UK core inflation reached 6.8% in April, the best since 1992. crypto slate reported in a current perception. This surge in inflation got here on the again of greater than 40 years of declining rates of interest and has fueled asset bubbles throughout the board.

Core inflation represents modifications in the price of items and companies, excluding gadgets inside the meals and vitality sectors. With unemployment under 4%, the UK is experiencing its weakest labor market in over 25 years, so this inflation fee stays stronger than general headline inflation.

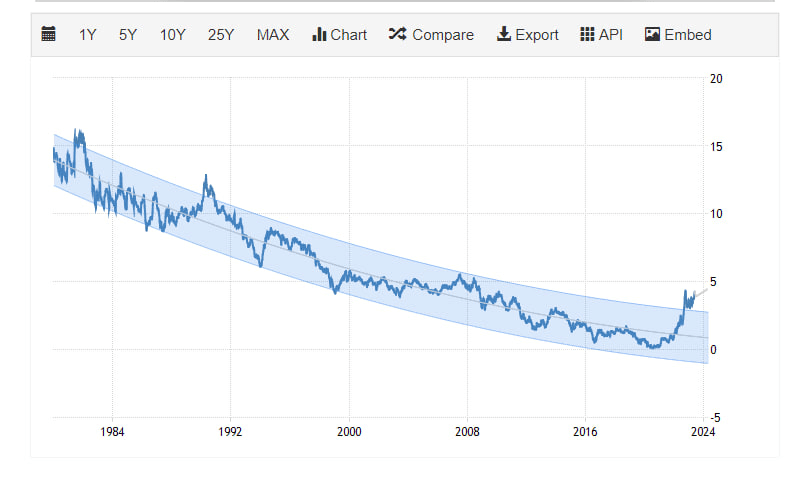

A pointy rise in core inflation despatched bond yields hovering that 10-year Treasury yields broke the 40-year development line. This has raised issues concerning the impression on monetary markets, primarily as debt ranges have crossed 100% of GDP. On this context, it is very important discover the potential impression of accelerating inflation within the UK on cryptocurrency markets, particularly Bitcoin (BTC).

Inflation Uncertainty Drives Bitcoin Adoption

Over the previous 12 months, buyers have most popular bitcoin to fiat forex in periods of excessive uncertainty. For instance, the Turkish lira has been declining constantly since 2018, with cumulative inflation exceeding 100% over the previous three years. The devaluation prompted Turkish buyers to diversify their belongings and considerably elevated BTC/TRY buying and selling quantity.

Equally, the British pound skilled a flash crash on September 26, 2022, dropping 4.3% of its worth towards the US greenback in sooner or later. The Financial institution of England’s emergency intervention within the bond market set BTC/GBP’s buying and selling quantity to a file excessive, surging over 1,200% in simply 24 hours.

These examples show a rising development amongst buyers all over the world. Bitcoin is more and more seen as a protected haven in instances of macro uncertainty, inflation and fiat forex depreciation.

Leveling the enjoying discipline for volatility

Traders within the area might undertake the same strategy, turning to Bitcoin as a hedge towards rising client costs, provided that UK core inflation is hovering. This modification might improve buying and selling quantity and general curiosity in BTC, particularly amongst buyers seeking to shield their belongings from declining worth.

Elevated fiat volatility, largely as a consequence of inflation, might successfully degree the historically perceived discipline of cryptocurrency volatility. Consequently, the excellence between conventional forex stability and digital asset volatility is turning into much less pronounced, altering the way in which buyers understand and strategy each monetary spheres.

(tag translation) bitcoin

Comments are closed.