- The Uniswap Basis has introduced the postponement of a vote on an improve to the protocol’s price mechanism.

- The value of UNI fell, dropping 9% to a low of $10.17.

The Uniswap Basis has postponed a governance vote on a proposal geared toward enabling a brand new price mechanism for the protocol. The proposal would have initiated a price swap on Uniswap, providing rewards to UNI token holders who stake and delegate their tokens.

As markets reacted to the information, UNI costs fell practically 9% throughout main exchanges, hitting a low of $10.17.

Uniswap postpones vote on key improve

Uniswap introduced its price swap proposal final week, with on-chain deployment and voting scheduled for at the moment, Friday, however the newest replace suggests this is not going to go forward as deliberate.

In an replace at the moment, the Uniswap Basis stated the delay was associated to points raised by stakeholders after the proposal, which required “extra consideration” on the a part of the inspiration.

“Because of the immutable nature and confidentiality of the proposed upgrades, we’ve made the troublesome choice to postpone posting this ballot. This was sudden and we apologize for the delay. We are going to notify the neighborhood of any vital modifications and replace you all as soon as we’ve extra confidence sooner or later timeframe.“,” the Uniswap Basis famous by way of its official X account.

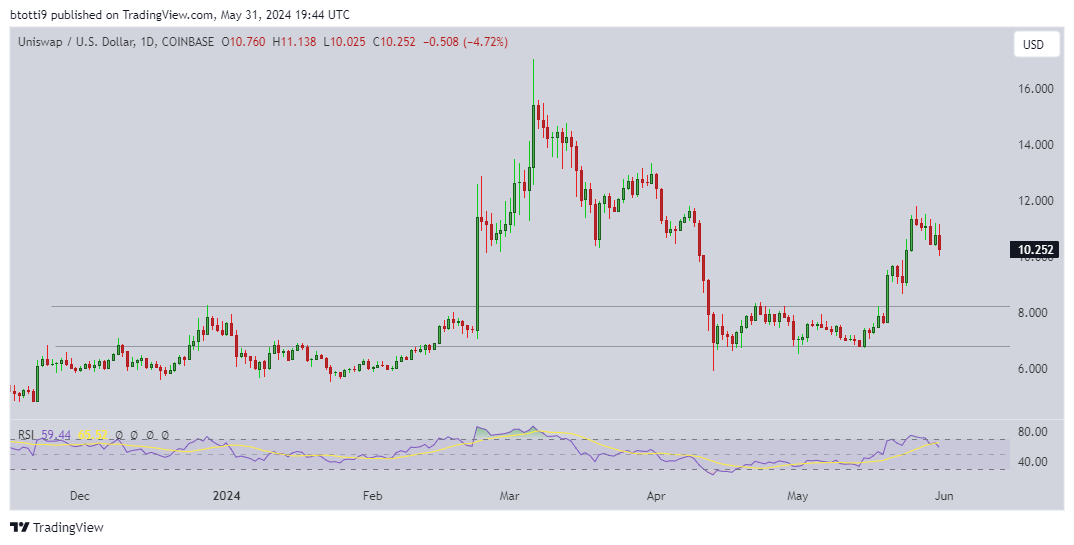

UNI Value

The UNI token traded at a excessive of $11.04 on Friday, however the worth of the token plummeted following the announcement.

The value of UNI has been declining since hitting a excessive of $11.79 on Could 26. The RSI on the day by day chart means that bears should be focusing on a value round $10.

Unswap value is at the moment hovering round $10.26 and if it breaks under the psychological stage, it may drop to the help close to $8.00.

As you’ll be able to see from the chart above, the value of UNI fluctuated between $6.80 and $8.22 within the days previous to the breakout on Could twentieth.