- TRX stays close to key Fibonacci ranges, suggesting a doable near-term bullish reversal

- Futures open curiosity stays secure, reflecting continued dealer confidence in TRON.

- On-chain inflows sign contemporary accumulation as buyers hope for additional restoration

Tron (TRX) is displaying early indicators of restoration from its current selloff, and merchants are holding an in depth eye on affirmation of a short-term reversal. The token is buying and selling close to $0.3222 as patrons cautiously re-enter the market.

After falling to an area low of $0.2946 earlier this month, TRX has stabilized close to a key retracement zone, suggesting a technical rebound could also be underway. The broader construction on the 4-hour chart reveals that though bearish management continues, momentum is regularly shifting in direction of the bullish aspect.

Worth construction and main know-how ranges

TRX’s newest rebound coincides with the 38.2% Fibonacci retracement degree at $0.3176, marking the primary vital space of resistance. Greater retracement zones are positioned round $0.3272 and $0.3360, which merchants think about to be decisive to substantiate the breakout. The token continues to commerce slightly below the 20-EMA of $0.3193 and 50-EMA of $0.3237, indicating that momentum stays blended.

If the worth sustains above $0.3170, a transfer above $0.3270 may set off a short-term rally in direction of the $0.3360 resistance cluster. However, if the worth can’t maintain this vary, it may weaken once more in direction of the assist zone at $0.3070 and even $0.2946. Subsequently, market members are intently monitoring these ranges and searching for sustained directional alerts.

Associated: Cardano Worth Prediction: ISO 20022 Hype Beneficial properties Consideration

Traits in open curiosity and market exercise

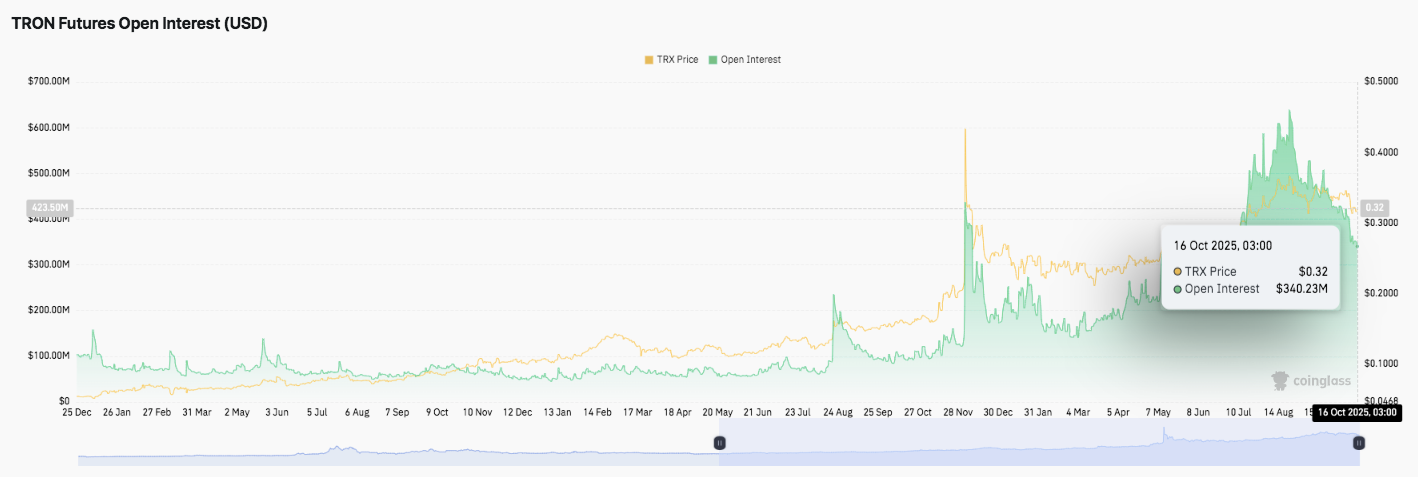

Futures market knowledge reveals open curiosity will fluctuate all through 2025, reflecting adjustments in dealer confidence. After a quiet first half, exercise elevated sharply from late June in response to TRX’s worth restoration.

The metric peaked at over $600 million in mid-August, however had settled to $340 million by October sixteenth. Though this decline was vital, it nonetheless displays wholesome speculative participation and means that merchants stay energetic and anticipate additional volatility.

Moreover, constant curiosity regardless of current corrections signifies a continued urge for food for publicity to TRX, seemingly fueled by optimism relating to TRON’s community stability and transaction effectivity. This resilience in futures positioning highlights the general market readiness for the opportunity of additional worth actions.

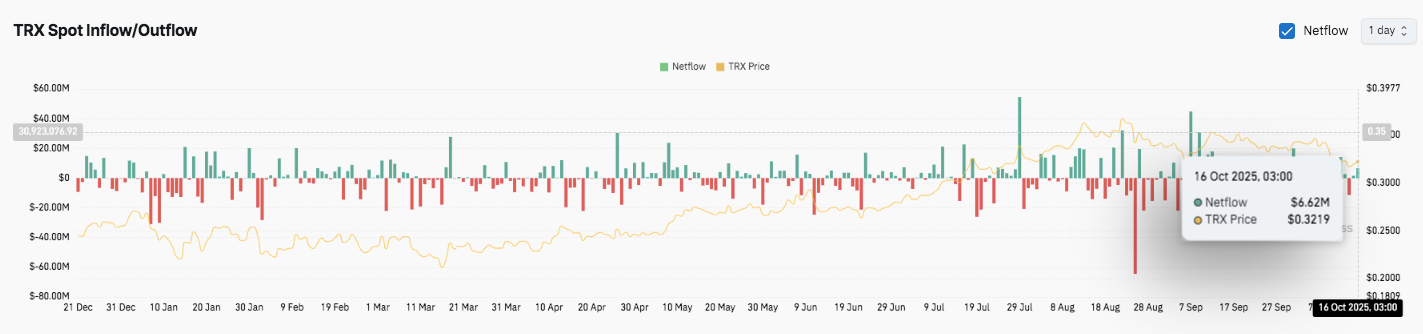

Capital flows present gradual accumulation

On-chain influx and outflow knowledge reveal blended investor habits all through 2025. Constructive internet inflows in April, July and September point out a powerful accumulation section, whereas outflows in late August mirror pre-consolidation revenue taking. Notably, TRX recorded an influx of $6.62 million on October 16, in keeping with the present worth stability.

Regular capital inflows since early October spotlight rising confidence amongst buyers and recommend that TRX could also be getting into an accumulation section for its subsequent decisive transfer. In consequence, sustaining momentum above $0.3170 may strengthen restoration prospects and appeal to new patrons within the coming weeks.

Associated: Ethereum Worth Prediction: Merchants Eye Key Help as BitMine Provides $417 Million to ETH

Technical outlook for TRON (TRX) worth

Key ranges stay properly outlined for late October.

- Prime degree: The instant hurdles are $0.3237, $0.3272, and $0.3337. A break above $0.3337 may prolong the restoration in direction of $0.3420 and $0.3500.

- Cheaper price degree: $0.3170 stays the primary assist, adopted by $0.3070 and $0.2946 (swing lows).

- Higher restrict of resistance: The confluence of the 200-EMA and the 78.6% Fibonacci retracement at $0.3337 is the important thing degree for a shift to medium-term bullish momentum.

The present construction means that TRX is compressing inside a correction channel with volatility contracting under a significant resistance zone. A definitive shut above $0.3272 may affirm a breakout and strengthen the opportunity of a near-term reversal.

Will TRON improve the backlash?

TRON’s short-term trajectory will rely upon whether or not it will possibly defend the $0.3170-$0.3200 zone lengthy sufficient to encourage patrons to proceed. Sustained capital inflows and a restoration in open curiosity since early October assist the opportunity of a restoration. If the bullish momentum strengthens, TRX may retest the resistance cluster between $0.3337 and $0.3420 and push in direction of $0.3500.

Nevertheless, failure to take care of the $0.3170 base may expose TRX to a deeper retracement in direction of $0.3070 and $0.2946. For now, TRX is at a pivotal level the place with the ability to reclaim the 200-EMA will decide whether or not the market strikes from a corrective rebound to a sustained bullish development.

Associated: Bitcoin (BTC) Worth Prediction: Bulls defend $111,000 as analysts see it catching up with gold

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.