- On-chain information evaluation reveals that long-term captive whales have been introduced ashore in current days with out attaining excessive returns.

- Issues stay excessive that BTC worth will fall additional as a number of indicators level to the tip of a historic four-year bullish cycle.

- The BTC/USD pair will both rally in the direction of a excessive interval or fall by 36%, just like 2018.

Bitcoin (BTC) entered the primary week of November 2025 with a bearish outlook. After ending October with a 3.69% decline, BTC worth fell 3% on Monday, November third, and was buying and selling at round $107,259 on the time of writing.

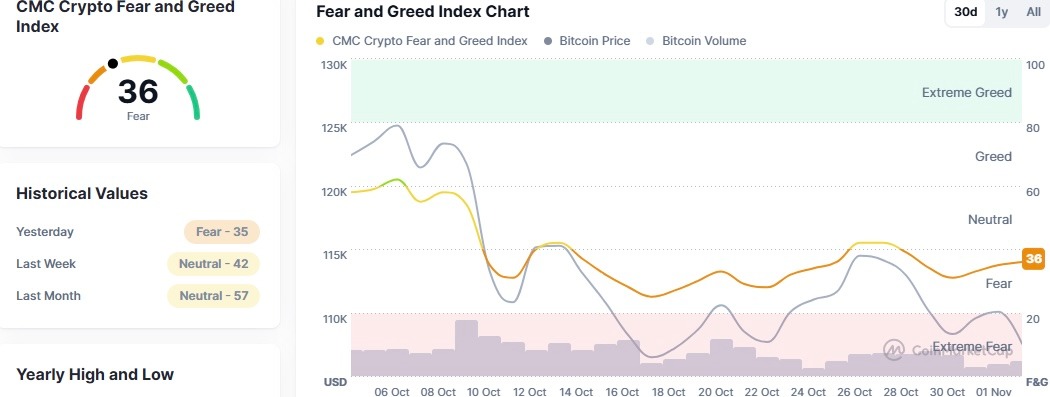

Bitcoin’s continued risky outlook raises medium-term issues about additional capitulation. The crypto concern and greed index is hovering round 36, indicating concern amongst merchants, in accordance with market information evaluation from Binance-backed CoinMarketCap.

Is the Bitcoin bull market over?

Will November be as bearish because it was in 2018?

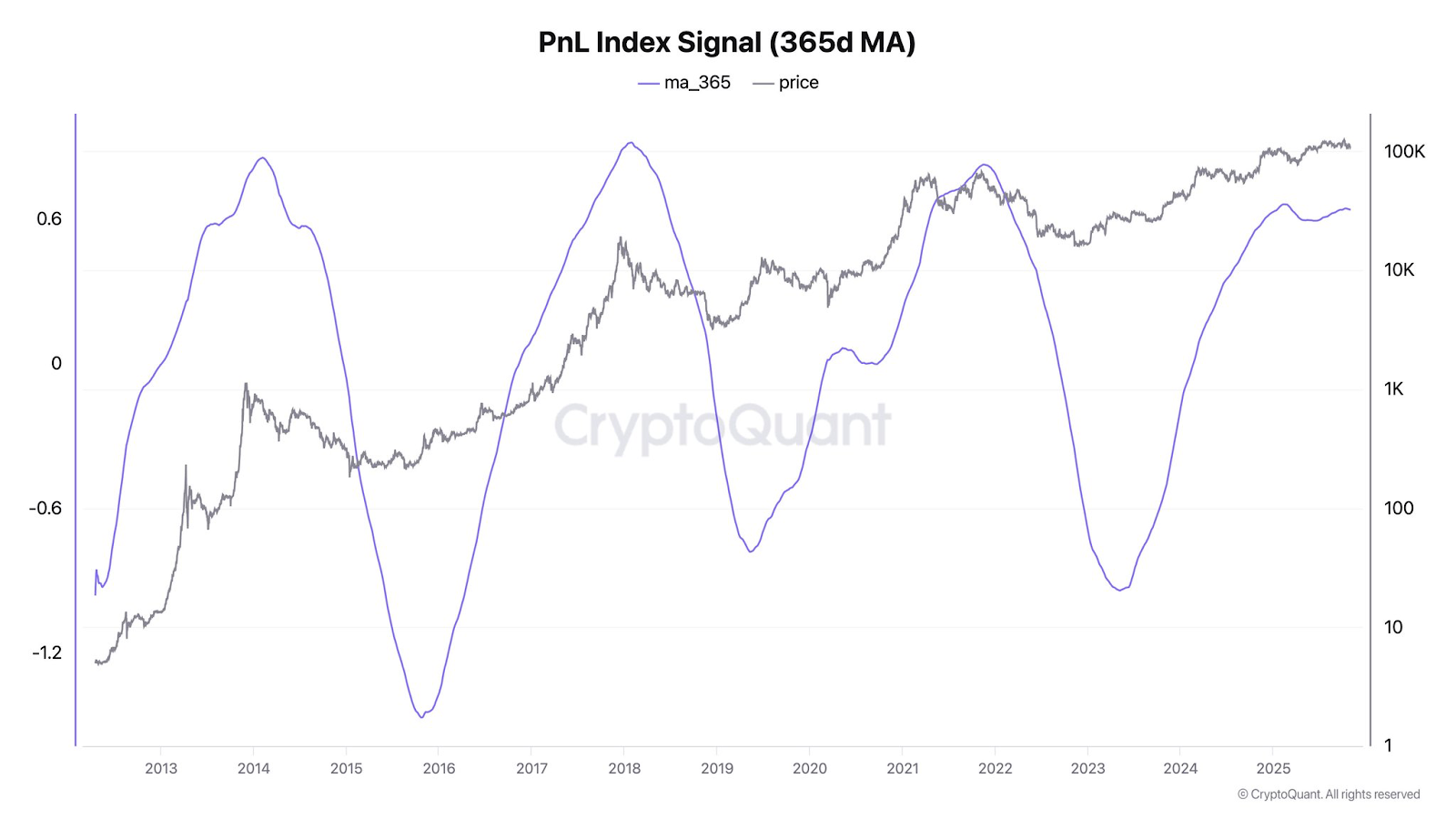

In accordance with CryptoQuant market information evaluation, the 365-day transferring common (MA) suggests a possible cycle prime. If historical past repeats itself, Bitcoin costs may very well be on a downward development for months and weeks.

Medium-term bearish sentiment for Bitcoin costs was exaggerated by October’s bearish closing worth for the primary time in six years. Notably, the final time Bitcoin costs had a unfavorable month-to-month shut in October was in 2018, after which they fell 36% in November and 5% in December.

Lengthy-term BTC whales are on sale

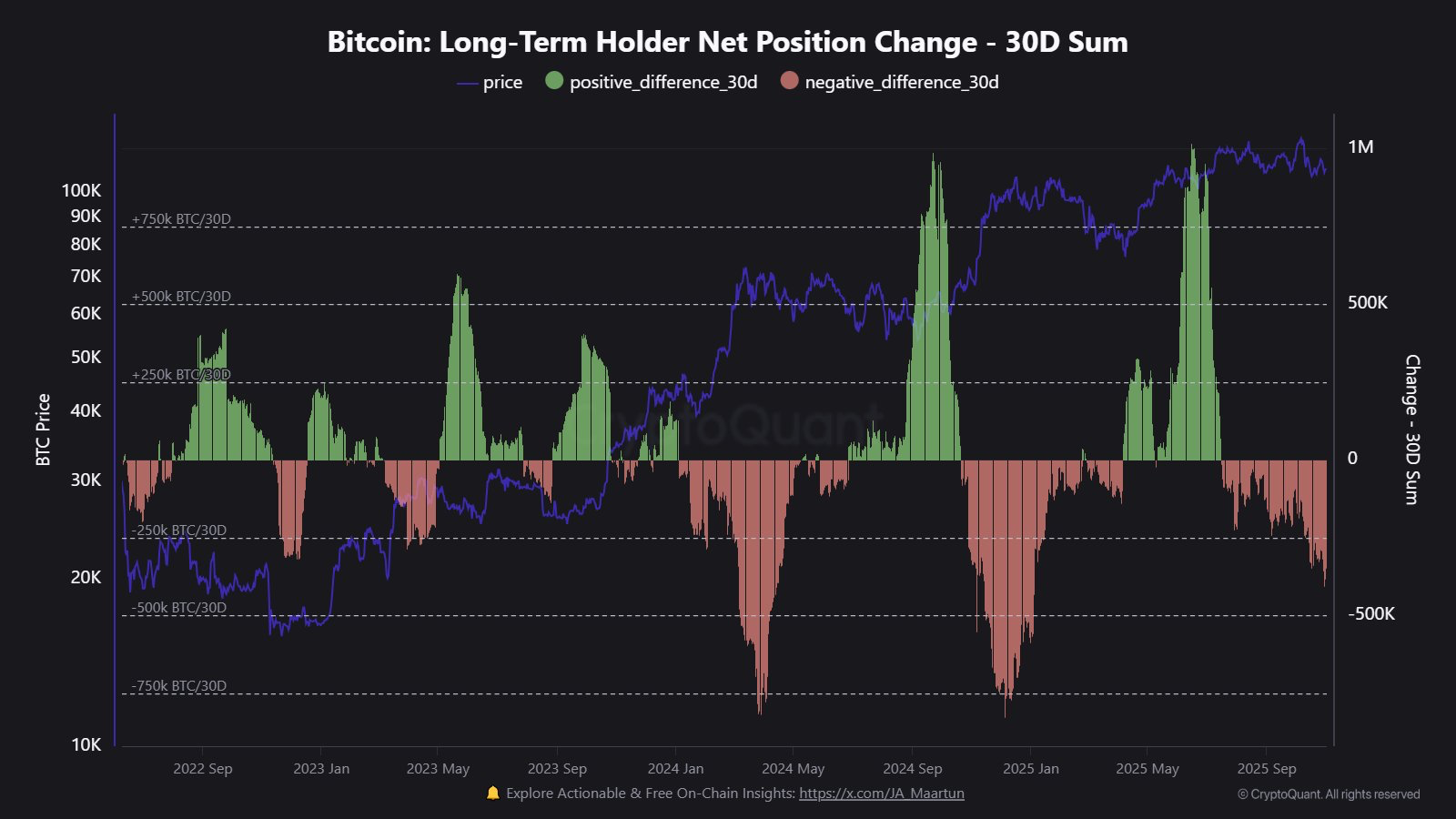

Medium-term bearish sentiment for Bitcoin is strengthened by low demand amongst long-term holders. In accordance with market information from CryptoQuant, this long-term Bitcoin investor has offloaded 405,000 BTC prior to now 30 days.

The notable decline in BTC from long-term traders coincides with weaker demand from monetary establishments comparable to Methods, whose weekly purchases are considerably decrease than at first of this 12 months.

Will a BTC euphoria happen?

Whales’ unrealized good points are usually not euphoric but

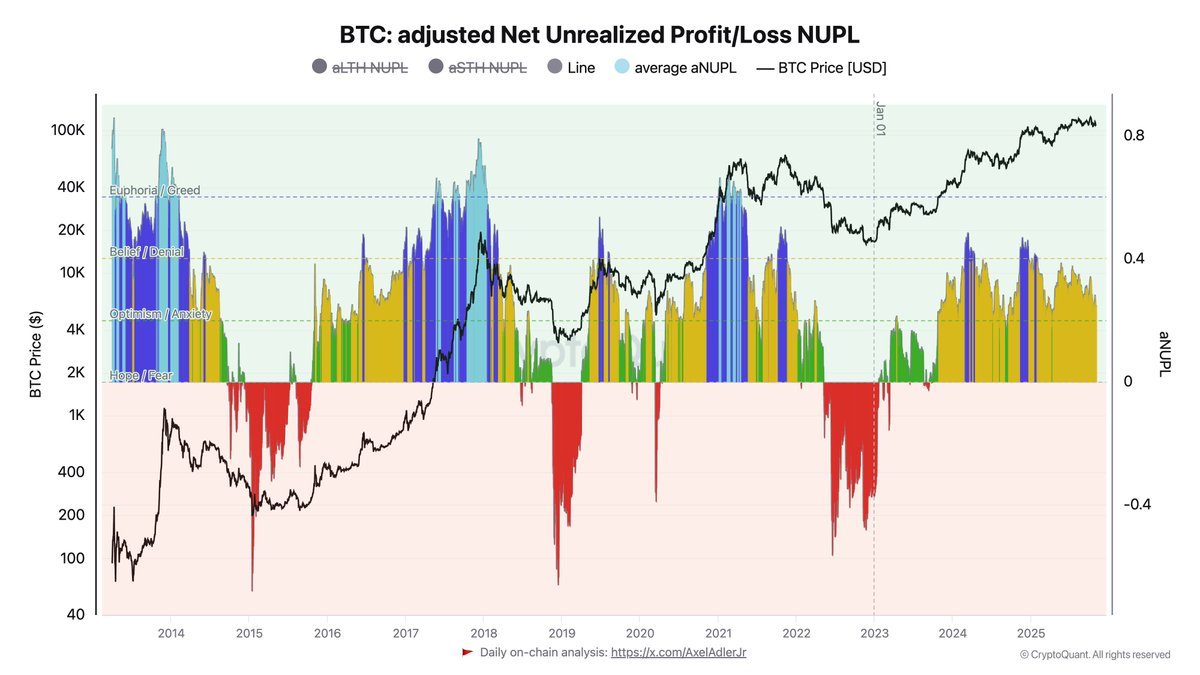

CryptoQuant’s on-chain information evaluation reveals that Bitcoin whales’ unrealized good points haven’t reached the intense ranges of earlier bull market cycles.

Due to this fact, Ki Younger Ju, founding father of CryptoQuant, identified that both the Bitcoin bull market has not occurred but or the crypto market is just too huge to attain excessive revenue margins.

Associated: $2 trillion Bitcoin nonetheless faces psychological dangers Newton discovered the onerous method

Retesting of key help ranges will increase uncertainty jitter

From a technical evaluation perspective, the BTC/USD pair is retesting an vital help stage. On a weekly timeframe, the BTC/USD pair will both rebound in the direction of the 2025 bull market excessive or capitulate in the direction of $69,000.

If the BTC/USD pair recovers from its present help stage, analysts led by Tom Lee and Arthur Hayes anticipate the asset to succeed in no less than $200,000. Bullish sentiment in the direction of Bitcoin is prevailing on the again of anticipated capital rotation away from gold, which just lately hinted on the prime of the bull market.

Associated: Bitcoin Worth Prediction: Analysts Eye $115K Breakout as November Seasonality Turns into Bullish

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.