abstract

The each day chart of TRXUSDT is at the moment bear market regimecosts have been pushed close to the decrease finish of the latest vary. Nonetheless, the overall capitalization of the broader cryptocurrency has elevated by roughly 3.9% previously 24 hours, suggesting that the liquidity state of affairs is bettering. On the identical time, the benefits of Bitcoin 57% It reveals that capital nonetheless favors the massive gamers over smaller layer 1 ecosystems. Feelings stay fragile and concern and greed index is extreme excessive concernwhich is commonly accompanied by a late draw back section or an early accumulation section. Intraday momentum is way hotter than the each day state of affairs signifies, with the hourly and 15-minute RSIs hovering in overbought territory. Total, this setup factors to a cautious setting the place short-term hypothesis is lively however long-term buyers stay defensive.

Tron Cryptocurrency At this time: Market Background and Course

First, wanting on the macro context, the market capitalization of cryptocurrencies stands at almost $3.2 trillion and is growing at a wholesome tempo day-after-day. Furthermore, this restoration comes regardless of Bitcoin holding a dominant share of simply over 57% of complete worth. This combination normally signifies: Danger-on stage led by blue-chip firmsaltcoins typically react late quite than main the motion.

In distinction, emotion gauges inform a extra measured story. The Concern and Greed Index is 22, firmly in excessive concern, indicating that many members stay in shock from the earlier spike in volatility. In consequence, you might be able to reply rapidly to profit-taking even with modest will increase, particularly for property exterior the highest tier. For TRX, this implies any try and reverse a each day downtrend might require a number of retests earlier than buyers absolutely belief the transfer.

On-chain exercise associated to the DeFi sector of the ecosystem additionally displays this pressure. SUNSwap V3 charges have fallen sharply over the previous week and month, suggesting a retreat in speculative buying and selling and yield farming. Nevertheless, the rise in each day charges in SUNSwap V1 is noticeable, suggesting that some liquidity is being circulated quite than being fully worn out. This sample is commonly Built-in system behind the scenescapital is quietly redeployed whereas mixture costs seem like depressed.

Technical Perspective: Learn the general setup

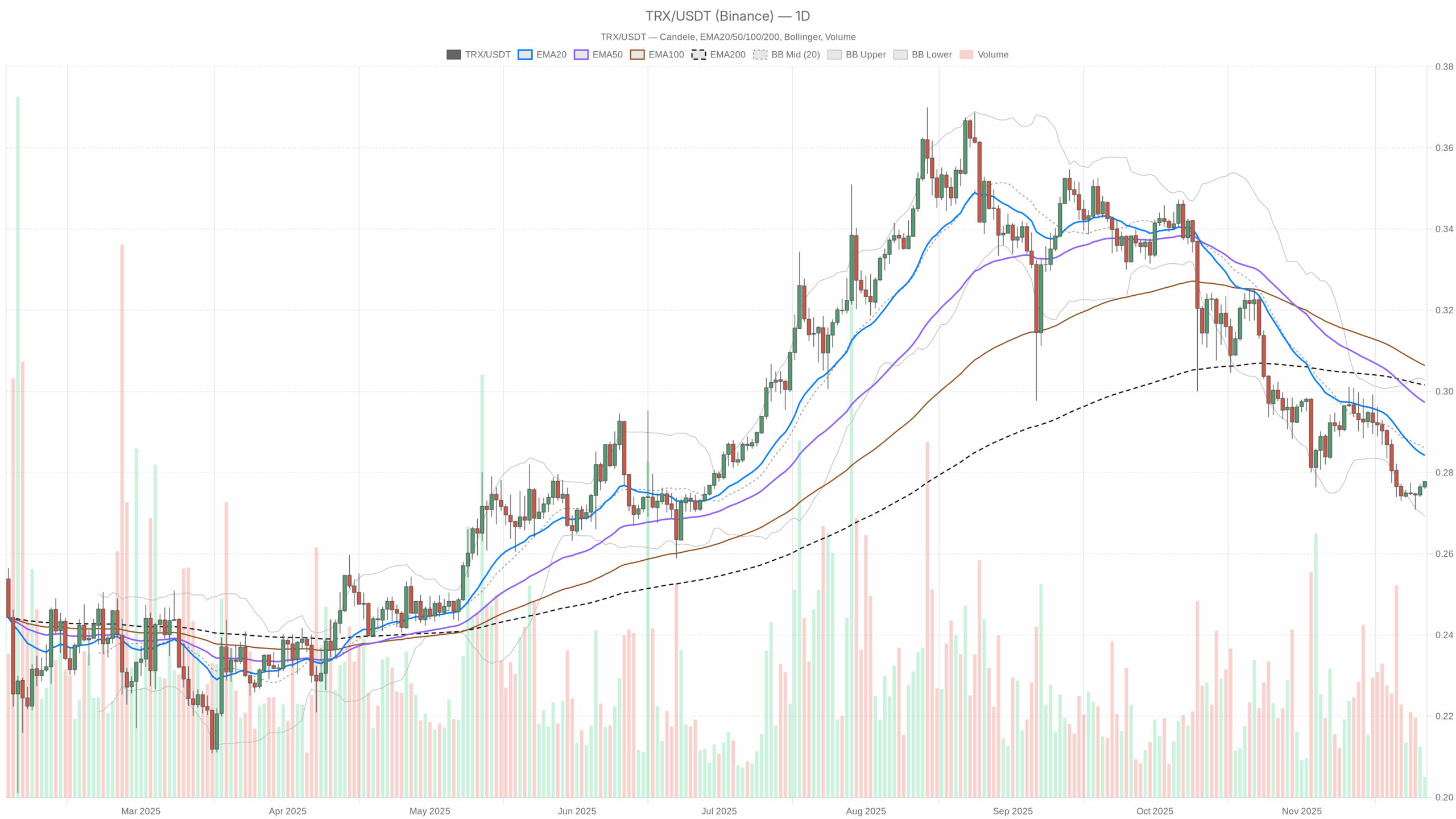

On the each day time-frame, TRXUSDT is buying and selling round $0.28, basically pegged to the 20-day exponential shifting common on the identical degree. The 50-day and 200-day EMAs are excessive at 0.30, so the construction is The downtrend has flattened to a possible base.. Sellers have misplaced some urgency, however consumers haven’t regained decisive management.

The 14-day RSI close to 35 helps this concept. Whereas not extraordinarily oversold, it’s clearly beneath the impartial mark of fifty, indicating that draw back stress nonetheless outweighs bullish conviction. Nevertheless, the dearth of utmost measurements means that: The downward momentum is weakeningthere’s room for a stabilization section if demand rebuilds slowly.

MACD reads again this interpretation. The MACD line and sign are each close to -0.01, however the histogram is basically flat at zero. This configuration refers to Depletion of momentum quite than aggressive promoting. In different phrases, the development is destructive, however the engine driving it’s idling as a substitute of accelerating.

Bollinger bands add additional nuance. The midline is round 0.29, the higher band is round 0.30, and the decrease band is round 0.27, with the worth hovering simply above the underside of the envelope. This positioning signifies that the market has toyed with excessive draw back not too long ago, however has but to trigger a full-blown decline. Volatility expands downwards. Moderately, the band stays reasonable, in line with risky, range-bound buying and selling in a nonetheless bearish backdrop.

The ATR on the each day chart is modest at round 0.01, confirming a interval of restrained motion. The decrease the ATR worth, the extra A compression section that precedes bigger fluctuations. Whereas this setting could also be irritating for swing merchants, it additionally implies that a definitive breakout from the present zone might attain additional than latest each day candlesticks recommend.

Intraday outlook and TRXUSDT token momentum

Daytime knowledge paints a clearer, extra energetic image. On the hourly chart, worth is as soon as once more centered round 0.28, with all three main EMAs (20, 50, 200) nearly overlapping. This tight clustering signifies short-term results. Equilibrium after pushing upneither aspect is dominant, however each are very attentive to their subsequent impulse.

Then again, an hourly RSI above 68 and a 15-minute RSI above 72 point out short-term momentum is pointing upwards. In consequence, late-comer consumers at these ranges will face excessive exit dangers, even when broader makes an attempt to kind a basis stay intact. The MACD for these intraday frames is hovering round zero, confirming that the strongest momentum has already handed and day merchants at the moment are debating whether or not to take earnings or take a chance.

Bands and volatility measurements on decrease time frames replicate this battle. The Bollinger Bands are very tight, with the ATR on each the 1-hour and 15-minute charts compressing in direction of zero. This case is commonly preceded by: quick, sharp bursts of volatilityIt will probably break both method, however it’s going to are inclined to comply with the trail of least resistance generated by the earlier transfer. Provided that the instantaneous impulse was rising, the primary try is commonly a steady rise, however a whipsaw is widespread when liquidity is skinny.

Key ranges and market reactions

On the each day chart, the pivot level is situated precisely at 0.28, which is successfully the place the worth is buying and selling. This confluence creates a pure battlefield. If consumers are capable of preserve a detailed above this zone, the following essential space will likely be situated towards the middle line of the Bollinger Bands round 0.29, adopted by heavier resistance across the 50-day and 200-day EMAs. 0.30. Constantly urgent on that higher band space will provide you with the primary significant indicators. Development affirmation of early bullish reversal.

On the draw back, failing to defend 0.28 too many instances will open the best way again to the decrease band round 0.27. A transparent breakdown beneath that help, particularly within the case of an ATR rise, can be a sign. A brand new path of power will likely be created that’s advantageous to sellers.. In that case, the broad bearish regime on the each day chart can be reaffirmed, and intraday bulls can be extra prone to be offered than embraced.

Future situations and funding outlook

Total, TRX is at a crossroads the place short-term optimism collides with long-term warning. Though the each day development stays technically destructive, the symptoms are displaying clear indicators of depletion quite than optimistic continuation. In the meantime, world market restoration and still-uneasy sentiment create fertile floor for a gradual return to selective altcoin rotation.

The important thing for lively merchants is to watch how the worth strikes across the 0.28 pivot and 0.30 resistance bands. Intensities above these ranges, ideally accompanied by a delicate rise in ATR quite than chaotic spikes, recommend {that a} extra sturdy base is forming. In distinction, if the present help can’t be sustained, coupled with volatility extending to the draw back, one would argue that persistence remains to be wanted and a greater entry level might emerge decrease.

On this setting, place sizing and danger administration are simply as essential as directional calls. Whereas the technical image nonetheless would not scream confidently in both path, it does point out that the quiet section could also be coming to an finish, and the asset’s subsequent decisive transfer might arrive ahead of smug observers anticipated.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding selections.