- Michael Burley posts his first X message since 2023, warning of bubbles in monetary markets

- His warning coincided with Thursday’s slide within the cryptocurrency market and a $488 million outflow in a Bitcoin ETF.

- Berry’s bearish phrases distinction together with his agency’s current rotation of $522 million into bullish name choices.

Michael Varley, the investor who predicted the 2008 housing crash, reappeared on X at this time, posting his first message since April 2023. huge briefMr Berry warned that monetary markets had been in a bubble once more, including: “The one solution to win is to not play.”

Posts mentioning the 1983 film battle video gameshad a tone of restraint reasonably than panic. Burley recommended that whereas the market seems overextended, not taking part stands out as the most rational choice.

Barry, who posted beneath the identify “Cassandra Unchained,” drew inspiration from Greek mythology about Cassandra, a priestess cursed to make correct predictions however ignored.

his header picture, Satire of Tulip Mania This work by Jan Brueghel (small) reiterates his long-standing warning in opposition to speculative mania, referencing the Dutch tulip bubble of the 1600s.

Associated: Michael Burry shorts the inventory market with $1.6 billion value of put choices

Does Berry’s portfolio match his bearish warnings?

Barry is thought for his bearish positions, however current portfolio filings point out a strategic shift. In mid-2025, his agency, Scion Asset Administration, changed $186 million in bearish put choices throughout 9 shares with $522 million in bullish calls.

These embody Estée Lauder, Lululemon, Alibaba, and JD.com, providing a extra nuanced outlook than outright pessimism. Based on Enterprise Insider, Scion’s holdings grew from seven to fifteen positions between March and June.

Peter Mallouk, chief govt of Artistic Planning, mentioned Barry “went from a high-conviction guess on a decline in a single sector to a broader guess that the bull market will proceed.”

Berry’s warning coincides with $488 million ETF outflow

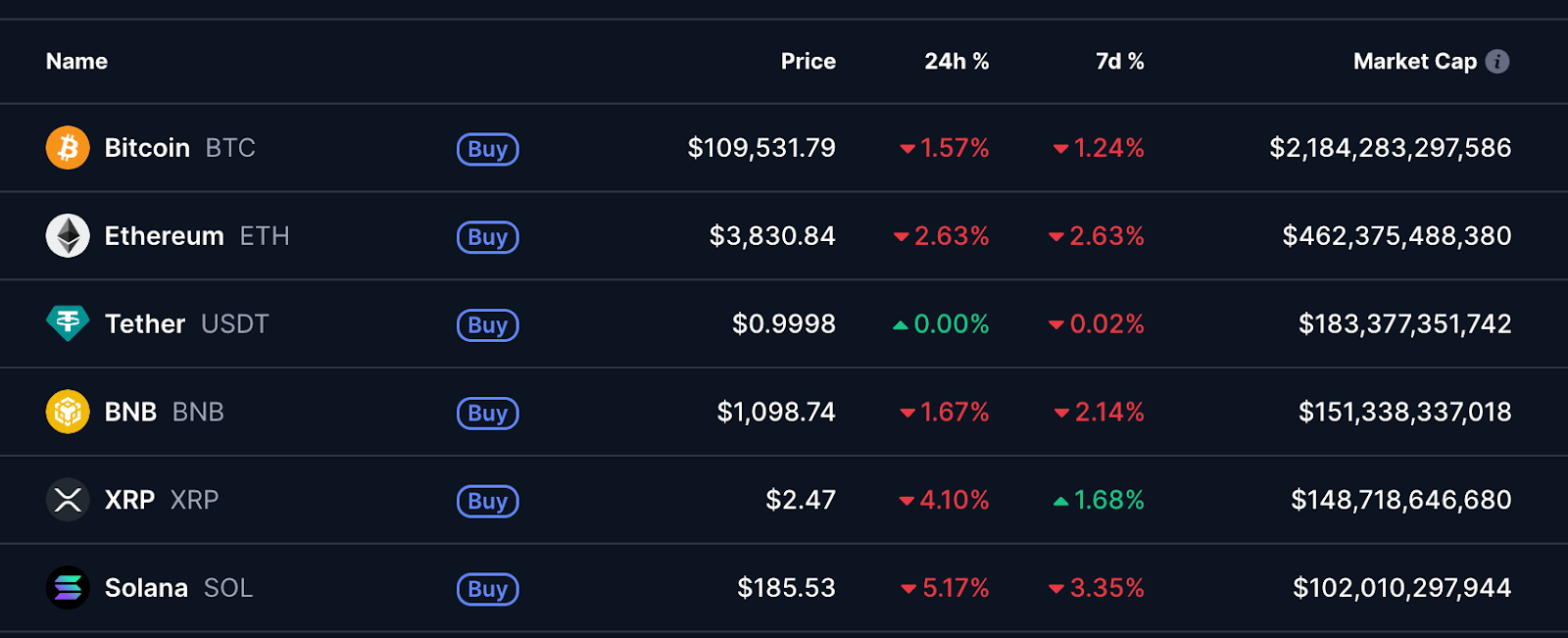

Berry’s submit comes because the cryptocurrency market is experiencing a widespread decline. Bitcoin is buying and selling at $109,642 after hitting $116,400 earlier this week, down 4.5% up to now month.

Nonetheless, Bitcoin is the one cryptocurrency within the prime 10 close to document ranges. Main tokens comparable to Ethereum, Solana, and XRP proceed to commerce greater than 40% under their peaks.

ETH hovered round $3,865 and confronted resistance close to $3,950-$4,200. Ethereum has recorded losses of three.5% and seven.5% over the previous day and month, respectively. XRP follows an identical sample, with beneficial properties of 1.7% and 5.6% over the previous day and two weeks, respectively.

Particularly, the market capitalization of cryptocurrencies has reached $3.7 trillion, which implies it has decreased by 1.9% up to now day. In the meantime, 24-hour buying and selling quantity remained at $192 billion, reflecting diminished exercise as main cryptocurrencies became the purple.

Associated: Michael Burley predicts 2008-level financial disaster because of cryptocurrency decline

The continued decline was in keeping with merchants’ expectations, following the Federal Reserve’s anticipated 25 foundation level (bp) charge lower. Nonetheless, the market reacted extra strongly to the information that quantitative tightening would finish in December.

Consequently, market sentiment has change into extra cautious, with the Crypto Concern and Greed Index dropping to 34 from 43 the earlier month.

In the meantime, Bitcoin ETFs noticed $488 million in outflows on Thursday, led by BlackRock, Constancy, and Ark. The Ethereum ETF skilled $184 million in outflows, reflecting a decline in investor confidence regardless of the Fed’s coverage shift.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.