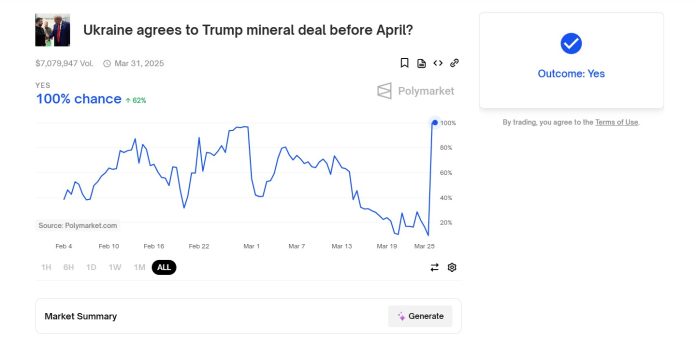

- Polymarket criticized the false “sure” final result towards the $7 million Trump/Ukrainian buying and selling guess.

- There are allegations of governance operations by horse whales.

- Polymarket moderators say there aren’t any refunds.

Polymarket, the world’s main decentralized forecasting market, is tackling a wave of criticism following a controversial decision of the high-profile guess.

The market in query has staked whether or not US President Donald Trump will settle for uncommon earth mineral commerce with Ukraine by April.

There is no such thing as a proof that such an occasion is going on, however on March 25, 2025, the market settled down as “sure”, sparking anger amongst customers, elevating questions on platform integrity.

With buying and selling volumes exceeding $7 million, this end result promotes issues about potential manipulation and governance vulnerabilities.

Polymarket’s “governance assault” tied to UMA protocol Oracle

Backlash focuses on allegations of “governance assaults” associated to using Polymarket’s UMA protocol blockchain oracle, guaranteeing that the precise occasion resolves the guess.

Crypto menace researcher Vladimir S. pointed to a single “whale” from UMA allegedly veteraning 5 million tokens to a few accounts, accounting for 25% of the entire vote, with the intention to power a false settlement. The transfer claimed on March 26, permitting huge names to make earnings on the expense of different merchants.

Governance assaults have occurred @polymarket right here a @umaprotocol Tycoon used voting energy to govern Oracle, permitting the market to resolve false outcomes and make earnings.

The massive names throw 5 million tokens throughout three accounts, accounting for 25%… pic.twitter.com/fyzmmfk2fq

– Vladimir S. | Government Notes (@officer_cia) March 26, 2025

Polymarket has since dedicated to stopping such incidents, however the injury to its status has already taken root.

However not everybody agrees with the manipulation story. Tenadom, a multi-layered consumer of pseudonyms, affords a unique view, suggesting that negligence is extra liable than malicious.

On the X-Publish on March twenty sixth, Tenadome argued that the choice was made out of an everyday voting whales from UMA, belonging to a group in protocols that aren’t buying and selling on Polymet. Ignoring the market clarification, they selected a fast resolution to safe rewards and keep away from penalties, he argued.

There have been no governance assaults. This was an excessive negligence from each @polymarket and @umaprotocol.

What really occurred was:

1. The consumer submitted a YES proposal “Does Ukraine comply with make the mineral commerce a Trump earlier than April?” (https://t.co/hehc6775k2) And this suggestion was… https://t.co/49bgheawrz

– Tenadome (@tenad0me) March 26, 2025

This competing perspective solely deepens the dialogue of accountability.

Polymarket eliminates refunds

Along with consumer frustration, Polymarket Moderators eradicated refunds. Moderator Tanner admitted that the decision ignored expectations and platform’s personal steering, however argued that it was not a “market failure” that ensures rewards.

This resolution made many merchants really feel betrayed by a platform that takes delight in transparency.

In response, Polymarket has vowed to implement a brand new surveillance system to handle what is named “unprecedented conditions,” however particulars stay unknown.

Particularly, the controversy lies in a broader growth for the forecast market supported by the 2024 US presidential election. Coingecko’s knowledge reveals bets throughout the highest three platforms rose 565% within the third quarter of 2024, reaching $3.1 billion from $463.3 million within the final quarter.

Polymarket, which led greater than 99% of its market share as of September, was a key driver of this progress. Nonetheless, because the incident revealed, its fast rise might be exposing a crack in its decentralized framework, inflicting observers to surprise if extra rigorous surveillance is required to take care of confidence in the way forward for the platform.

Publish-Polymericket faces surveillance over Trump Ukraine’s mineral commerce guess operations.