peak of $1.16 trillion to $88.336 billion.

Market Information Indicators Proceed Altcoin’s Debilitating

In the meantime, a key commentary from market knowledge is a $928 billion rejection on the 20-day index transferring common (EMA). This degree serves as a robust barrier to bullish surges, that means that the altcoin lacks upward momentum and will drop even additional except a significant reversal seems.

Associated: Ethereum costs set to 4k breakout as upgrades drive rally

Capital rotation helps Bitcoin

It must be famous that the crypto market fell in early February following President Donald Trump’s announcement of tariffs in China, Canada and Mexico. Bitcoin bounced, however Altcoins like XRP, BNB, Solana (SOL) and Meme Cash suffered sudden losses.

Traders look like shifting their funds to Bitcoin, which they assist over the high-risk altcoins going through adoption and sensible challenges. Moreover, regulatory stress on many ERC-20 tokens has weakened market sentiment.

AltCoin’s market capitalization outlook

Chart evaluation exhibits that if the Altcoin market doesn’t outperform its 20-day EMA by $928 billion, the $800 billion mark may proceed. In the meantime, the relative power index (RSI) is barely above 38, suggesting a slight bounce instantly. Nonetheless, restoration requires stable quantity assist to show lasting change.

Associated: 480K-146K: Bitcoin’s OTC Exodus and Bull Market Dialogue

The MACD indicator checks the vendor’s management and the blue line stays beneath the crimson sign line. The MACD histogram stays crimson, however its depth is declining, implying a possible bullish crossover quickly.

Disclaimer: The knowledge contained on this article is for info and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version will not be responsible for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.