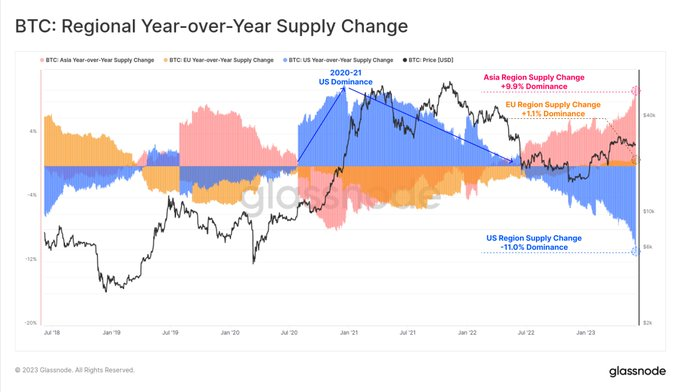

- Glassnode on-chain information reveals that US corporations maintain 11% much less BTC than in 2022.

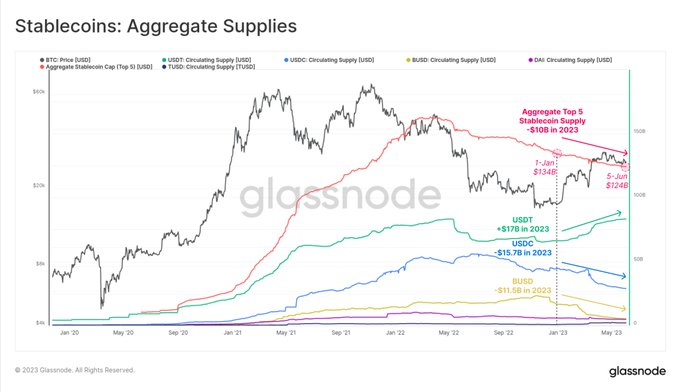

- The information additionally confirmed that USDT provide lately hit an all-time excessive.

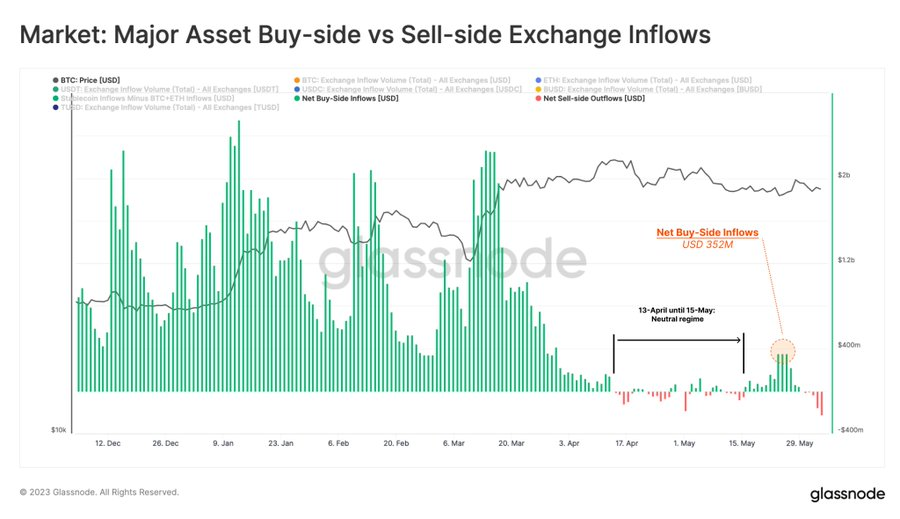

- Glassnode additionally famous that stablecoin inflows considerably outpaced BTC and ETH inflows within the first quarter.

On-chain analytics platform Glassnode at the moment shared a number of posts on Twitter to spotlight some new tendencies that may be noticed inside the cryptocurrency house. In considered one of his posts, Glassnode defined that there was a giant shift in Bitcoin (BTC) provide dominance over the previous two years.

U.S. companies have skilled a notable 11% drop of their bitcoin holdings since June 2022, based on on-chain information. In distinction, buyers actively taking part throughout Asian buying and selling hours noticed a big 9.9% improve of their Bitcoin holdings. This represents a transparent reversal from the bullish development noticed through the 2020-2021 cycle.

In the meantime, Glassnode additionally famous in its second submit that huge adjustments are occurring within the stablecoin world. Tether (USDT) provide hits a brand new all-time excessive, indicating elevated utilization and demand.

In the meantime, stablecoins akin to USD Coin (USDC) and Binance USD (BUSD) have seen provide dwindle to multi-year lows. Analysts say these tendencies counsel that U.S. capital is changing into much less lively within the digital asset house.

Along with this, Glassnode additionally talked about latest on-chain information from exchanges in one other submit. After inspecting the alternate’s on-chain circulate, the analytics agency discovered a notable drop in demand since April.

Within the first quarter, stablecoin inflows considerably outpaced Bitcoin (BTC) and Ethereum (ETH) inflows, indicating a choice for steady property. Nonetheless, because of the present market correction, the influx of Bitcoin and Ethereum, that are assumed to be sell-side transactions, is bigger than that of stablecoins.

Disclaimer: As with all info shared on this pricing evaluation, views and opinions are shared in good religion. Readers ought to do their very own analysis and due diligence. Readers are strictly accountable for their very own actions. COIN EDITION AND ITS AFFILIATES SHALL NOT BE LIABLE FOR ANY DIRECT OR INDIRECT DAMAGES OR LOSSES.

(Translate tags) Market information

Comments are closed.