Though the TRON cryptocurrency remains to be buying and selling close to the decrease finish of its current vary, some short-term indicators recommend an try at stabilization, though long-term alerts stay fragile.

Abstract about cryptotrons

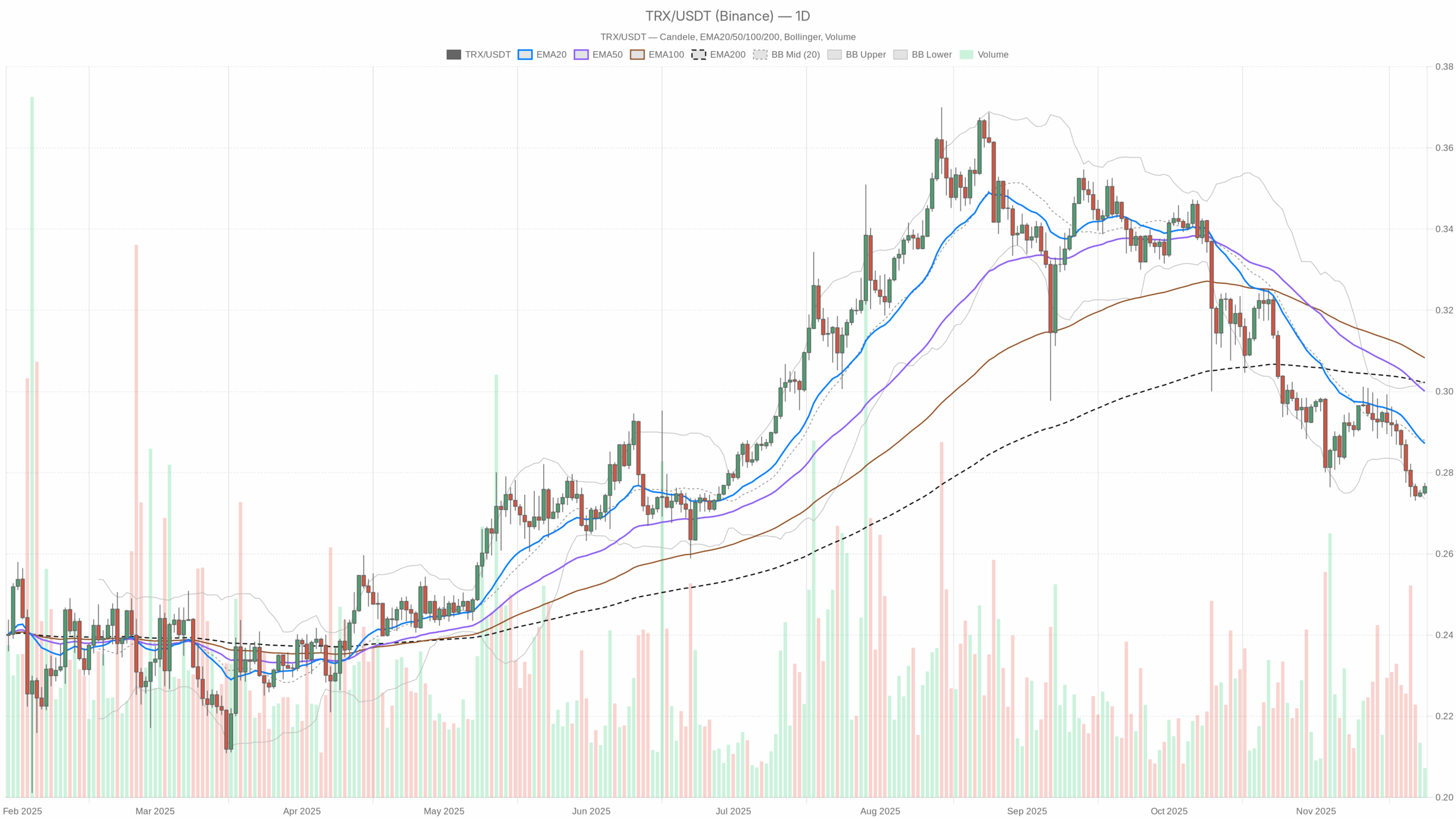

The each day chart reveals: bear market regimeworth closed 0.28 beneath the 20-day, 50-day, and 200-day EMAs round 0.29-0.30. Momentum stays weak on the upper time frames because the each day RSI is hovering round 32, near oversold territory. The MACD for a similar timeframe stays barely detrimental and the histogram is flat, giving a sign. There may be fatigue from the downtrend, however there isn’t a reversal but..

Moreover, the Bollinger Bands are comparatively tight between 0.27 and 0.30; calm volatility Moderately than a whole yielding spike. On the macro stage, with the market capitalization of digital currencies exceeding $3 trillion and Bitcoin’s dominance reaching almost 57%, there’s a risk-on bias concentrated in giant corporations. Nevertheless, the Concern & Greed Index of 19 (excessive worry) makes it clear that sentiment, particularly for altcoins, stays fragile.

Tron Crypto: Market Background and Course

The present context of this community token can’t be learn in isolation from the broader market. The worldwide market capitalization is roughly $3.4 trillion, with Bitcoin gaining roughly 56.9% management and capital persevering with to be concentrated within the prime property. Moreover, the 24-hour market capitalization change was marginally constructive, simply over 0.5%, suggesting a cautious however constructive international atmosphere reasonably than a panic section.

That mentioned, sentiment indicators inform a extra nuanced story. The Concern & Greed Index is at 19, firmly within the Excessive Concern class, highlighting that many buyers stay distrustful of bull markets, particularly outdoors of Bitcoin and the most important good contract platforms. In distinction, this identical atmosphere might be fertile floor for accumulation for long-term individuals who’re prepared to look past the short-term noise. Within the case of this token, the mix of a temper of worry and the still-rising dominance of Bitcoin sometimes ends in: Relative power restrained versus the broader marketExcept a strong catalyst emerges.

Technical Perspective: Learn the general setup on Cryptotron

On the each day time-frame, the value closed 0.28 beneath the 20, 50, 200 session exponential shifting common round 0.29-0.30. Predominant bearish development construction. The truth that all three EMAs are at present clustered barely above worth suggests a well-defined provide zone overhead, the place sellers have repeatedly defended the rally. For swing merchants, this correction normally signifies {that a} pullback into that space might initially be handled as a corrective transfer reasonably than a brand new uptrend.

The each day RSI of 32.17 provides an essential nuance. It reveals that it’s near, however not inside, typical oversold territory. Momentum is weak and there may be room for additional decline Nevertheless, there may be additionally the potential for a sudden rebound from the reliever. If the RSI stabilizes whereas the value stays above the current low close to the 0.27 decrease Bollinger Band and begins to maneuver up from this space, it will be an early clue that promoting stress is dropping power.

The MACD on the each day chart reveals a flat histogram round zero, with each the road and the sign round -0.01. This configuration is typical of markets the place consumers usually are not in management, although the earlier down market has slowed. It displays the following stage. Depletion of momentum reasonably than a transparent development reversal. In conditions like this, merchants usually watch for a decisive cross that expands the histogram to substantiate {that a} new directional leg is underway.

Bollinger bands reinforce this case. Volatility stays subdued because the midband is 0.29 and the envelope is roughly within the 0.27-0.30 vary. There are not any indicators of a violent squeeze and breakout but, however the worth’s proximity to the decrease band suggests one. cheaper price saturation. The each day ATR is roughly 0.01, with common each day fluctuations restricted to a couple cents, indicating a comparatively quiet atmosphere. This compressed volatility can precede a bigger transfer if a catalyst or breakout stage is triggered.

Intraday outlook and TRON cryptocurrency momentum

Shorter time intervals, however, inform a considerably completely different story. On the hourly chart, the value is positioned alongside the most important EMAs, with the 20-hour, 50-hour, and 200-hour averages all centered round 0.28. This alignment across the identical stage is impartial daytime regimeneither bulls nor bears have a transparent benefit right here.

In consequence, many short-term merchants deal with breaks above and beneath this stability zone to identify the following microtrend.

The hourly RSI of round 57 suggests barely constructive momentum in distinction to the weaker each day studying. This implies that intraday bullish consumers are energetic close to present ranges and are attempting to defend the vary.

The MACD on the hourly and 15-minute charts is nearly flat, reflecting sideways worth actions. Brief-term consolidation inside a broader downtrend. This divergence between each day weak point and intraday neutrality usually precedes a decisive transfer as one timeframe finally adapts to the opposite.

Key ranges and market reactions

From a stage perspective, the each day pivot level is precisely at 0.28, which is per the present worth and serves as a reference for each consumers and sellers. The primary help space seems close to the underside of the Bollinger Band at round 0.27, and up to date reactions recommend value-oriented individuals are intervening. If this ground breaks out on robust quantity, the prevailing help space will probably be validated. bearish continuation setup This opens the door to deeper correction.

On the upside, essentially the most urgent problem lies simply above the pivot, between 0.28 and 0.30, the place the each day EMA and higher Bollinger Band converge. A sustained shut above 0.29-0.30 would point out that the market is beginning to take in oblique provide. In that case, Stabilization of the development reasonably than a sustained decline It is going to develop into extra sensible, particularly whether it is accompanied by a rise in buying and selling quantity and an enchancment within the RSI.

Future eventualities and funding outlook

General, the principle state of affairs for this asset stays cautiously bearish on the each day time-frame, weakened by indicators of depletion and low volatility. Brief-term merchants might search for a spread technique round 0.27-0.30 whereas ready for a breakout to redefine route. Nevertheless, long-term buyers might interpret the mix of maximum worry, compressed volatility, and proximity to help as a possibility to scale up over time, supplied they settle for the danger of additional drawdowns. Such an atmosphere requires a disciplined method that respects key ranges and responds to what’s recognized. breakout or breakout sign It has the potential to outperform aggressive bets on a direct development reversal within the TRON cryptocurrency.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding choices.